By Graham Summers, MBA

“Someone” is manipulating stocks higher. And the manipulations are getting even more desperate.

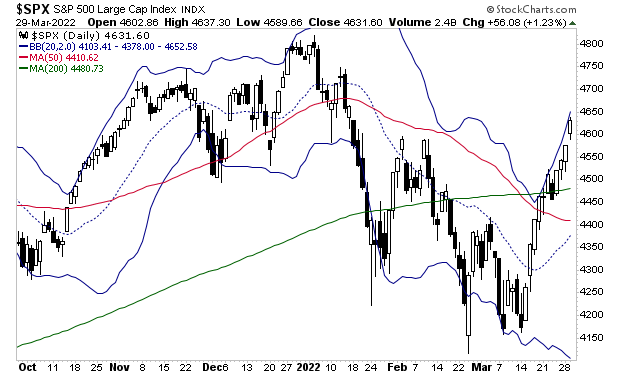

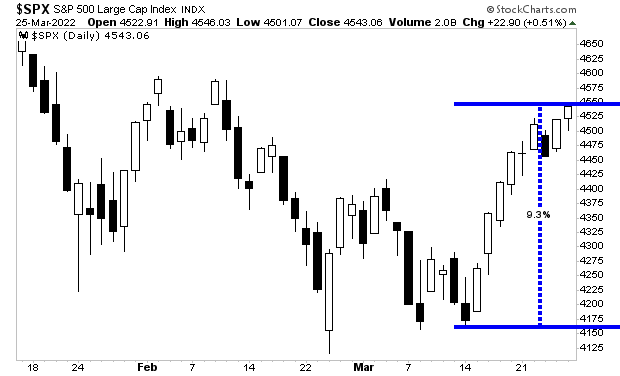

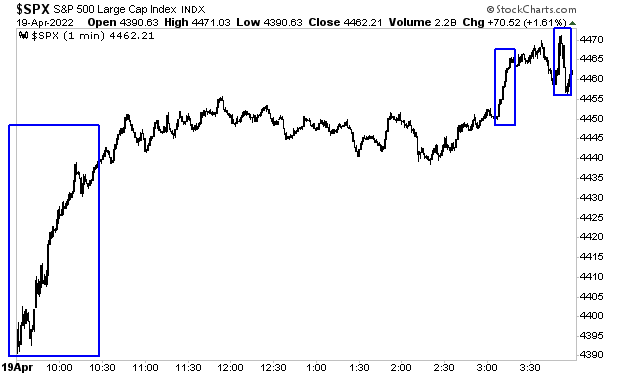

Over the last two weeks, there has been a determined effort to manipulate the stock market higher. Time and again, stocks have gone vertical on new news or no major developments.

Financial institutions do NOT attempt to move markets. In fact, the traders charged with executing these institutions’ trades are graded based on their ability to buy and sell large chunks of stocks without moving the tape.

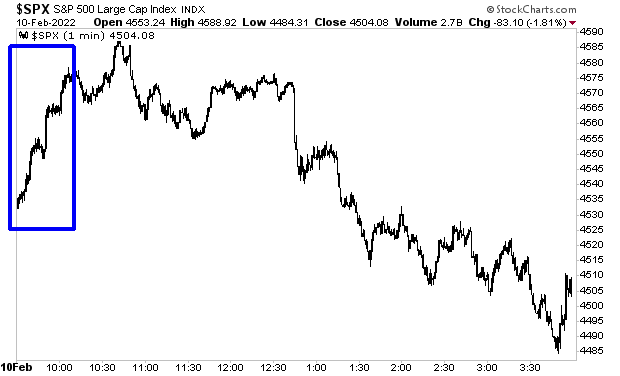

Which is why we knew that no real investor was responsible for the moves that occurred yesterday from 9:35AM to 11:00AM, again at 3PM and finally at 3:40PM. All three of those moves saw the S&P 500 move 20-50 points on no news or developments.

No real investor does this. This is egregious manipulation. And it shows us that the manipulators are becoming increasingly desperate.

Why?

