So the Fed finally moved… but what precisely did it do?

After a full year of the most extreme monetary policy in history, including…

- Over 12 months of ZERO interest rate policy despite the economy growing.

- Over $3 trillion in money printing.

- Buying corporate bonds, muni bonds, corporate bond ETFs, Treasuries, Mortgage-Backed Securities Student Loans, Certificates of Deposit, etc.

…the Fed finally announced it is thinking about tightening monetary conditions.

It only took CPI clearing 5%, multiple signals that inflation is running hot, housing entering a bubble, stocks roaring to new all-time highs, and signs of frothiness including: someone sold a Non-Fungible Token (NFT) of a fart, crypto-currencies including ones that were designed as a joke exploding higher, etc.

Put simply, it only took an extreme level of frothiness as well as some of the worst inflation prints in decades for the Fed to decide it needed to do something. That something?

The Fed announced that intended to start tapering QE in late 2021/early 2022 while also potentially raising rates late in 2022/ early 2023.

Regardless of whether or not the Fed will actually do any of this (more on that in a moment), what matters for us today is how the market reacted to the Fed announcement.

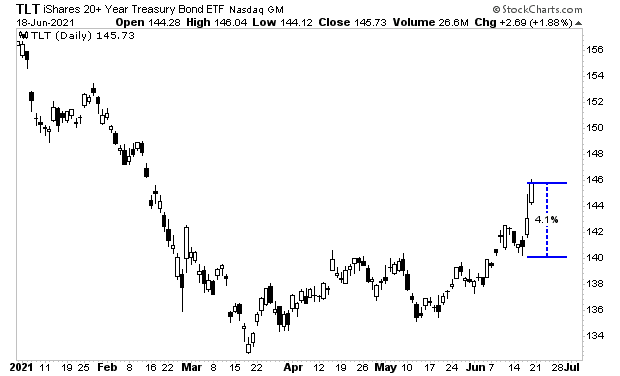

Treasuries, particularly long-term Treasuries (20+ years) caught a major bid on the news.

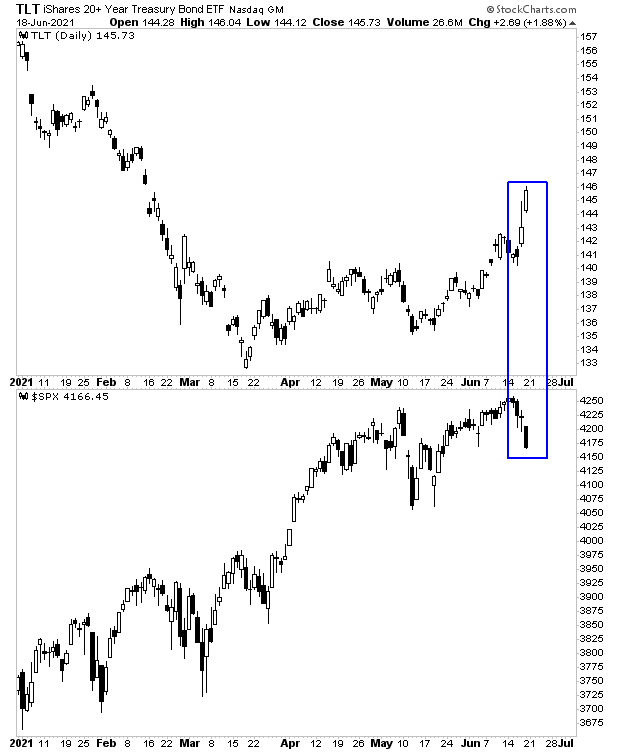

The long-term Treasury ETF (TLT) jumped 4% in the span of a few days. This forced widespread liquidations at hedge funds in their short bond positions. And when hedge funds start liquidating losses, they often will liquidate winners as well to free up capital.

You can see this in the stock market when compared to TLT: they are a mirror image of one another (blue rectangle in the chart below) with stocks falling in near perfect synchronization as TLT rallied.

This suggests that the sell-off in stocks was collateral damage from the move in bonds, NOT necessarily a bearish development outright for stocks.

With all of this in mind, we need to take a look at what the bond market is currently doing for signs of where things are headed. Remember, it was Treasuries, that forced the Fed to act. And it was Treasuries that forced the sell-off in stocks last week.

So, what precisely did the Fed do?

We’ll address that in tomorrow’s article.

In the meantime, we have published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research