Over the last week, we’ve been outlining the absurdity of Treasury Secretary Janet Yellen’s belief that higher inflation and higher interest rates would for the U.S.

By quick way of review:

1) Secretary Yellen believes that President Biden’s $4 trillion spending program would be good for the U.S. even if it contributes to higher inflation and results in higher interest rates.

2) Inflation is already roaring in the U.S. before President Biden’s $4 trillion spending program. Higher inflation would NOT be good at this point as Americans are already experiencing rising costs living.

3) Higher interest rates would also be extremely problematic as the U.S. now has $28 trillion in public debt. This massive debt load requires extremely low interest rates for the U.S. to avoid a debt crisis. The last time interest rates spiked higher in 2018, the corporate debt market froze, and the stock market collapsed 20% in a matter of days.

Now, Yellen is one of the two most important and powerful figures in the financial world. As such her views on this are of extreme significance for determining what policymakers will be doing going forward. As far as the Treasury is concerned, inflation will be allowed to rage.

This leaves Fed Chair Jerome Powell as the only potential voice of sanity from a senior policymaker perspective. And unfortunately for us, Powell is likely to prove just as delusional as Treasury Secretary Yellen when it comes to issues of inflation.

The first sign of this came in 2018 when Powell used his first Jackson Hole symposium to glorify former Fed Chair Alan Greenspan’s economic insights and “considerable fortitude” in not raising interest rates back in the late ‘90s.

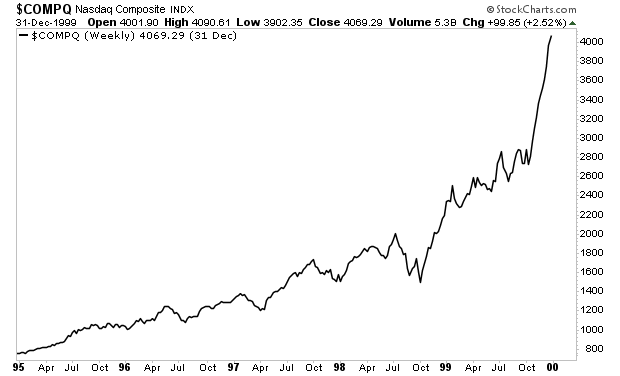

Yes, Powell believed Greenspan was a genius for not raising rates in the late’ 90s. If you don’t remember what stocks did at that time, it looked like this:

Considering this, the below quote from Powell’s 2018 speech is quite revealing.

The FOMC thus avoided the Great-Inflation-era mistake of overemphasizing imprecise estimates of the stars. Under Chairman Greenspan’s leadership, the Committee converged on a risk-management strategy that can be distilled into a simple request: Let’s wait one more meeting; if there are clearer signs of inflation, we will commence tightening.13 Meeting after meeting, the Committee held off on rate increases while believing that signs of rising inflation would soon appear. And meeting after meeting, inflation gradually declined.

Source: the Federal Reserve records

In this context, it is not surprising to see Fed Chair Powell now arguing that inflation is “transitory” and should be ignored. This is practically the exact policy he lionized in hits 2018 speech: ignore inflation, don’t raise rates no matter how frothy the markets become, and allow a massive stock bubble to form.

From Powell’s Q&A session in early May:

“We suspect transitory factors may be at work,” Powell said, adding inflation should return to the Fed’s target over time, and then be symmetric around its objective. Powell was commenting at a news briefing, following the Fed’s two-day meeting.

“If we did see inflation running persistently below, that is something the committee would be concerned about and something we would take into account when setting policy,” he said.

Source: CNBC

So, what does this mean?

That both the Treasury Secretary AND the Fed Chair, the two most important figures in finance, believe inflation is NOT an issue or even worse, is a good thing. Neither policymaker believes that they need to tighten monetary conditions. If anything, Treasury Secretary Yellen believes the government should print and spend even MORE money!

So inflation is going to rage and rage, until this bubble bursts wiping out trillions in investor capital.

As I keep warning, inflation is going to ANNIHILATE investor portfolios.

However, those investors who are properly positioned for it will make literal fortunes.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research