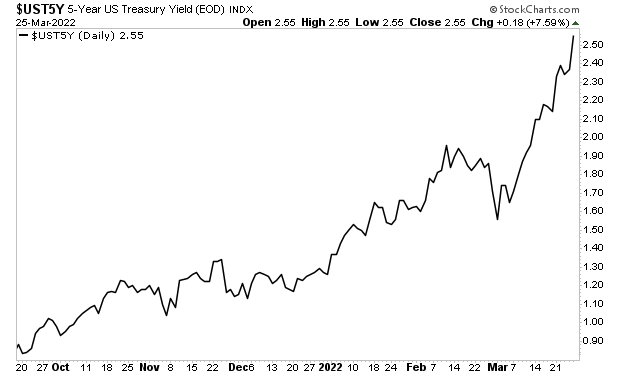

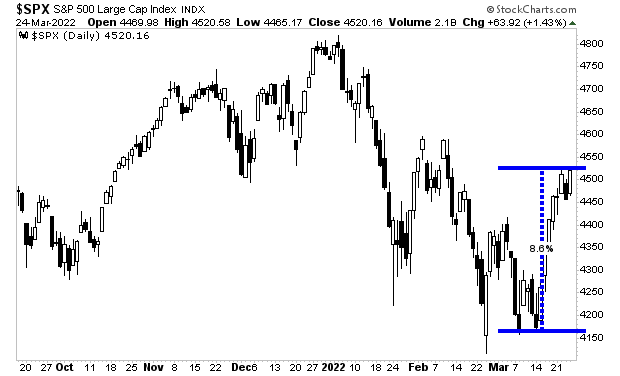

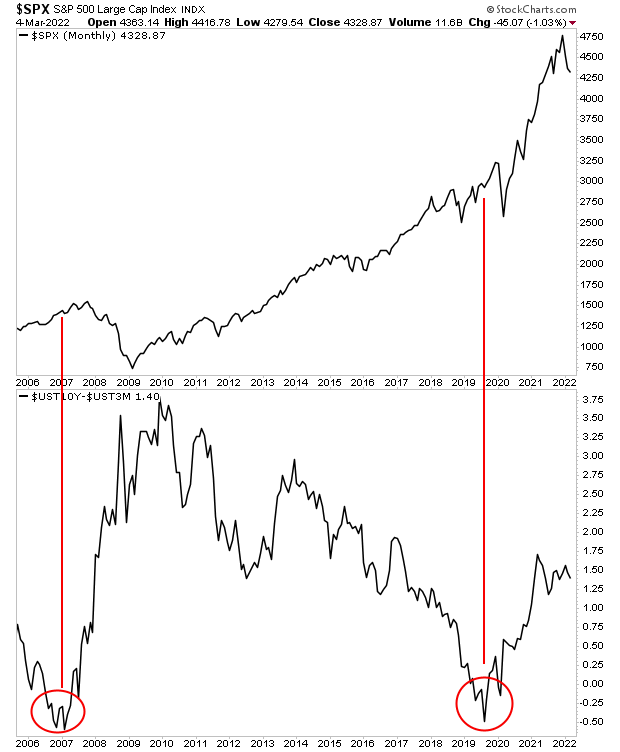

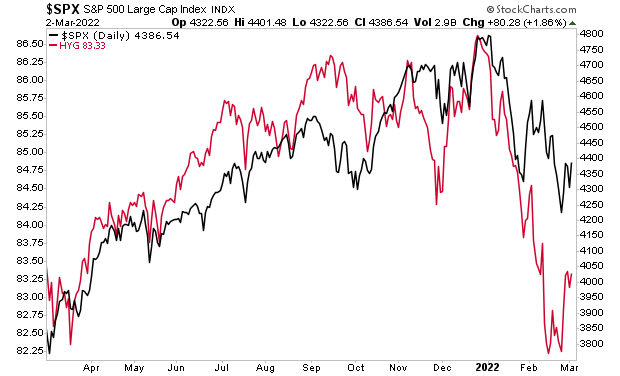

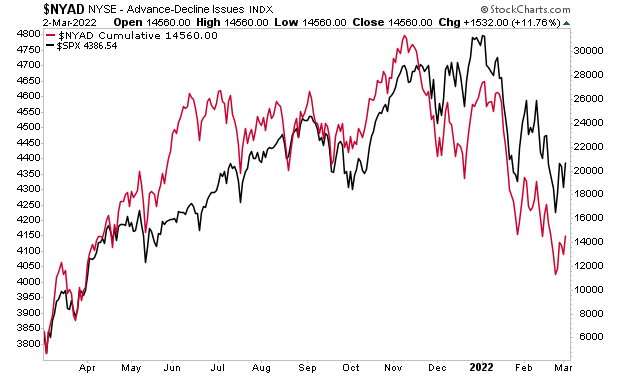

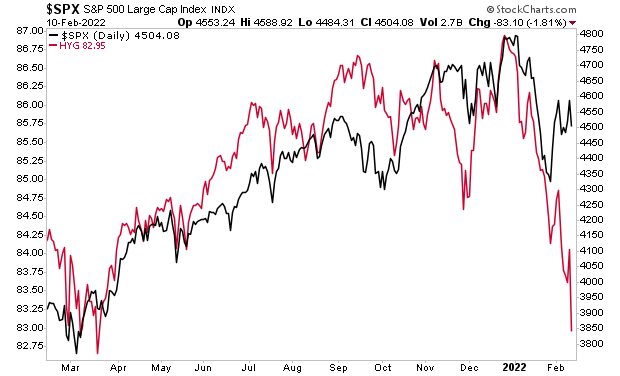

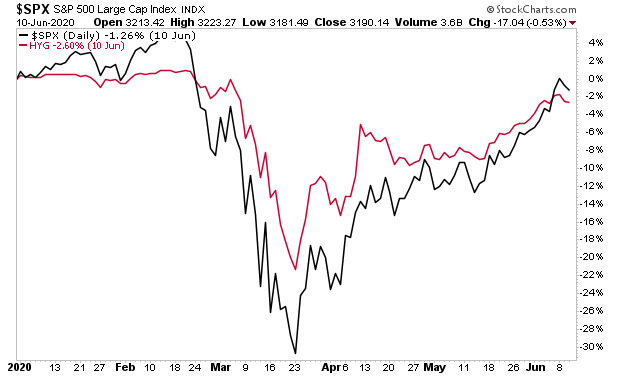

