Stocks are up this morning on news that President Trump came to an acceptable agreement with the Mexican government over the weekend.

As a result of this, his proposed tariffs on Mexico’s good and services to the US were dropped.

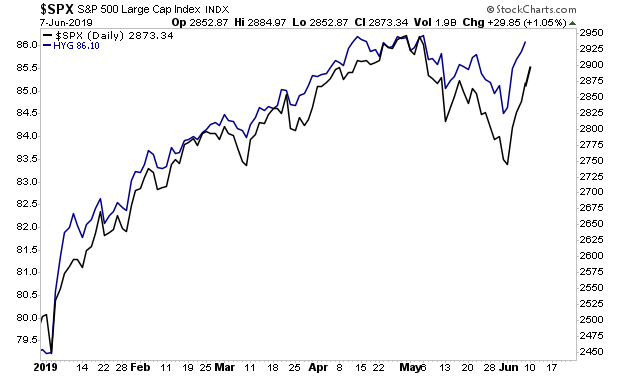

Stocks (black line in the chart below) are now within spitting distance of our final upside target for this rally: the low- to mid- 2,900s where Junk Bonds (blue line in the chart below) have been signaling that stocks were heading for several weeks now.

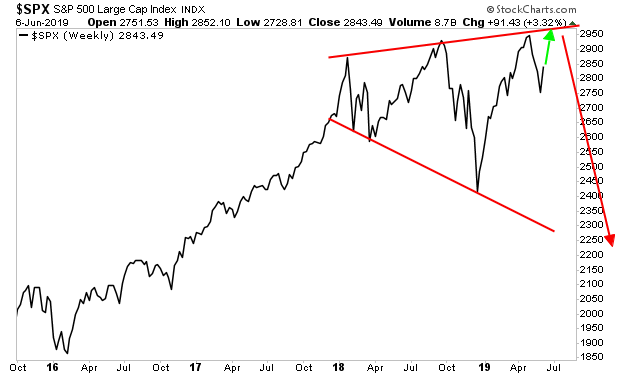

However, after that the market reaches those levels, it’s primed for a collapse.

Why?

The Mexico situation was an easy one to resolve… the China situation … not so much.

The markets are still pinning their hopes on a deal being struck between US and China at the G-20 meeting in Osaka Japan at the end of this month.

This won’t happen… and bonds know it.

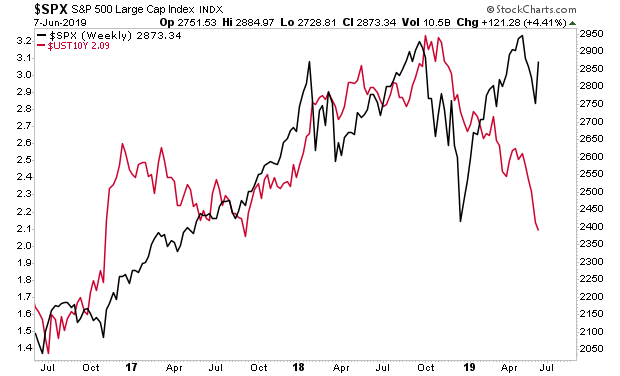

Regarding a US/ China Trade deal… if this was coming at the end of the month the Treasury market would have signaled that we are entering a period of economic stability.

That has not been the case. Treasury yields (red line in the chart below) have continued to drop, telling us that the economy is weakening rapidly… and that NO trade deal is coming.

Which means…

A Crash is coming…

A Crash is coming…

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research