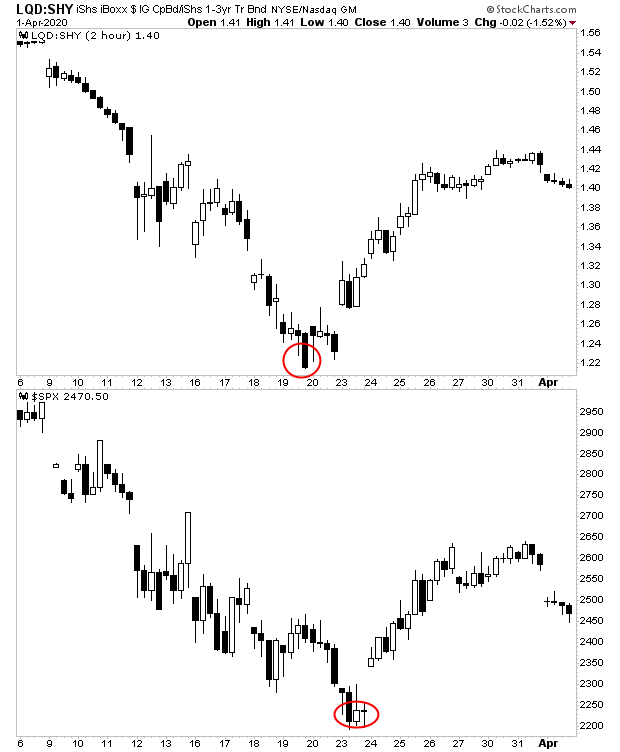

The single most important chart in the world right now is investment grade credit spreads.

The Fed has announced it will buy investment grade corporate debt for the first time in history. The Fed also announced that it will be directly buying investment grade corporate debt ETFs like $LQD.

With that in mind, credit spreads on investment grade corporate debt have become “the canary in the coal mine” for this Fed intervention. If they collapse in a significant way despite the Fed buying them, then we know the Fed has failed to prop up the system.

You can see this in the below chart. Credit spreads for investment grade corporate debt actually bottomed on Thursday March 19th. Stocks didn’t bottom until Monday of the following week.

———————————————————–

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

An annual subscription to all of our current newsletters costs $1,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

Today is the last day this offer is available.

To lock in one of the remaining slots…

———————————————————–

Again, credit is leading stocks here. So if you want to get an idea of where the markets are heading you NEED to watch credit.

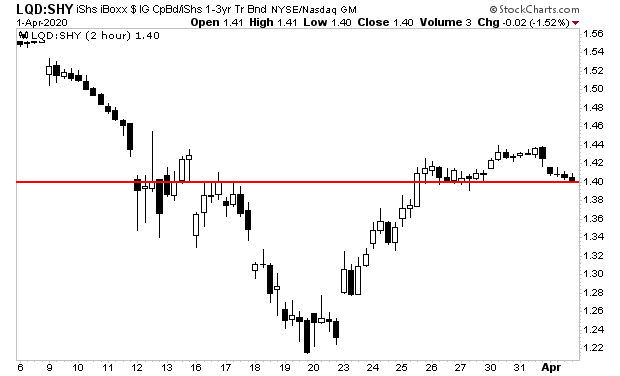

With that in mind, yesterday’s breakdown was extremely dangerous for the credit markets. As you can see in the chart below, the drop brought credit right to THE line of CRITICAL support.

If we see a breakdown from here, then it’s HIGHLY likely the system will go back into a panic and we will see new lows for stocks.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research