By Graham Summers, MBA

The stock market manipulations are getting even more desperate.

For weeks now, I’ve noted time and again that the only thing holding up the stock market was abject manipulation.

Financial institutions do NOT attempt to move markets. In fact, the traders charged with executing these institutions’ trades are graded based on their ability to buy and sell large chunks of stocks without moving the tape.

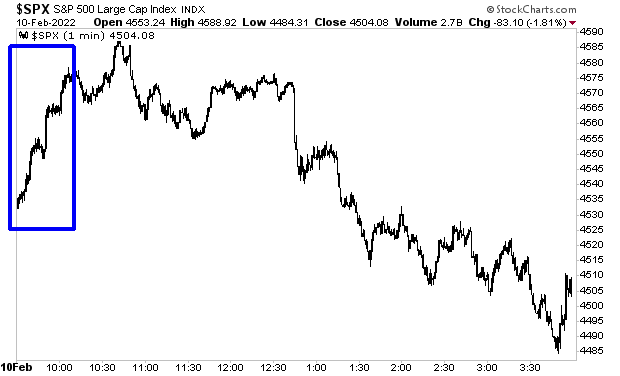

Which is why we knew that no real investor was responsible for the move that occurred yesterday at the open. I’m talking about the move that pushed stocks up from 4,535 to 4,575 in a matter of minutes on announcements that inflation has hit a 40-year high.

The CPI came in at 7.5% yesterday. The Fed’s funds rate is still at zero. Yesterday’s news means the Fed is WAAAAAYYY behind the curve on inflation and will need to hike rates aggressively.

So what investor would buy panic buy stocks based on this? The answer is NO ONE. This was egregious manipulation. And it shows us that the manipulators are becoming increasingly desperate.

Why?

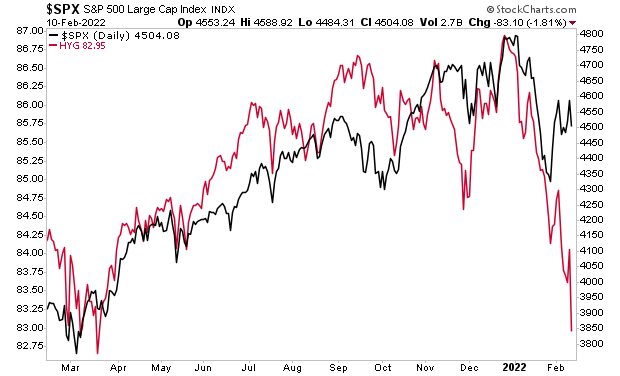

The credit markets are imploding. They know what is coming. It ain’t pretty.

Let me be blunt here, if you’re not taking steps to prepare for what’s coming, NOW is the time to do so.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,