By Graham Summers, MBA

You’re no doubt confused by the market’s action of the last week. Are we about to see a waterfall crash… or are stocks about to explode higher to new highs?

The answer is probably neither.

Markets are tricky things. More often than not, their goal is to induce the maximum amount of suffering to the maximum number of investors.

So let’s dive in together and sort this out.

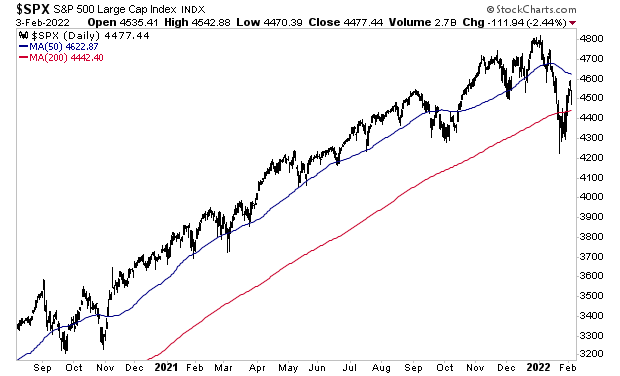

On a daily and weekly basis, the S&P 500 is now trending down. The market broke below its 200-day moving average (DMA) for the first time since the March 2020 lows. That’s a BIG deal and suggests a new bear market is here. Stocks have since reclaimed that level, but are failing to get much higher.

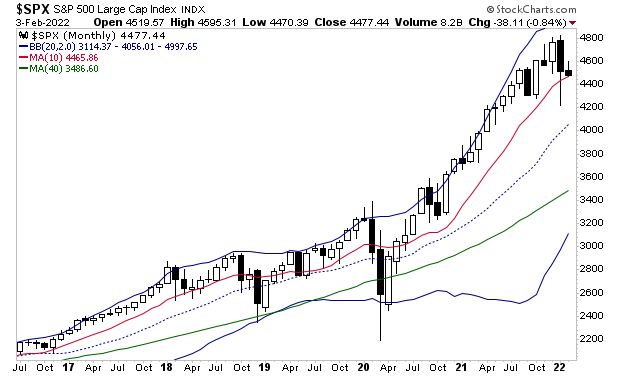

Moreover, on a monthly basis, the S&P 500 is clinging to the ledge of a cliff at its 10-monthly moving average (MMA) at 4,465.

This is a BIG deal for the bulls because every time the market has broken that line in the last five years, a bear market has hit, with stocks losing 20%-30% of their value quite rapidly.

Where does this leave us?

Overall, the tilt for the market is decidedly NEGATIVE. The trend remains down on a daily basis and the monthly chart is looking quite dangerous as well.

This means the odds favor more downside… and possibly even a crash/ bear market.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards