By Graham Summers, MBA

The #1 question from clients over the weekend was whether Russia would invade Ukraine.

My answer: it doesn’t matter as far as stocks are concerned.

This is not to say that a war isn’t significant. And I’m certainly not making light of human suffering or loss of life. What I am saying is that stocks are going to new lows regardless of what happens in Eastern Europe/ Russia.

Let me explain.

The #1 rule for investing since 1996 has been: don’t fight the Fed.

What I mean by this is that as the financial system has become more and more addicted to Fed interventions, your goal as an in investor should be to align your interests with whatever the Fed is trying to do.

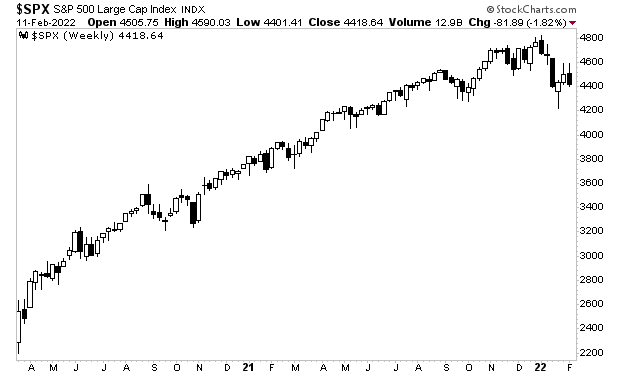

If the Fed is trying to reflate the financial system by printing trillions of dollars, you generally want to be long stocks. This was certainly the case from March 2020 until November 2021, during which time the Fed was easing monetary conditions aggressively, printing over $4 trillion. Stocks went up in an almost straight line throughout this period. Anyone who attempted to fight the Fed by betting on a crash got taken to the cleaners.

So, what is the Fed doing now?

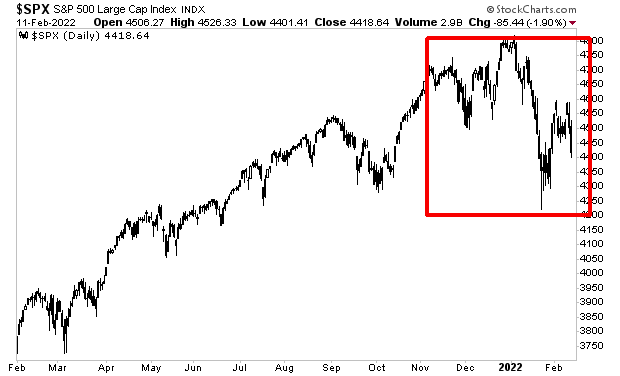

Since November 2021, the Fed has been reducing its money printing. Its last day of QE will be in early March (three weeks from today). And from that point onward, the Fed will be tightening monetary policy by raising interest rates.

Put simply, the Fed is tightening, which is generally BAD for risk assets like stocks. Investors already got a taste of what’s coming during the first leg down in late January.

So again, whether Russia invades Ukraine or not is relatively insignificant. The Fed, which is the single most powerful force in the markets, is tightening monetary policy right now, which means stocks are going to break down… or possibly even crash.

After all, the last three times the Fed did what it is doing now resulted in:

1) The Tech Crash (2000-2002) stocks lost 80%.

2) The Housing Crash (2007-2009) stocks lost 60%.

3) The late-2018 meltdown (October-December 2018) stocks lost 20%.

Let me be blunt here, if you’re not taking steps to prepare for what’s coming, NOW is the time to do so.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,