Well, that’s that.

The markets surged on the Fed announcement of NO rate cuts because the market now believes the Fed is GUARANTEED to make a MASSIVE cut in July.

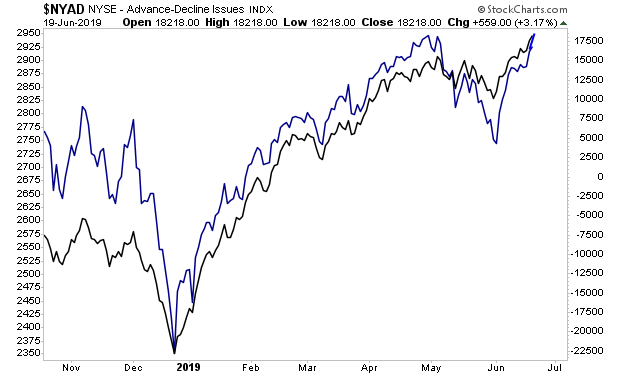

The S&P 500 (blue line in the chart below) hit our upside target for this rally, catching up the breadth (black line in the chart below). We might finish the week around here, but going forward anyone going long is effectively “picking up pennies in front of a steamroller.”

Between their expectation of a MASSIVE rate cut from the Fed in July… and hype and hope of a trade deal between the US and China at the G-20 next week, the markets are primed for MAJOR disappointment.

Look, let’s face the facts…

The Fed did NOT promise a rate cut yesterday. It removed the word “patient” from its statement and stated “uncertainties about this outlook [strong growth and 2% inflation] have increased…”

Nowhere… and I do mean NOWHERE did the Fed say a rate cut was coming. Fed Chair Jerome Powell himself didn’t even hint at a rate cut during his Q&A session stating that “we’d like to see more going forward” before changing course.

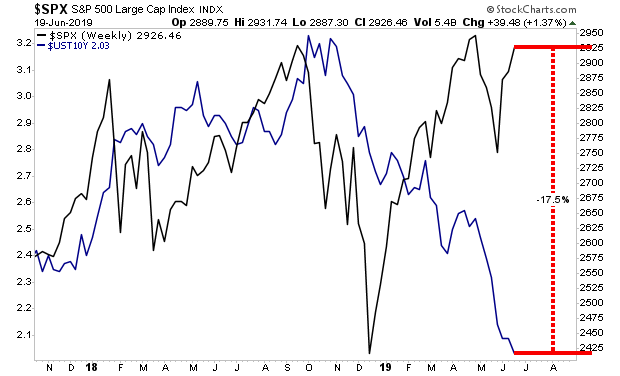

Meanwhile, the markets are SCREAMING that the economy has rolled over. The bond market is telling us the S&P 500 should be 17% lower today.

Ignore this all you like, but bonds were right in December… and they’re going to be right again this time.

Which means…

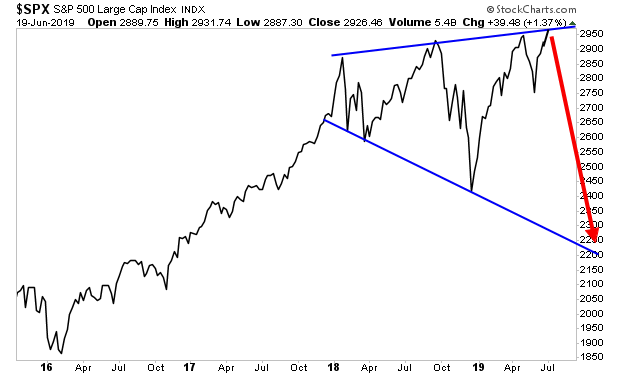

A Crash is coming…

Those investors who take the right steps to prepare for this, will make literal fortunes.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Today is the last day this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research