By Graham Summers, MBA

The U.S. passed a debt ceiling resolution in May of 2023. Both the GOP and the Democrats claimed victory for the deal, but the reality is the government won and Americans were screwed.

How do I know this?

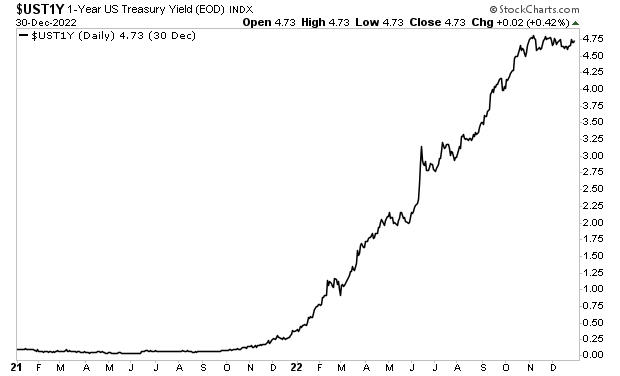

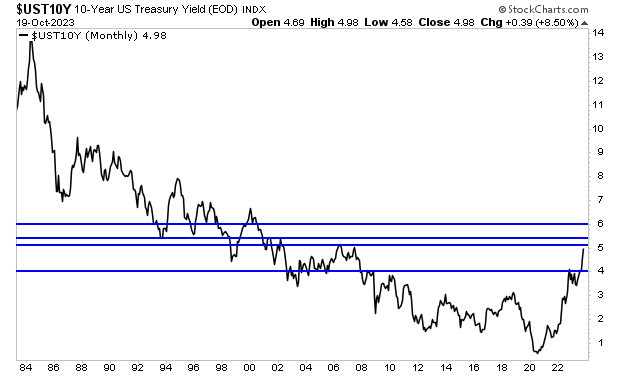

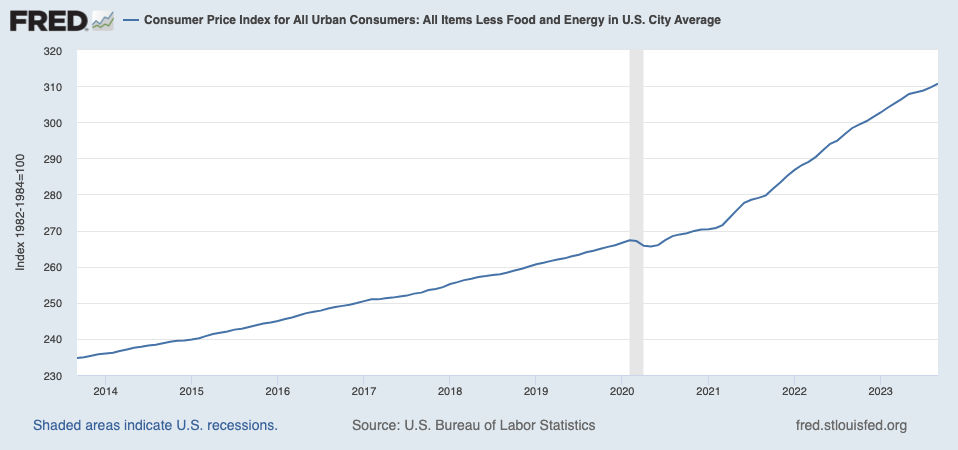

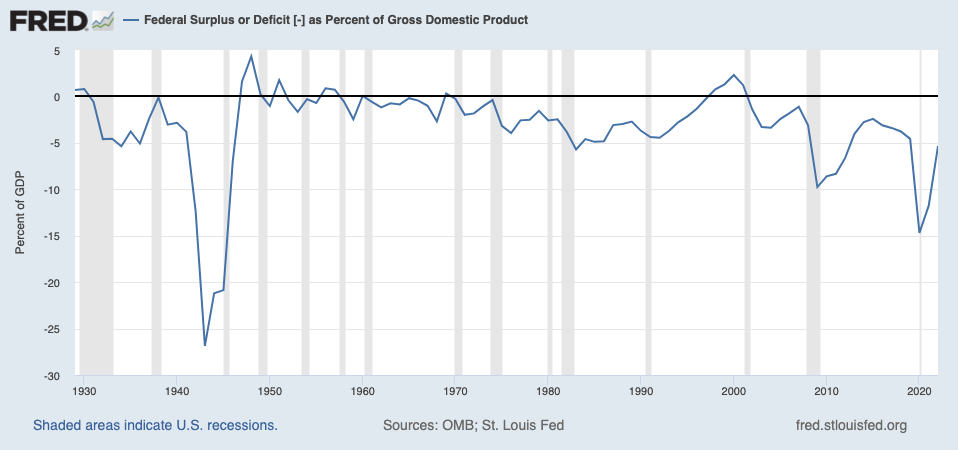

