It is impossible to understand what is happening in the U.S. today from a COVID-19 policy response.

One day Dr Fauci says there will NOT be lockdowns, and the very next President Biden suggests there will.

One day CDC Director Rochelle Walensky states that the Biden Administration will likely issue a national mandate for the COVID-19 vaccine… and the next day she walks that back stating that “an experimental vaccine cannot be mandated by anyone.”

One day we are told by Biden administration officials that Delta variants are the biggest concern in terms of spread… and the next day the White House Deputy Press Secretary admits that she doesn’t even know if there’s a test for it.

You can draw your own conclusions from this situation. Some people will say that COVID-19 is a complicated situation that changes on a weekly basis, hence the confusion. Others will say this whole mess is about politics and has nothing to do with science. Others will say it’s a mix of the two.

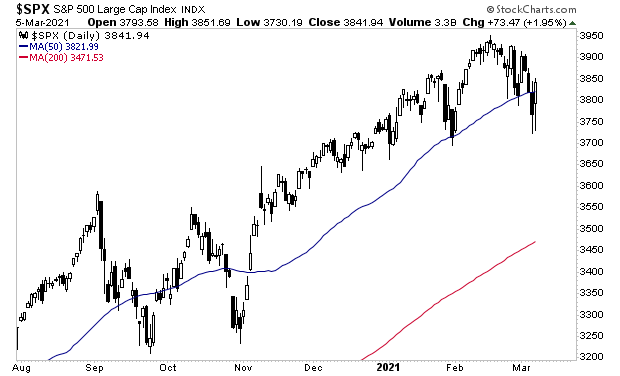

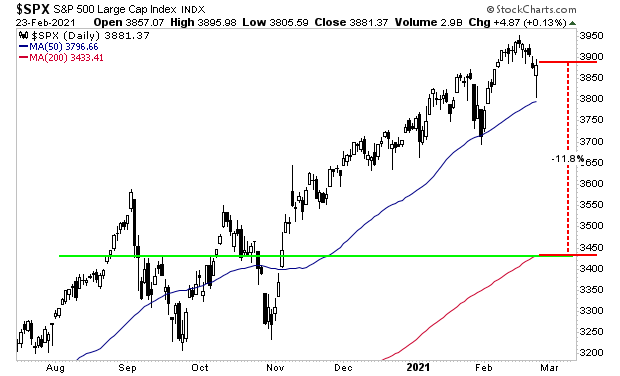

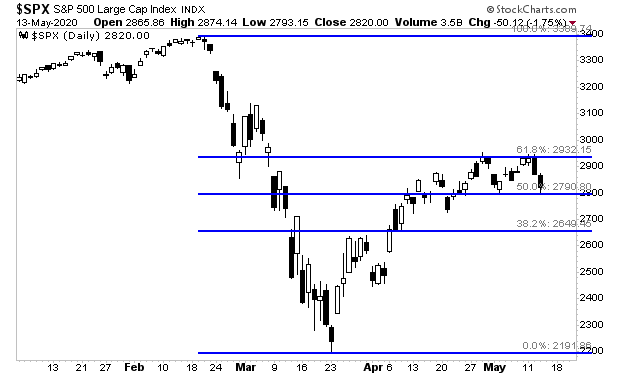

For investors, given the market impact of another round of shutdowns, the wisest move is to ignore all the news and focus on price levels.

Put another way, don’t try to be psychic… let the market show you what’s going on.

