Stocks are roughly flat this morning.

The issue for everyone is whether THE bottom is in, or if it’s simply just “a” bottom and stocks are due to retest the lows.

No one knows the answer to this. If your advisor or some pundit claims they do, they are lying.

The reality is that regardless of whether or not the Covid-19 pandemic ends sooner rather than later, the economic fallout from this mess is very real.

Personally, I am watching the credit markets very closely to see how this plays out. Credit leads stocks. And credit is where we’ll see signs of duress long before stocks pick up on it.

———————————————————–

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

An annual subscription to all of our current newsletters costs $1,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

Today is the last day this offer is available.

To lock in one of the remaining slots…

———————————————————–

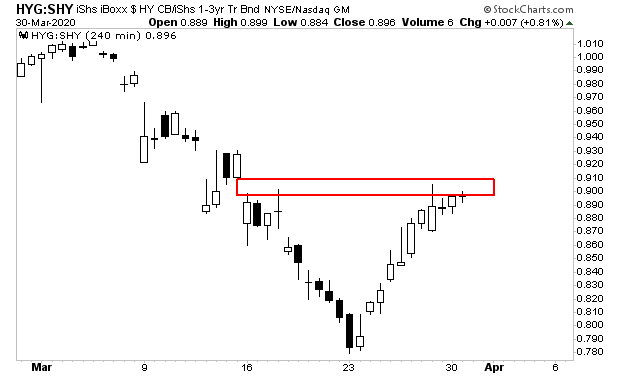

High yield credit spreads have rallied strongly but are struggling to close the gap from the limit down open on Monday March 16th (red box). Personally, I want to see this gap closed before moving aggressively back into the markets.

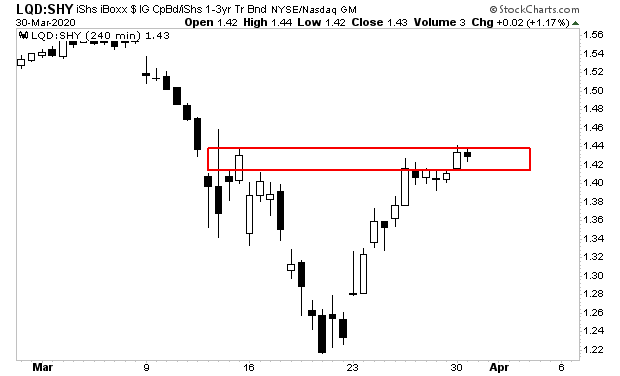

The same is true for investment grade credit spreads. Here, spreads have actually entered the gap, but have yet to break above it.

Considering the Fed has broadcasted it would be buying investment grade credit with “unlimited QE” I am surprised credit is struggling here.

If both credit spreads break above their gaps, I’d issue an “all clear” on stocks. But right now, they’re struggling to move higher.

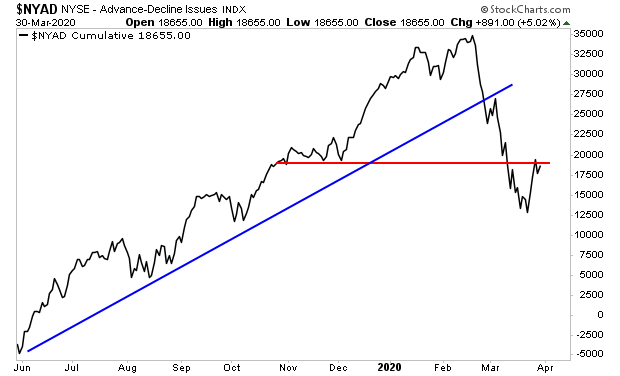

This, combined with the fact that breadth is struggling to break above resistance (red line in the chart below), has me concerned we are going to see another significant drop.

These are the three charts I personally am watching to determine what the next move is for the markets.

In the meantime, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research