By Graham Summers, MBA | Chief Market Strategist

The trade wars just claimed their first victim: Nvidia (NVDA).

NVDA is one of the most important companies in the stock market. The reason for this is that NVDA produces the chips/ Graphics Processing Units (GPUs) that the entire world is using to build out Artificial Intelligence (AI) platforms.

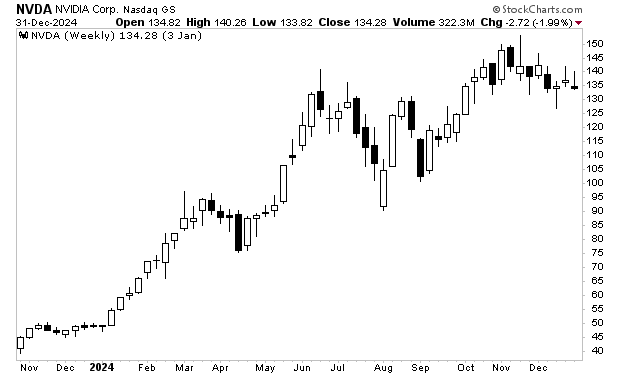

Because of this, NVDA has been a true market leader for most of the bull market begun in 2023. NVDA shares more than tripled in 2024. And at one point, NVDA was the largest company in the world based on market capitalization.

Last night, NVDA reported that it would take a $5.5 billion charge this quarter due to the U.S. restricting its exports of H20 AI chips to China. Roughly 20% of NVDA’s business comes from China, so this is not a small issue.

NVDA shares sold off hard in the after-hours.

NVDA is the first company to “take it on the chin” due to the tariffs/ trade wars, but it won’t be the last. The Trump administration’s chaotic rolling out of its policies has resulted in the stock market as a whole losing some $11 TRILLION in value since late January.

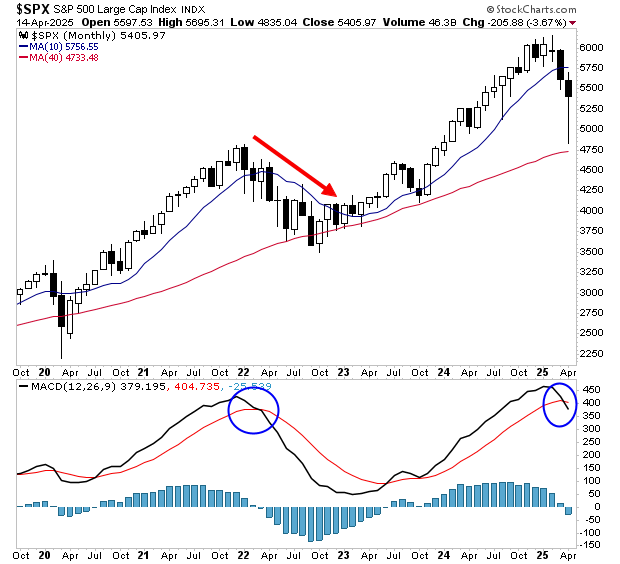

The technical damage to the markets has been severe, to the point that the S&P 500 has just triggered a MAJOR sell signal for the first time since the 2022 top. What followed was a year-long bear market that saw stocks lose over 20%.

If you’ve not prepared for this, the time to do so is NOW before this unfolds.

Indeed, our proprietary Crash Trigger is now on red alert. This trigger went off before the 1987 Crash, the Tech Crash, and the 2008 Great Financial Crisis.

We detail this trigger, how it works, and what it’s saying about the market today in a Special Investment Report titled How to Predict a Crash.

Normally this report is only available to our paying clients, but in light of what’s happening in the markets today, we are making just 99 copies available to the general public.

To pick up one of the remaining copies…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research