Jerome Powell is going to create the mother of all bubbles.

The first sign of this came in 2018 when Powell used his first Jackson Hole symposium to glorify former Fed Chair Alan Greenspan’s economic insights and “considerable fortitude” in not raising interest rates back in the late ‘90s.

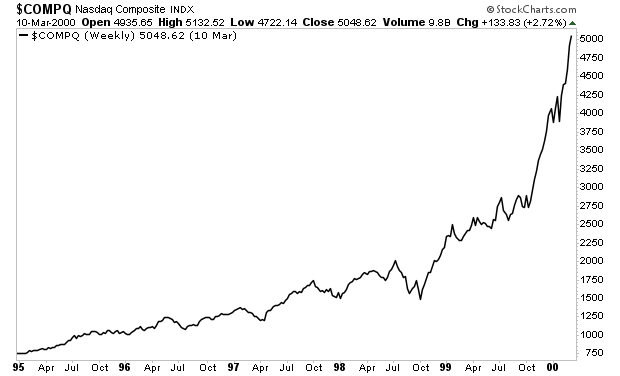

Yes, Powell believed Greenspan was a genius for not raising rates in the late’ 90s. If you don’t remember what stocks did at that time, it looked like this:

The below quote is quite revealing. And looking back, this speech was a hint of things to come.

The FOMC thus avoided the Great-Inflation-era mistake of overemphasizing imprecise estimates of the stars. Under Chairman Greenspan’s leadership, the Committee converged on a risk-management strategy that can be distilled into a simple request: Let’s wait one more meeting; if there are clearer signs of inflation, we will commence tightening.13 Meeting after meeting, the Committee held off on rate increases while believing that signs of rising inflation would soon appear. And meeting after meeting, inflation gradually declined.

Source: Federal Reserve

In the 12-18 months following this speech, Jerome Powell became one of the biggest monetary easers in history, cutting interest rates while also launching multiple repo programs through which the Fed funneled hundreds of billions of dollars into the financial system despite any indications of a recession.

Bear in mind, this was before the COVID-19 pandemic. Once COVID-19 hit, Powell would unleashed a tsunami of liquidity that would make even Alan Greenspan blush.

We’ve reviewed the Fed’s recent monetary easing multiple times in recent weeks. However, given the magnitude of what the Fed is about to announce, it’s worth repeating.

To combat the economic fallout from the COVID-19 pandemic, the Fed:

- Made its quantitative easing (QE) program “unlimited.” meaning it would simply print money and buy assets ad infinitum.

- Increased the scope of its QE program from simply buying U.S. Treasuries and mortgage backed securities to include: everything from municipal bonds to corporate junk bonds.

- Expanded its money market QE to also include a “wider range of securities” including certificates of deposits (CDs).

- Expanded its commercial paper QE program.

- Introduced a new QE program to buy any asset-backed security (ABS) including student debt.

- Began a bailout program for small- and medium-sized business.

- Lowered the interest rate on its repo programs from 0.15% to LITERAL ZERO (meaning NO interest charged).

At its peak in March 2020, the Fed was pumping $125 billion into the market every day.

Things have since calmed down as stocks rocketed to all-time highs. However, Powell’s recent statements clearly indicate he doesn’t think this is enough.

Indeed, during recent press conferences Powell’s Fed has maintained that the Fed will keep interest rates at ZERO through 2023.

Yes, 2023.

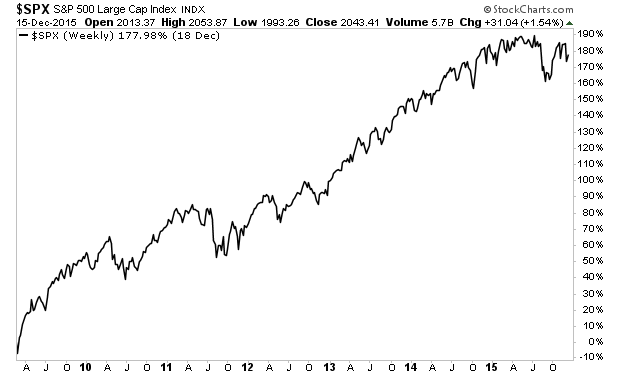

What do you think this is going to do to stocks? The last time the Fed held rates at ZERO for years was from 2008-2015. During that time, the S&P 500 nearly TRIPLED.

Currently stocks are up 50% from the lows. If they were to follow a similar move, we’d see the mother of all bubbles with the S&P 500 rising to over 6,000.

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed and other central banks are trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

With that in mind, we’ve just published an investment report titled Triple Your Money With the Mother of All Bubbles.

It outlines what the Fed is doing, why it’s doing it, and a unique investment that could easily triple as the Fed unleashes a tsunami of liquidity pushing stocks to nosebleed levels.

The last time the Fed began an easing cycle, this investment rose over 1,439%. And this time around we could see similar gains.

We are making only 100 copies of this report available to the general public,

To pick up your copy, go to:

https://www.phoenixcapitalmarketing.com/MOAB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research