By Graham Summers, MBA

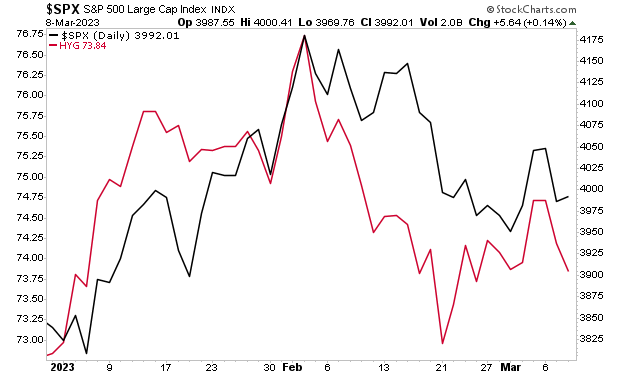

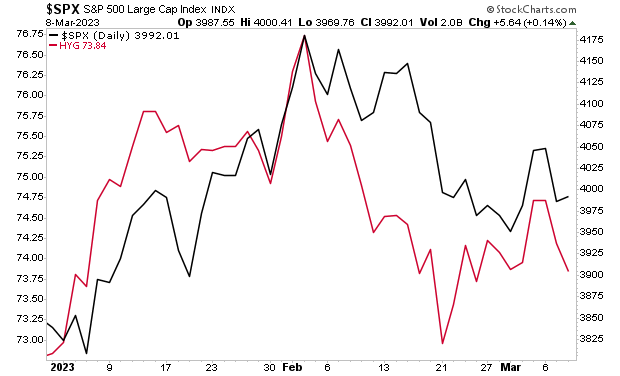

High yield credit is turning back down again.

This is a big deal as historically high yield credit leads stocks.

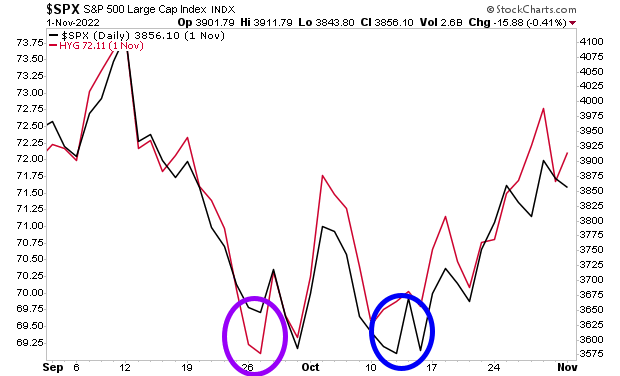

Indeed, high yield credit bottomed in October 2022 (purple circle in the chart below) a full two weeks before stocks did (blue circle in the chart below).

Now high yield credit is telling us stocks are set to drop. According to high yield credit, the S&P 500 should already be at 3,900 a full 100 points lower.

Oh… and by the way… our proprietary Bear Market Trigger… the one that predicted the Tech Crash as well as the Great Financial Crisis… is on a confirmed SELL signal for the first time since 2008.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

https://phoenixcapitalmarketing.com/BM.html

PS. Our new investing podcast Bulls, Bears & BS is officially live and available on every major podcast application (Apple, Spotify, etc.)

To download or listen, swing by: