The bounce hit as I had expected, but I must be honest… things got pretty hairy there for a few hours on Monday.

The issue now is where do we go from here?

Stocks are still in deep trouble.

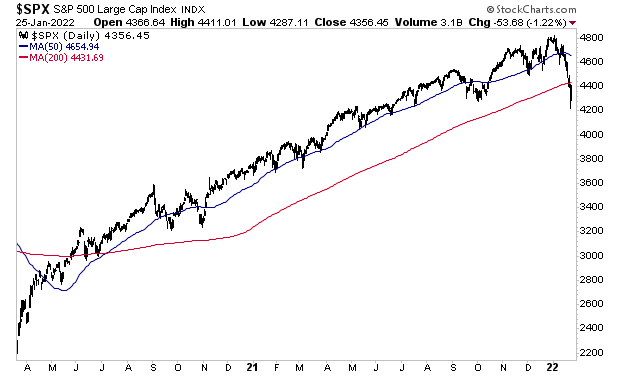

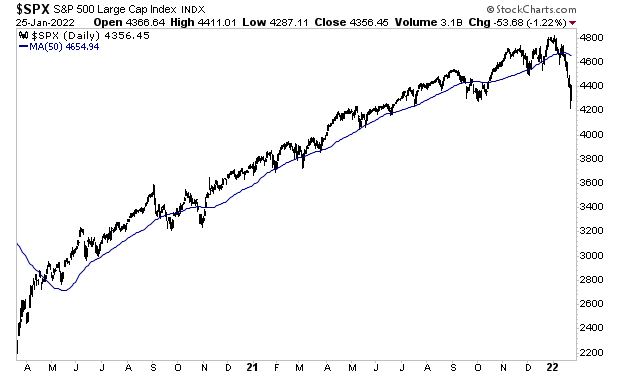

First and foremost, the S&P 500 remains below both its 50-day moving average (DMA) and its 200-DMA. Those lines now present major resistance to any upside move. Remember, this marks the FIRST time stocks have broken below these levels since the March 2020 Crash.

Secondly, the trend, as illustrated by the 50-day moving average (DMA), is now DOWN. This again marks the first time this has been the case since the March 2020 Crash. Yes, there have been periods in which the 50-DMA was flat or sideways, but DOWN? This is the first.

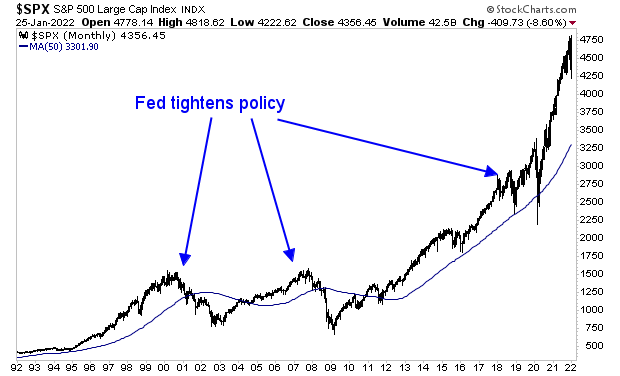

So, you can see the predicament here. Regardless of the bounce the trend is DOWN and it will take considerable time and strength to reverse this. Against this backdrop the Fed is now tightening. Sure, it might not be as much tightening as everyone fears, but it’s still tightening.

The three times the Fed tried this, stocks crashed.

Those occasions were:

- The Tech Bubble of the late ‘90s.

- The Housing Bubble of the mid ‘00s.

- The attempted normalization of late 2017-2018.

What are the odds the Fed succeeds this time around… especially when you consider the size of this bubble relative to the others.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,