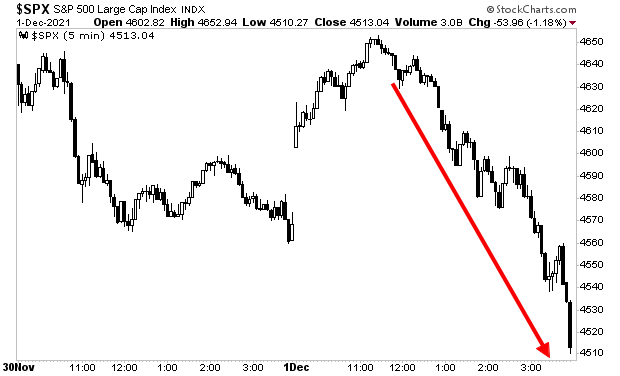

The dip buyers got annihilated yesterday.

Stocks started the day up as traders “bought the dip” expecting that once again the Fed would intervene to prop the markets up.

They were wrong, and stocks rolled over a dropped hard into the close.

What is going on here?

What is going on is that the Fed is no longer in the business of propping the markets up with more easing. As I noted yesterday, the Fed has completely shifted its focus from growth to inflation.

This means the Fed will be TIGHTENING, not easing going forward.

If you don’t believe me, maybe you’ll believe Fed Chair Powell who told a Senate panel yesterday: “The risk of persistently higher inflation has clearly risen, and I think our policy has adapted.”

“Policy has adapted” = we are tightening to crush inflation.

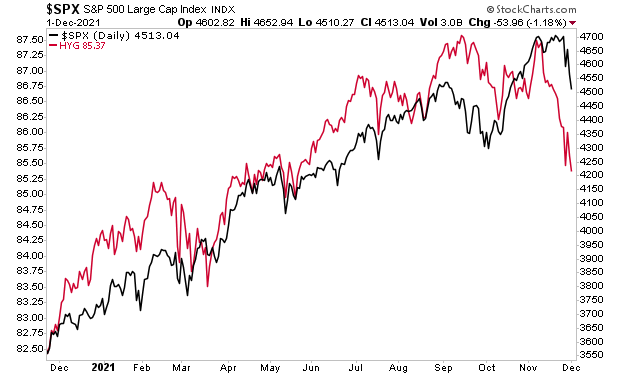

So, if you think the Fed is coming to the rescue anytime soon, you are mistaken. Stocks have NOT bottomed. If anything, this mess has just gotten started.

High yield credit (red line) has already figured this out. Stocks are only just starting to “get it.”

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,