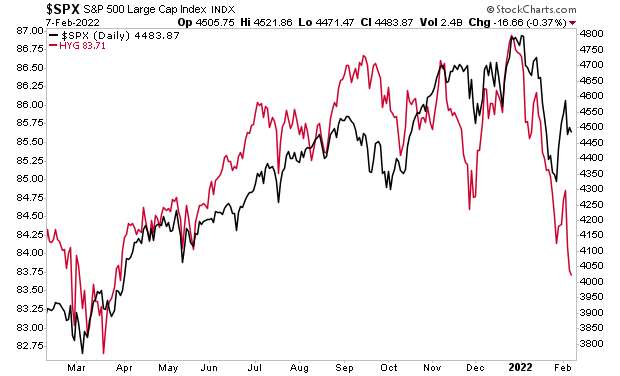

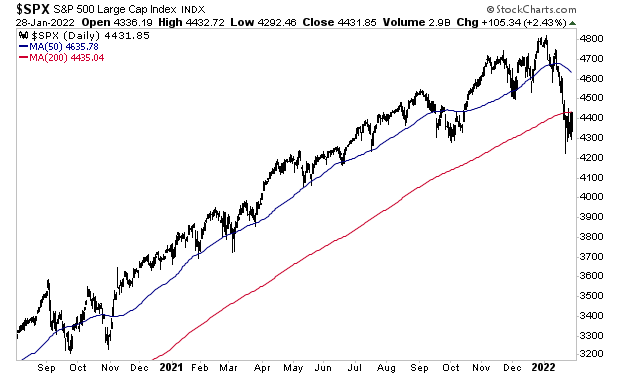

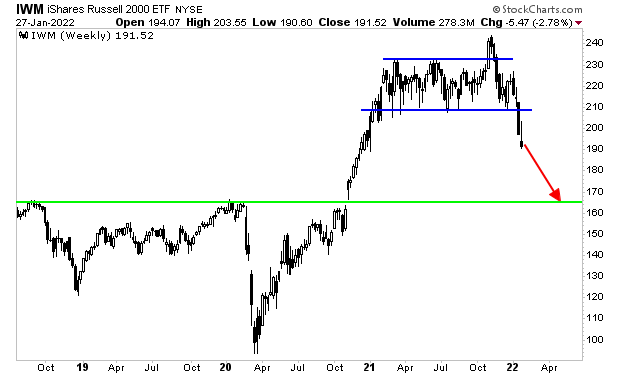

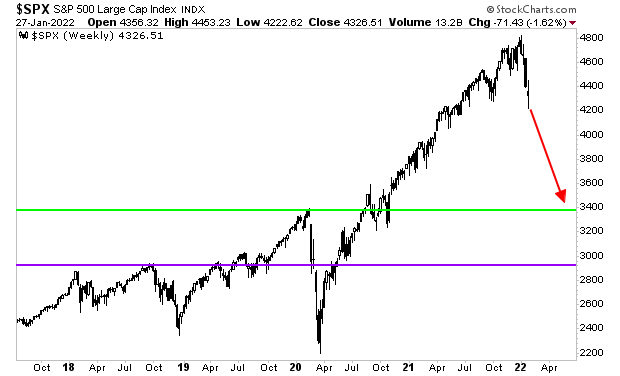

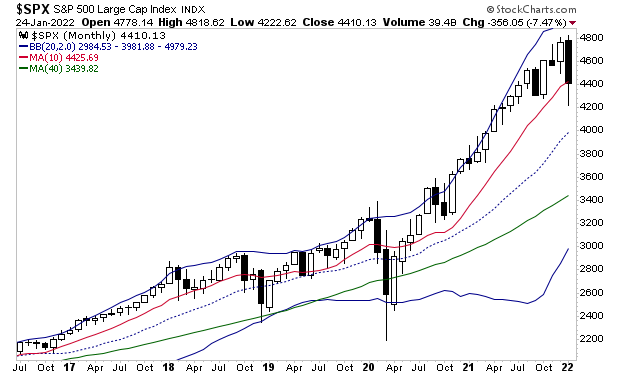

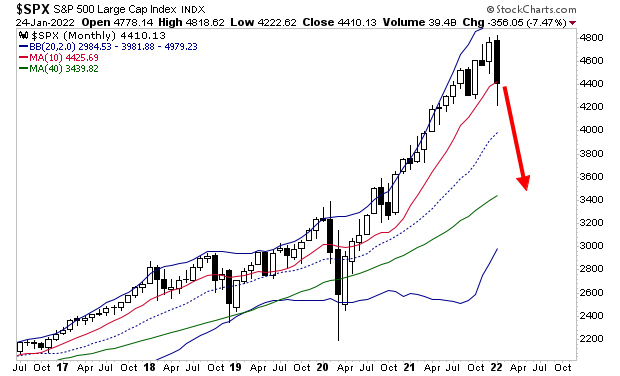

