Yesterday was another day of bad economic data with the ISM report showing the worst employment figure since September 2009.

The bulls believe that bad economic data means more QE. The problem with this is that they’re ignoring the fact that this current spat of bad data is coming out while QE 3 and QE 4 are occurring.

At any other time in the last four years, bad news could open the door to more QE as every QE plan had a fixed timeline in place. So there was always the possibility of more QE coming if economic data worsened once a particular program came to an end.

However, today the Fed is already running two QE programs that are correctively pumping $85+ billion into the system per month. So the fact that bad economic data is coming out now indicates QE is losing is effect.

This does NOT open the door to more QE now. If the Fed tapers QE in the future then yes, it might engage in more QE later down the road. But the idea that the Fed will increase QE when it’s already running $85 billion a month is misguided.

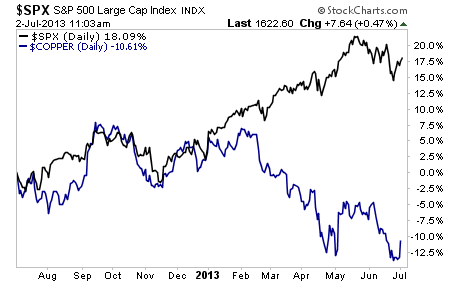

Copper, the commodity with a PhD in economics, gets this. Stocks do not.

Guess which asset class is in for a surprise in the coming months?

This is just the start. I warned Private Wealth Advisory subscribers in our most recent issue that higher rates were coming noting a collapse in bonds in Europe and the emerging market space.

This could easily become truly catastrophic. The world is in a massive debt bubble and the Central banks are now officially losing control. The stage is now set for a collapse that could make 2008 look like a joke.

If you are not preparing in advance for this, the time to get started is NOW.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

As I write this, all of them are SOARING (one is up 12% this today alone). In fact we just closed another yesterday bringing our new winning streak to NINE trades.

Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash? If not, take out a trial subscription to Private Wealth Advisory and start protecting your hard earned wealth today!

We produced 72 straight winning trades (and not a SINGLE LOSER) during the first round of the EU Crisis. We’re now preparing for more carnage in the markets… To join us…

Best Regards,

Graham Summers