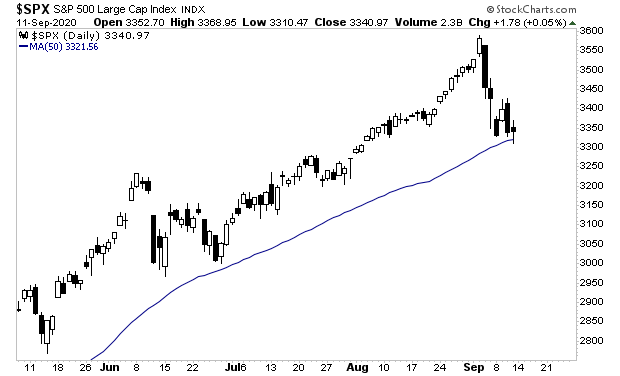

Stocks held their 50-DMA as expected last week. As I write this Monday morning, they are bouncing hard.

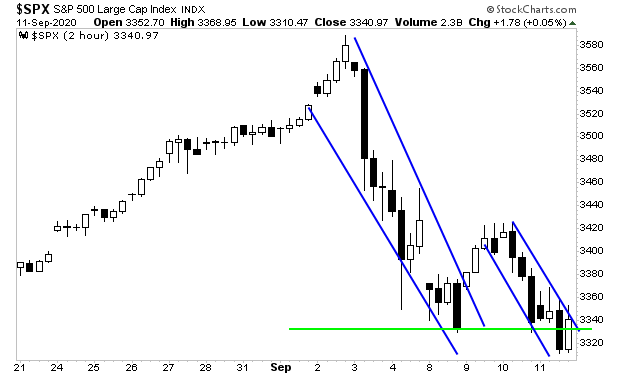

However, this doesn’t mean we’re out of the woods by any means. The technical damage from last week’s sell offs was significant. We’ve broken below support (green line). And the bulls have failed to mount any significant energy to get stocks back into an uptrend.

What does this mean?

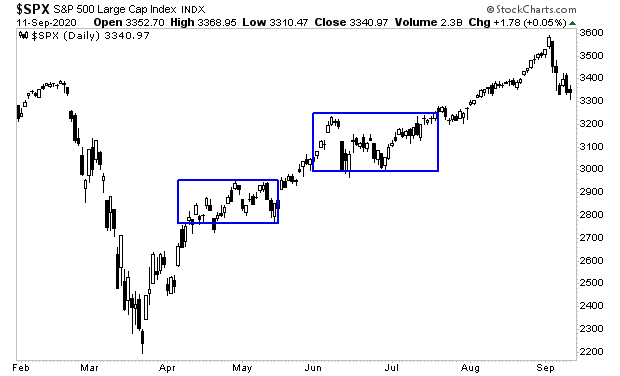

That we’re likely to see more chopping/ sideways action for some time. The S&P 500 has had two such periods since the March bottom. I’ve highlighted them in blue rectangles in the chart below.

In terms of price, I wouldn’t expect stocks to break down a lot lower than where they are… but similarly I wouldn’t expect us to see a sustained rally either. Instead we’re like to see a lot of ups and downs for the next few weeks into October.

However, if things begin to get ugly I expect the Fed to intervene aggressively.

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed and other central banks are trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

We had the Tech Bubble in the ’90s.

The Housing Bubble in the mid-00s.

And now the Everything Bubble in 2020.

On that note, we’re putting together an Executive Summary on how to play this move.

It will identify which investments will perform best during the Fed’s next bubble, including a unique play that could more than double the performance of the S&P 500.

This Executive Summary will be available exclusively to subscribers of our Gains Pains & Capital e-letter. To insure you receive a copy when it’s sent out, you can join here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research