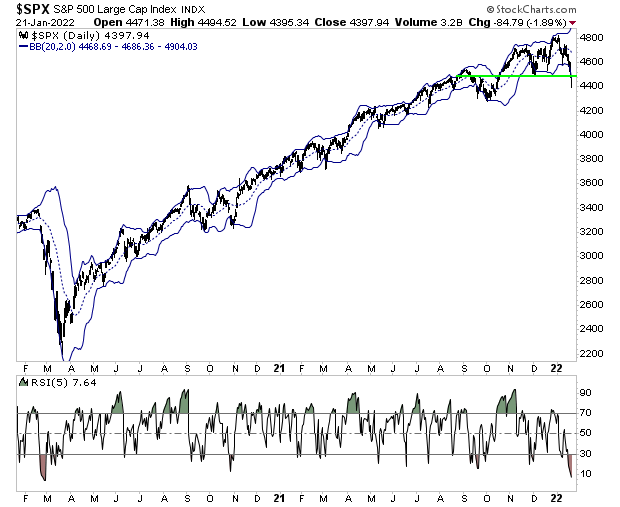

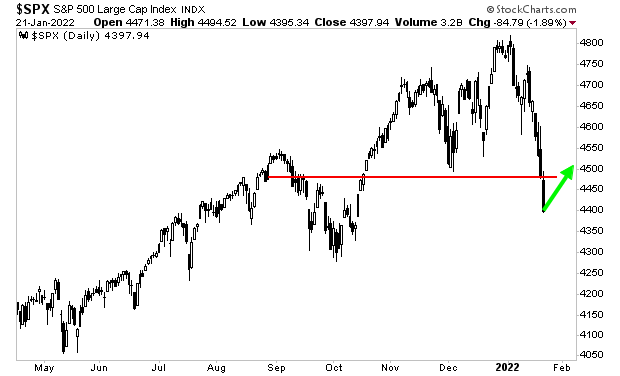

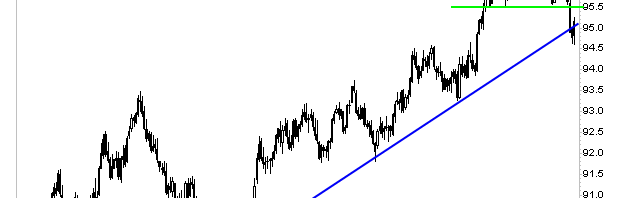

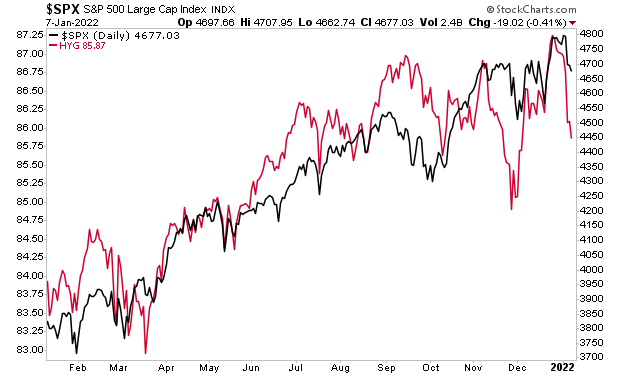

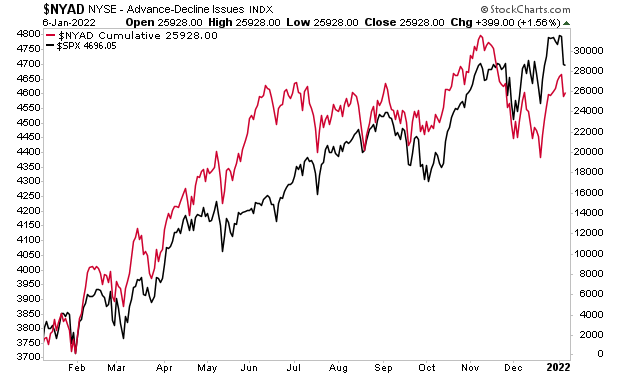

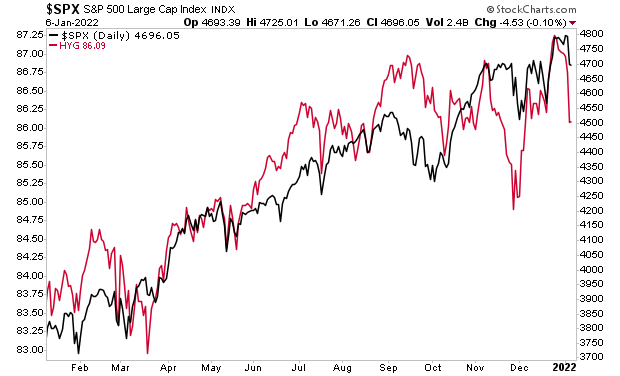

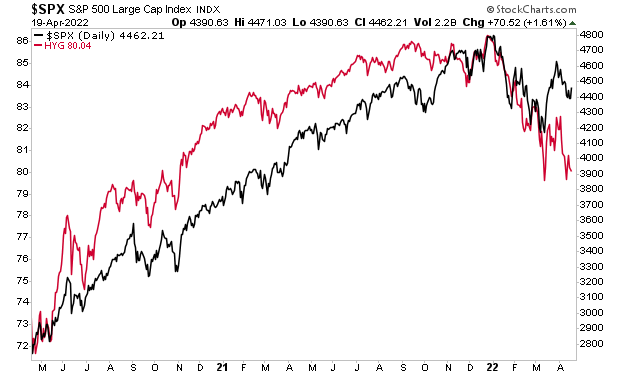

High yield credit, which typically leads the stock market, is telling us the S&P 500 should be down at 3,900 (stocks are at 4,400 right now). You can see it lead stocks higher throughout 2021. And now it’s leading them lower. Without manipulation, the S&P 500 would easily be sub-4000.

