Over the last few weeks, we’ve outlined some truly extraordinary facts pertaining to just how much money printing the Fed has performed.

As a brief recap:

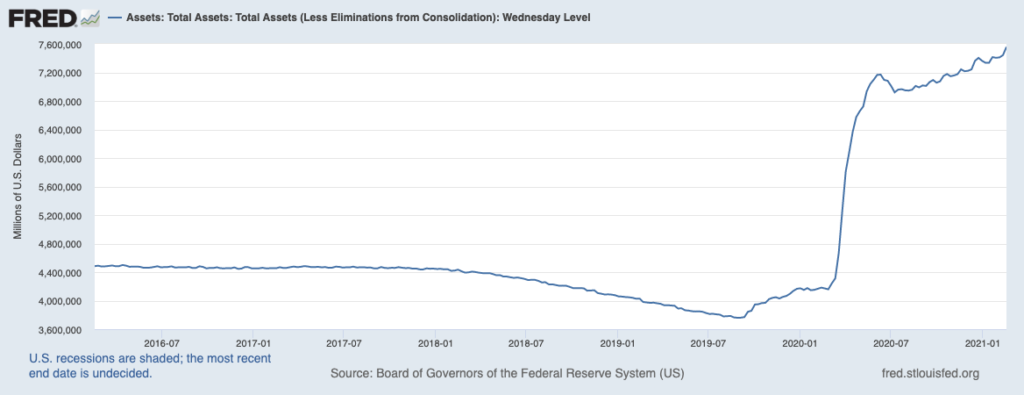

1. If you add up all of the money the U.S. has ever printed… over 40% of it was printed in 2020 alone.

2. In three months in 2020, the U.S. increased its deficit by more than it had during the past five recessions combined (’73, ’75, ’82, early ‘90s and Great Financial Crisis).

3. Under Jerome Powell, the Fed bought more Treasuries in SIX WEEKS than it did in 10 years under Ben Bernanke and Janet Yellen.

All of this money printing has ignited an inflationary storm. The Fed refuses to acknowledge this, but the reality is staring us all in the face.

Put simply inflation is ripping through the financial system.

And the craziest thing? The Fed just printed another $100 BILLION this week alone.

That’s not a typo. On February 20Th the Fed balance sheet was $7.442 trillion. This week, it’s $7.557 trillion. The Fed balance sheet is not only at a new all-time high, but it’s now the size of the economies of Japan and the United Kingdom, COMBINED.

This is absolute madness. The media is claiming over and over that the COVID-19 pandemic is now under control and things will start returning to normal, but the Fed’s still printing over $120 billion in money per month.

At this pace, the Fed will print $1.4 TRILLION this year alone. Not billion, TRILLION with a T.

And they show no signs of stopping.

The coming inflation is going to ANNIHILATE most investors’ portfolios.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

Today is the last day this report will be available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research