The Fed is preparing to pull the plug on the markets.

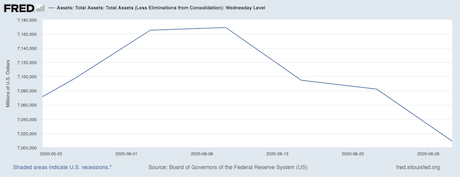

Quietly and with little notice, the Fed balance sheet has begun shrinking. Indeed, it started in early June 2020.

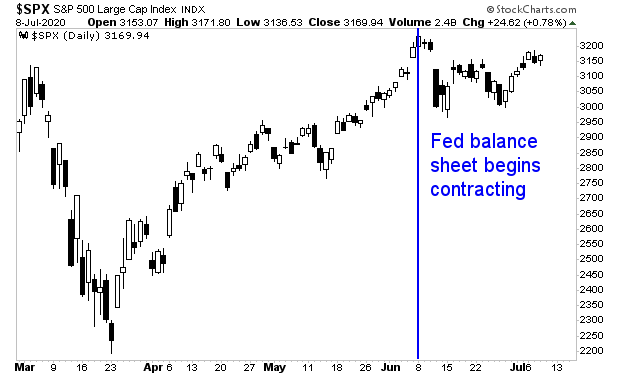

It is not coincidence that the S&P 500 peaked around that date.

Much of the prior contractions were due to the Fed reducing its currency swaps. However, this last week, the Fed actually drained $24 billion in liquidity from the system.

This is a BIG NEGATIVE for stocks.

Moreover, the head of the NY Fed’s Markets Group, (the man who in charge of doing the actual buying involved in the Fed’s QE programs) made a speech indicating that the Fed is planning on reducing its QE programs soon.

Since the SMCCF’s launch, as market functioning has improved, we have slowed the pace of purchases, from about $300 million per day to a bit under $200 million a day. If market conditions continue to improve, Fed purchases could slow further, potentially reaching very low levels or stopping entirely.

Source: The New York Fed.

So the Fed is literally warning us that if the markets continue to rally, the Fed is going to “pull the plug” on QE.

Buckle up.

In light of this, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We made 100 copies available to the public.

As I write this, there are 29 left.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market StrategistParagraph

Phoenix Capital Research