The Fed stepped in to save stocks yesterday.

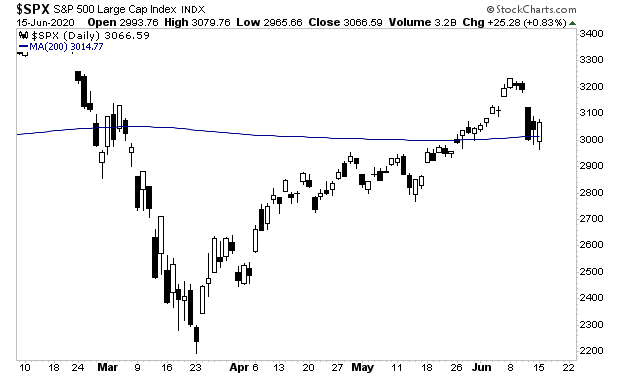

At the time, the market was experiencing its first significant decline since the March 23rd bottom, falling ~10% from peak to trough. From a technical analysis perspective, stocks were on the verge of losing the all-important 200-day moving average (DMA).

It is not coincidence that the Fed used this opportunity to announce a new twist to one of its bond buying programs, specifically, that for the first time in history the Fed would buy individual corporate bonds.

The Fed was already buying corporate bonds in bundles via exchange traded funds and indexes. Thanks to the new program, the Fed will continue doing this while also buying corporate debt from individual companies.

The implications of this are tremendous. The Fed can now “prop up” a failing company by buying the company’s debt. And unlike real investors, the Fed isn’t interested in turning a profit.

This only further signals that the Fed is moving to corner all risk in the financial system. The Fed is now involved in:

- The Treasury markets (US sovereign debt)

- The municipal bond markets (debt issued by states and cities)

- The corporate bond markets by index (debt issued by corporations)

- Individual corporate bonds.

- The commercial paper markets (short-term corporate debt market)

- And the asset-backed security markets (everything from student loans to certificates of deposit and more).

Seeing this, it’s clear the Fed will soon be buying stocks most likely by first buying ETFs eventually buying individual stocks themselves.

Put another way…

We are now entering the greatest bubble of all time: a situation in which the Fed will spend trillions and trillions of dollars to corner all risk in an effort to reflate the financial system.

As I write this, the Fed has already spent over $3 trillion in the last three months. I expect this will soon be $5 trillion or even $6 trillion before the end of 2021.

This is going to unleash an inflationary storm. Already gold and other assets have begun to discount this. And smart investors are preparing their portfolios to profit from it.

On that note, we just published a Special Investment Report concerning FIVE contrarian investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU through care investing in the precious metals sector and precious metals mining.

We are making just 100 copies available to the public.

There are just 9 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research