The stock market is clinging to the ledge of a cliff.

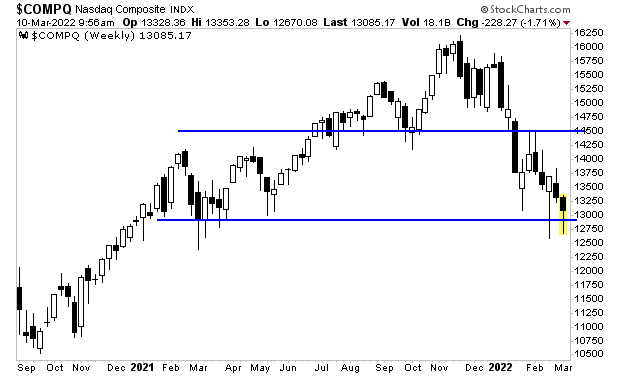

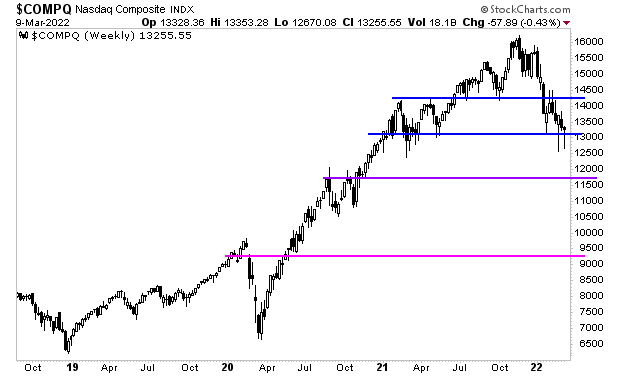

The weekly chart of the NASDAQ is truly. Tech stocks have been trading in a wide range since stocks peaked in November 2021. And they are just BARELY clinging to the lower line of this range on a weekly basis.

Why is this a big deal? Because if the NASDAQ closes below the lower line of this range on a weekly basis, it opens the door to an unwind of most if not ALL of the COVID-19 bull market. This would mean a 40%-50% collapse from current levels.

And all of this is happening right as the Fed ends QE and starts raising rates. Meanwhile, the economy is rolling over and the tech-heavy market is barely able to rally.

Sounds like the recipe for a crash to me!

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html