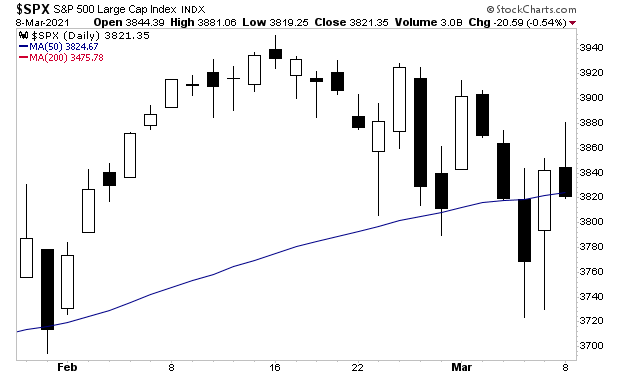

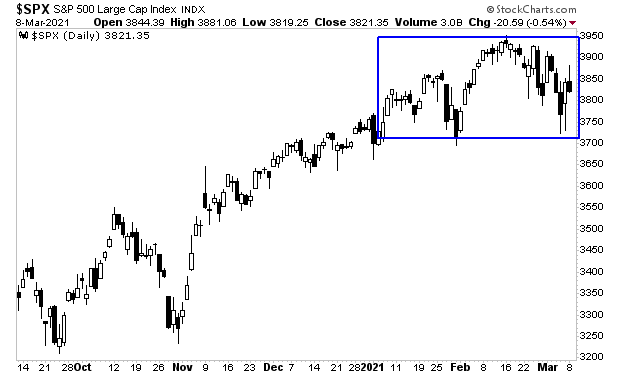

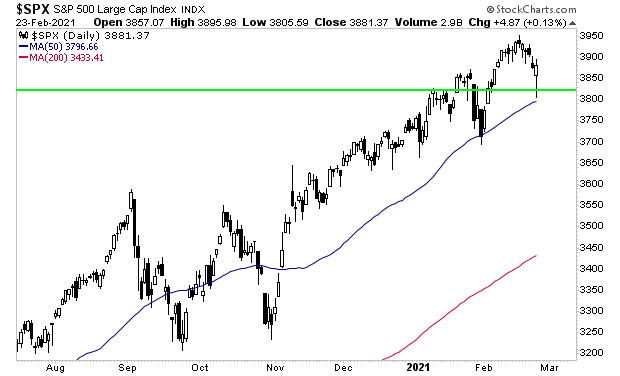

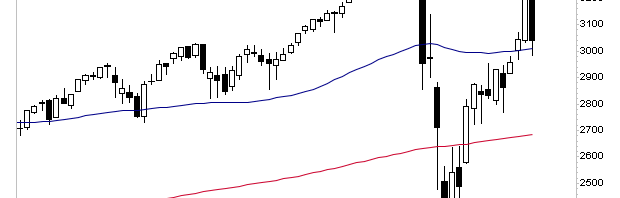

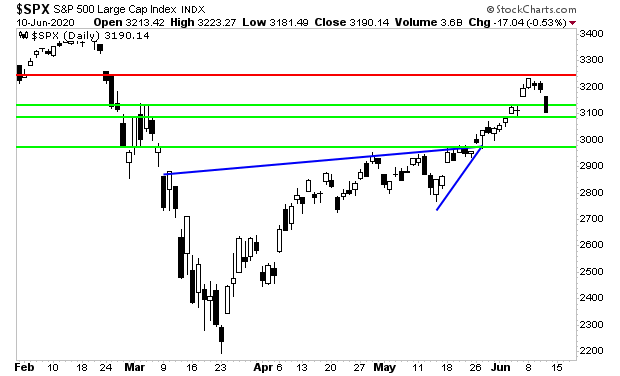

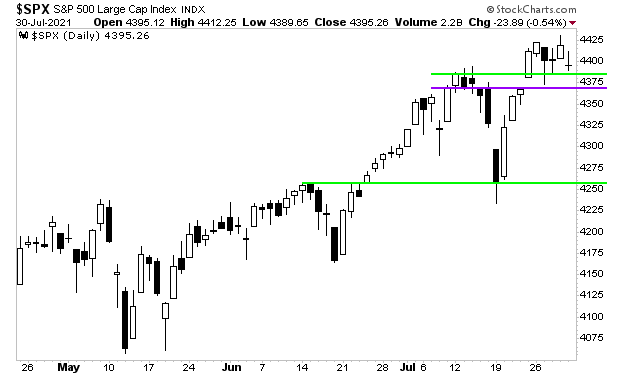

I’ve illustrated the major lines of support for the S&P 500 with green lines in the chart below. They are currently 4380 and 4265. We also have minor support at 4,370 (purple line).

The key with bull markets is to let ride them for as long as possible. Put another way, until the market starts to “do something wrong,” by breaking down and taking out support lines you need to fight the urge to sell.

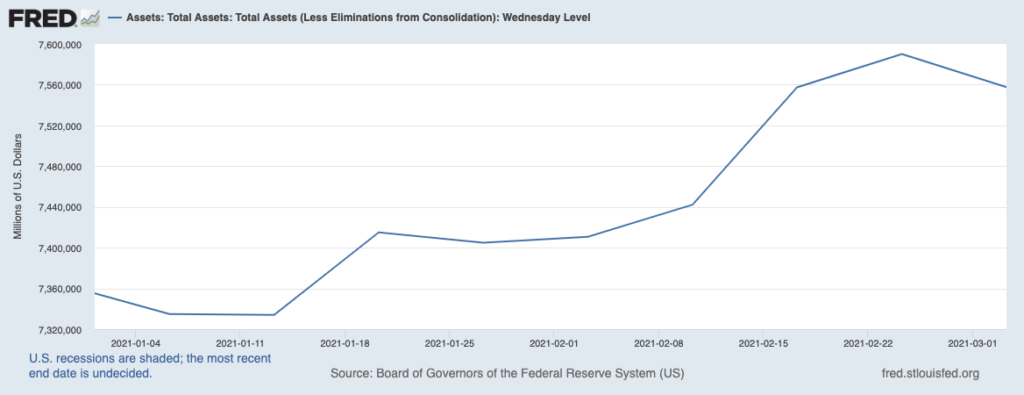

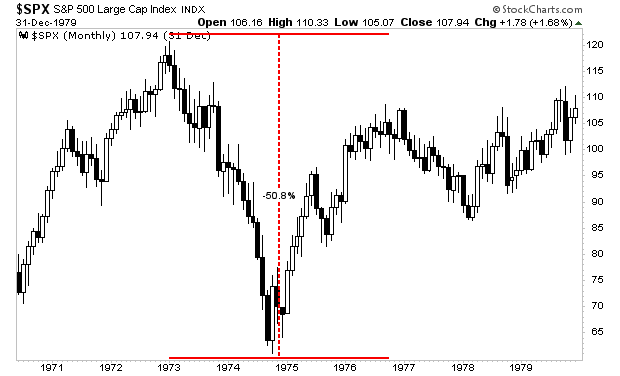

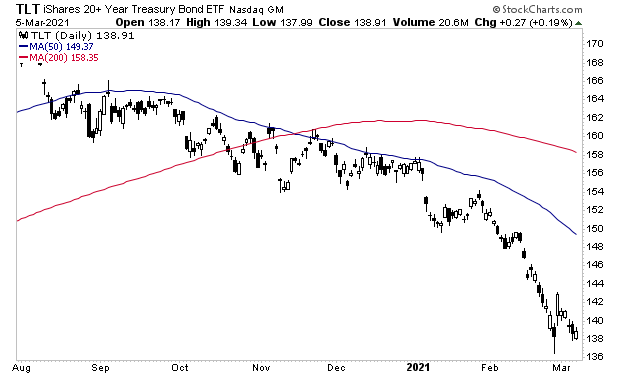

At some point the stock market will break down again as the Everything Bubble finally bursts and the financial system lurches into another crisis.

With that in mind, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the general public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist