The US Dollar as we know it, derives its value based on where it trades against a basket of other currencies. Some 56% of this basket is comprised of Euros. Because of this, moves in the Dollar and the Euro tend to be closely correlated.

So, when the ECB cut interest rates to negative in June 2014, capital began to flow aggressively away from the EU and into the US Dollar. This in turn kicked off a strong US Dollar rally.

Which in turn began to implode the $9 trillion global US Dollar carry trade.

Globally, the world is awash in borrowed money… most of it in US Dollars. The US Dollar carry trade is north of $9 trillion… literally than the economies of Germany and Japan COMBINED.

When you BORROW in US Dollars you are effectively SHORTING the US Dollar. So when the US Dollar rallies… you have to cover your SHORT or you blow up.

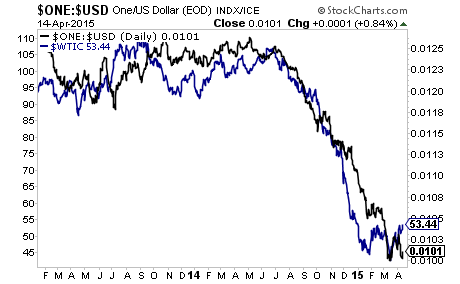

Below is a chart showing the inverse US Dollar (meaning that when the Dollar strengthens, the black line falls) and the Euro (blue line). Note that the two move almost lockstep together:

This situation is not over. The US Dollar carry trade did not clean itself out in the space of six months. Again, there are over $9 trillion in borrowed Dollars floating around the financial system. If the US Dollar continues to strengthen at a bare minimum 50% of this will need to be unwound.

If you’re looking for actionable investment strategies to profit from the coming collapse, we highly recommend you take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter that tells you what stocks to buy, and what stocks to avoid to insure you see consistent gains. Our track record is rock solid with recent positions closed out with gains of 26%, 29%, and 37%… all held for six months.

In fact, we just closed two new winners of 20% and 52% last week!!!

And we’ve only closed ONE loser in the last 7 months!

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents

If you don’t like it… just drop us a line and you won’t be charged again. Everything you received during your 30 day trial (the reports, investment ideas, etc.) are yours to keep…

To take out a $0.98 trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research