Yesterday, Fed Chair Jerome Powell made a starling admission,

“The U.S. federal government is on an unsustainable fiscal path,” Powell told the Senate Banking Committee, noting that “debt as a percentage of GDP is growing, and now growing sharply… And that is unsustainable by definition.”

Source: Yahoo! Finance

What Powell said has been obvious to anyone with a functioning brain for years. However, we have to remember one key item…

This is the FED CHAIR talking… the person in charge of maintaining STABILITY for the financial system and who controls the printing the of the US currency… not just some talking head on TV.

So just how bad are the US’s finances that the Fed Chair would be willing to admit this PUBLICLY?

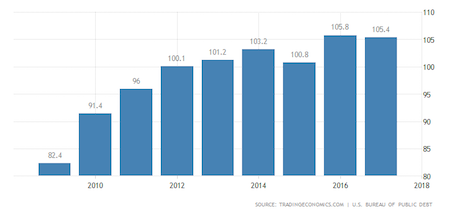

Total US debt has just hit $22 trillion. The US now has a Debt to GDP ratio of 105%. This is roghly where Greece was when it entered a debt crisis in 2010 (though there are certain key differences between the US’s and Greece’s abilities to deal with their debt issues).

Fed Chair Jerome Powell has also made it clear that it is NOT the Fed’s job to fix this.

“We need to stabilize debt to GDP. The timing the doing that, the ways of doing it —through revenue, through spending — all of those things are not for the Fed to decide.”

Source: Yahoo! Finance

So… either the US Political Elite needs to spend less (not going to happen) or it needs to find access to new sources of capital… ours.

With that in mind, the current political agenda to push for Wealth Taxes, cash grabs and other means of raising capital all makes sense.

Consider the following:

- The IMF has already called for a wealth tax of 10% on NET WEALTH.

- More than one Presidential candidate for the 2020 US Presidential Race has already openly called for a wealth tax in the US.

- Polls suggest that the majority of Americans support a wealth tax.

And if you think this will stop with the super wealthy, you’re mistaken. You could tax 100% of the wealth of the top 1% and it would finance the US deficit for less than six months.

Which means…

Cash grabs, wealth taxes, and more will soon be coming to Main Street America.

Indeed, we’ve uncovered a secret document outlining how the Fed plans to both seize and STEAL savings during the next crisis/ recession.

We detail this paper and outline three investment strategies you can implement right now to protect your capital from the Fed’s sinister plan in our Special Report The Great Global Wealth Grab.

We are making just 100 copies available for FREE the general public.

You can pick up a FREE copy at:

http://phoenixcapitalmarketing.com/GWG.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research