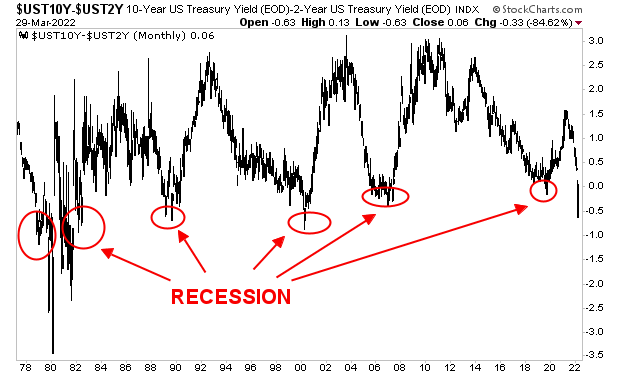

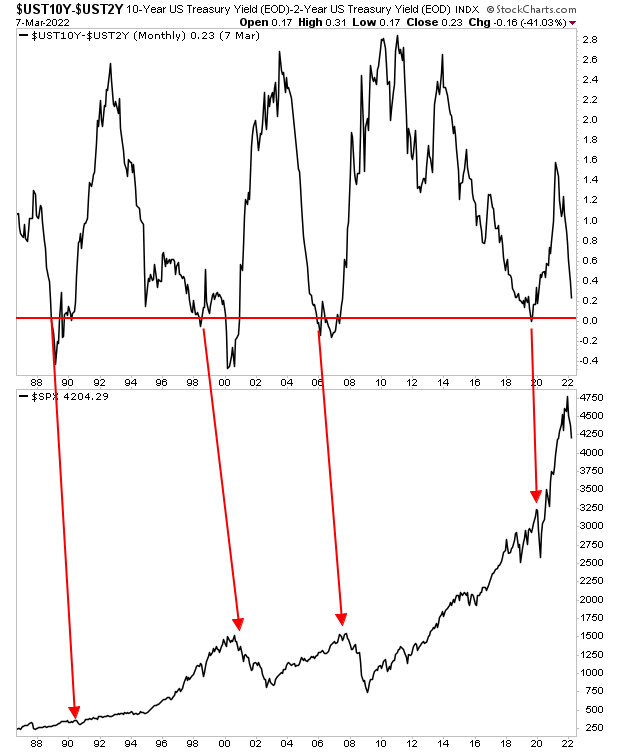

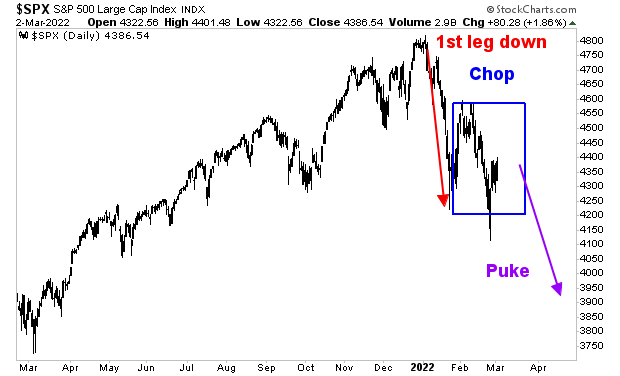

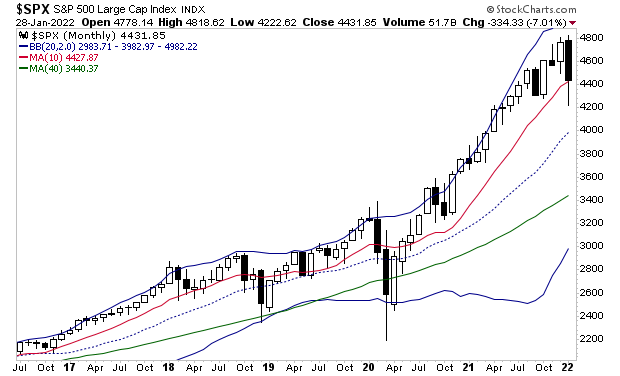

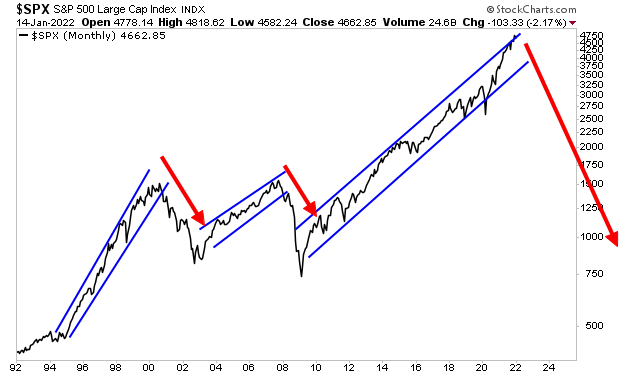

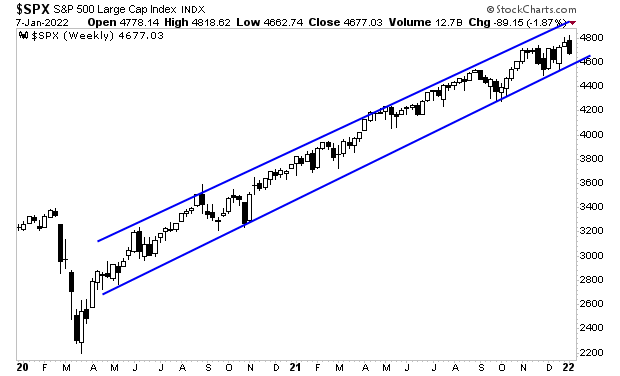

In simple terms, the signs are clear: another bloodbath is coming. The markets will soon be a sea of red again. And the losses will be staggering.

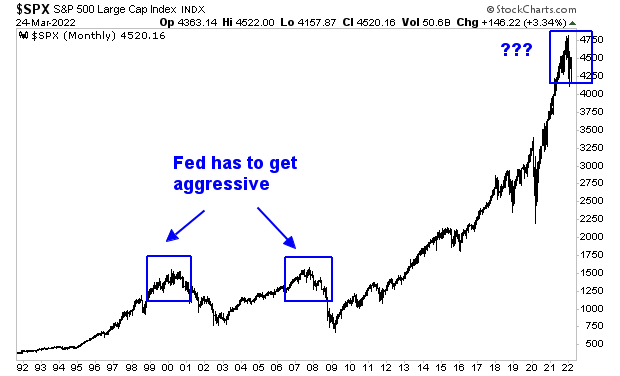