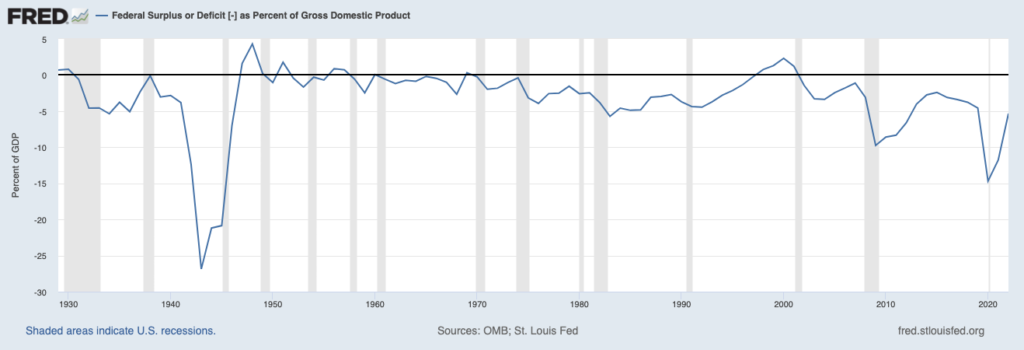

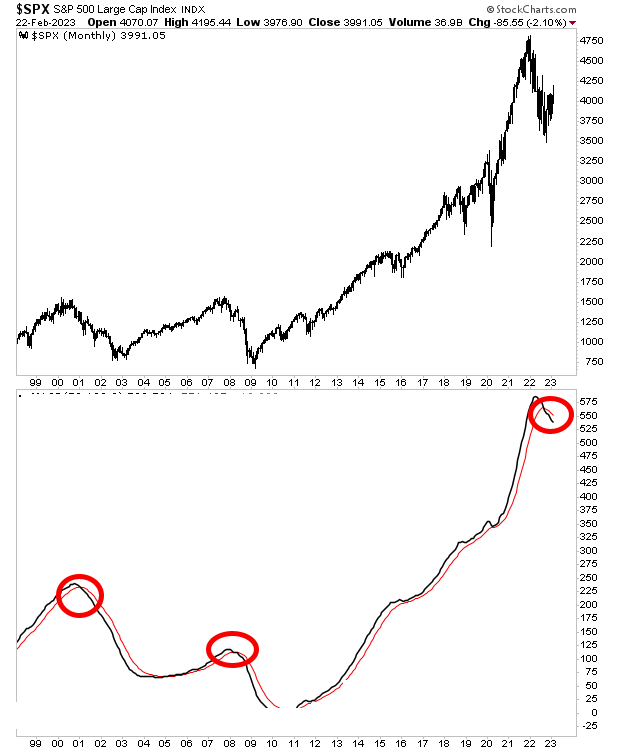

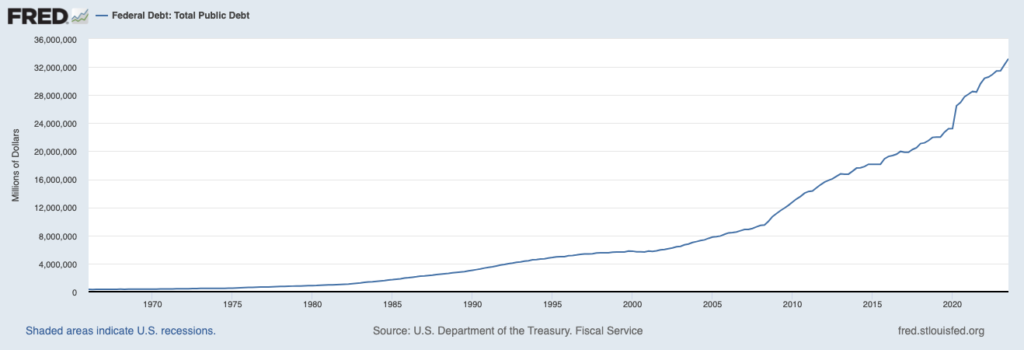

It took the U.S. 232 years to generate its first $10 trillion in debt. It added another $10 trillion in debt in just nine years once the Fed pinned interest rates at zero and cornered the bond market with Quantitative Easing (QE) from 2008 to 2017.

