The Fed will soon be buying stocks.

Earlier this week, the Fed announced that it will begin buying corporate bonds from individual companies. Before this announcement, the Fed was already involved in the:

- The Treasury markets (US sovereign debt)

- The municipal bond markets (debt issued by states and cities)

- The corporate bond markets by index (debt issued by corporations)

- The commercial paper markets (short-term corporate debt market)

- And the asset-backed security markets (everything from student loans to certificates of deposit and more).

With the introduction of individual corporate bonds, the Fed is now one step closer to buying stocks outright.

Indeed, the Fed has made ZERO references to stopping its monetary madness. Just yesterday Fed Chair Jerome Powell emphasized to Congress that the Fed is “years away from halting its assets monetization scheme.”

Again, the Fed is explicitly telling us that it plans on buying assets (Treasuries, municipal bonds, corporate bonds, etc.) for years to come.

The next step will be for the Fed to buy stocks.

It won’t be the first central bank to do so…

The central bank of Switzerland, called the Swiss National Bank has been buying stocks for years. Yes. It literally prints money and buys stocks in the U.S. stock markets.

Then there’s Japan’s central bank, called the Bank of Japan. It also prints money and buys stocks outright. As of March 2019, it owned 80% of Japan’s ETFs.

Yes, 80%.

The BoJ is also a top-10 shareholder in over 50% of the companies that trade on the Japanese stock market.

If you think this can’t happen in the US, think again. The Fed told us in 2019 that it would be forced to engage in EXTREME monetary policies during the next downturn.

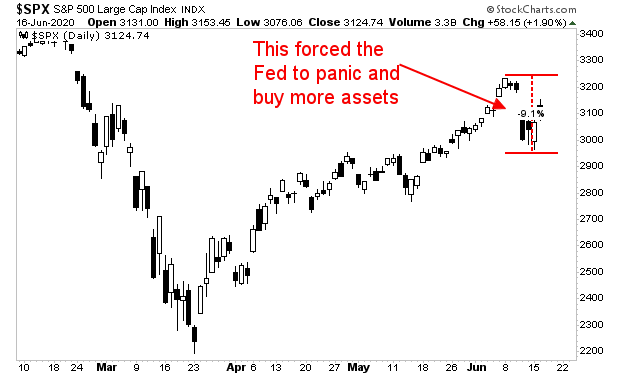

Fast forward to today, and the Fed is doing precisely this. Heck, it couldn’t even handle a 10% correction without introducing a new monetary scheme… and this is AFTER one of the sharpest rallies in years!

Put another way…

We are now entering the greatest bubble of all time: a situation in which the Fed will spend trillions and trillions of dollars to corner all risk in an effort to reflate the financial system.

As I write this, the Fed has already spent over $3 trillion in the last three months. I expect this will soon be $5 trillion or even $6 trillion before the end of 2021.

On that note, we just published a Special Investment Report concerning FIVE contrarian investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU through care investing in the precious metals sector and precious metals mining.

We are making just 100 copies available to the public.

There are just 3 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research