The only thing holding the stock market up is blatant manipulation.

Financial institutions do NOT attempt to move markets. In fact, the traders charged with executing these institutions’ trades are graded based on their ability to buy and sell large chunks of stocks without moving the tape.

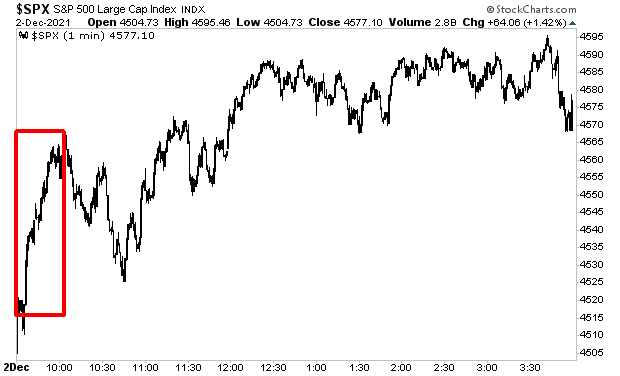

Which is why we know that no real investor is responsible for a move like this:

“Someone” or “someones” pushed stocks up from 4,506 to 4,566 yesterday morning in the span of a few minutes. No major news item or development hit the tape during this time. This was abject manipulation by someone trying to force stocks higher.

It makes you wonder what they’re afraid of…

Perhaps they’re afraid of the fact that stocks are in the single largest bubble in history… a bubble so frenzied with insane speculation that it makes the Tech Bubble look tame by comparison?

Perhaps this “someone” is concerned that the Fed is ending its monetary easing… the same monetary easing that has provided over $4 trillion in liquidity to the system since March 2020?

Perhaps this “someone” is also worried that the federal government is no longer able to provide $5 trillion in fiscal stimulus to prop up the system.

Or perhaps the “someone” is worried that a stock market crash would make the Biden administration look even worse when its polling is already in the toilet.

Whatever the reason, “someone” is intent on stopping the markets from imploding. Meanwhile, hedge funds, corporate insiders, and smart money are all selling the farm.

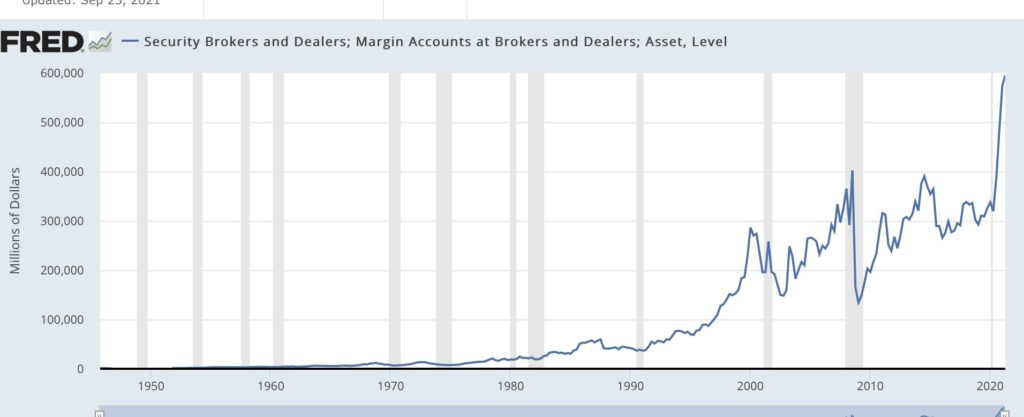

And they’re selling the farm to individual investors… who have borrowed more money to buy stocks than at any point in history.

So let’s review.

1) The Fed is ending its liquidity schemes.

2) Uncle Sam is ending his fiscal stimulus schemes.

3) Hedge Funds and corporate insiders are selling the farm.

4) Individual investors have borrowed a RECORD amount of money to buy stocks.

Guess who’s going to get taken to the cleaners on this?

Let me be blunt here, if you’re not taking steps to prepare for what’s coming, NOW is the time to do so.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,