The U.S. then added another $10 Trillion in debt in just five years when the Fed reintroduced ZIRP and QE in NUCLEAR fashion in response to the pandemic. Obviously, you’re beginning to see the trend here: the U.S. added $10 trillion in debt in 232 years, nine years, and five years.

But the “debt deal” has really added fuel to the fire.

The U.S. has added another $4 trillion in debt since 2022. But~ $2 trillion of this was added in the seven months since the debt deal was passed! And thanks to the debt deal removing the debt ceiling until 2025, there is little chance that the pace of debt issuance will slow anytime this year.

How will this end? With a debt crisis of some sort. The details, for now, are unclear.

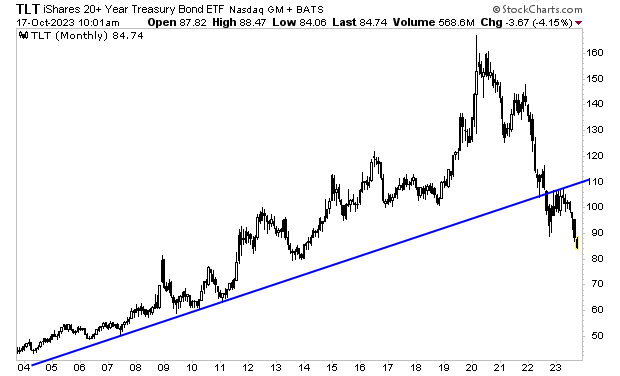

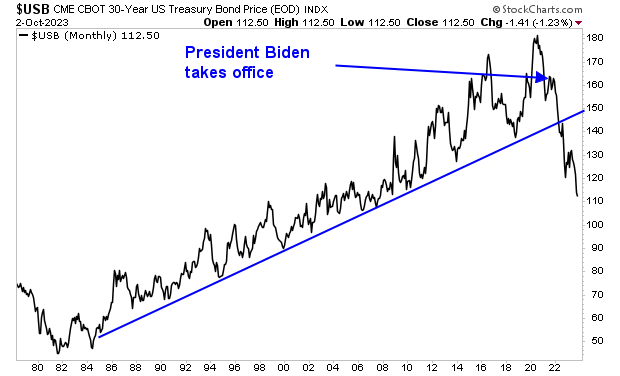

What isn’t unclear is that investors can potentially make a LOT of money from this situation. Those who invested in the right assets at the right times during the last 20 years while the U.S. has engaged in a debt bonanza have seen some truly OBSCENE returns.

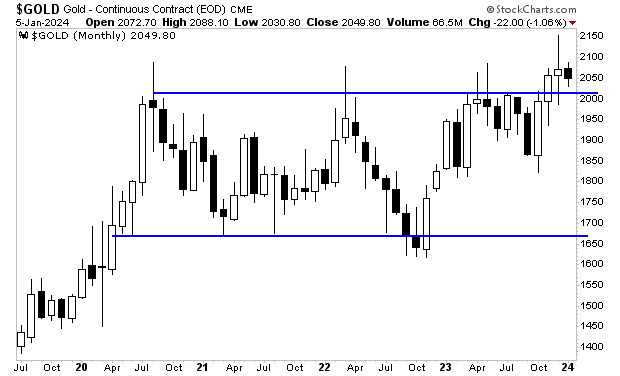

And no, I’m not talking about gold. The precious metal has traded sideways for four years, while the U.S. has tacked on another $10 trillion in debt.

If you’re looking for someone to guide your investing to insure you crush the market, you can sign up for our FREE daily market commentary, GAINS PAINS & CAPITAL.

As an added bonus, I’ll throw in a special report Billionaire’s “Green Gold” concerning a unique “off the radar” investment that could EXPLODE higher in the coming months. It details the actions of a family of billionaires who literally made their fortunes investing in inflationary assets. And they just became involved in a mid-cap company that has the potential to TRIPLE in value in the coming months.

To pick up your copy, swing by:

https://phoenixcapitalmarketing.com/GreenGold.html