Could the markets crash again?

This is the #1 question I’m receiving from subscribers. When I ask them why they’re concerned, the #1 explanation is that the economy is in a recession/depression and yet stocks are close to or have already hit new all-time highs.

Let’s dissect this way of thinking…

First and foremost, we need to dispel the myth that the stock market and the economy are closely related.

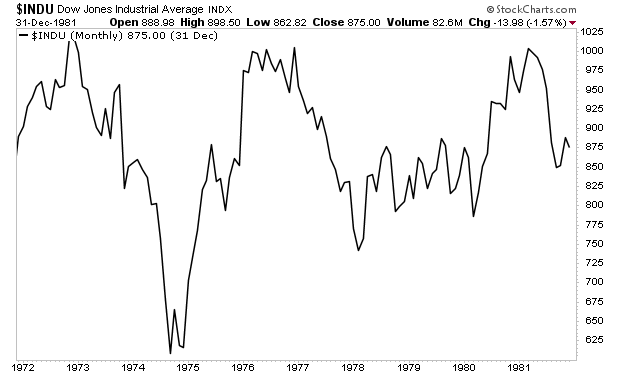

As Puru Saxena has noted, between 1972 and 1982, the US economy nearly tripled in size from $1.2 trillion to $3.2 trillion. And yet, throughout that entire period the stock market traded sideways for ZERO GAINS!

————————————————————

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

Two annual subscriptions (2 years total) to all of our current newsletters costs $3,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

The doors close on this offer tonight at midnight.

———————————————————–

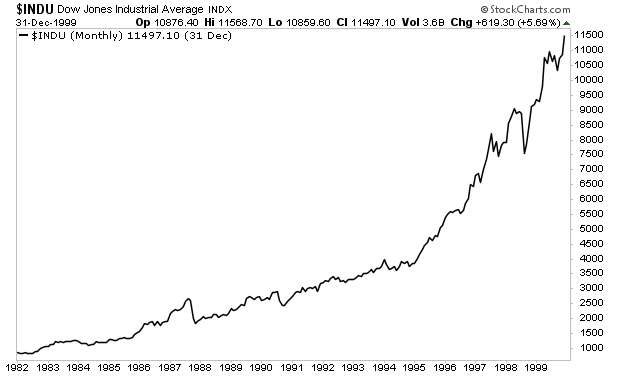

In contrast, from 1982 to 2000, the US economy again nearly tripled in size from $3.2 trillion to $10 trillion. But during this particular time, the stock market exploded higher rising nearly 1,500%!

So, we have two time periods in which the economy nearly tripled in size. During one of them, the stock market went nowhere, while during the other, the stock market rose nearly 1,500%.

Again, stocks have little if any correlation to the economy. There are times when stocks will care a lot about the economy, but those time periods are usually short and due to an unexpected surprise (like the surprise of the economy being shut down to deal with the COVID-19 pandemic).

So, what do stocks care about?

Liquidity.

Historically, whenever central banks start printing money at a rapid clip, stocks do well. A great example of this is the time period from 2008 to 2016 when the economy was weak at best and flatlining at worst. But because the Fed printed over $3.5 trillion during this time period, socks soared, rising over 100%.

Which brings us to today… stocks are rallying hard yet again, despite the economy being extremely weak.

The reason for this is because of the TSUNAMI of liquidity policymakers are throwing at the financial system.

Central Banks alone have printed over $5 trillion in the last three months. Much of this money has found its way into the stock market.

On top of this, G-10 governments have implemented fiscal stimulus programs ranging from 5% (Norway) to over 35% of (Germany and Italy) of their historic revenue and spending budgets!

Put another way, trillions upon trillions of dollar/s yen/ euros/ pounds have been printed and funneled into the financial system. This is sending stocks through the roof. And unless we get another nasty economic shock to the downside, this trend will likely continue.

On that note, we just published a Special Investment Report concerning FIVE contrarian investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU through care investing in the precious metals sector and precious metals mining.

We are making just 100 copies available to the public.

There are just 3 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research