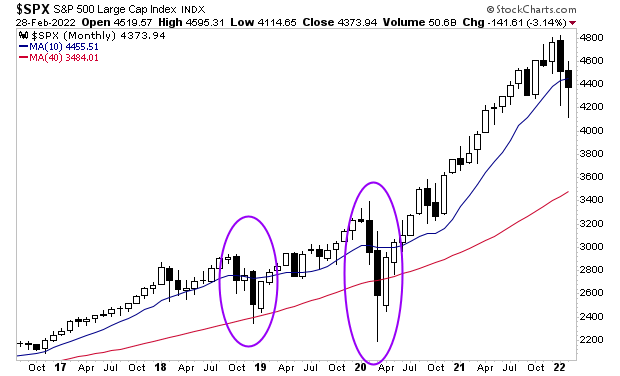

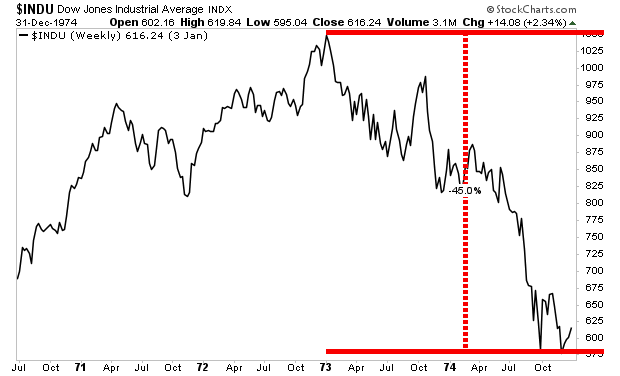

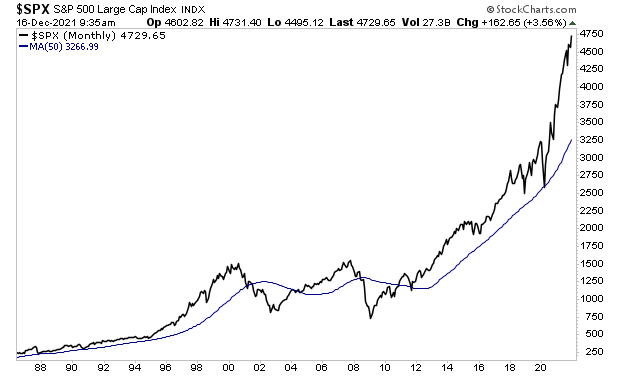

And it’s just the beginning. It’s quite possible the markets are entering a prolonged BEAR MARKET… a time in which stocks lose 50% or more over the course of months.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guide can show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html