Since 2008, the Keynesians running global Central Banks had always suggested that there was no problem too great for them to handle. They’d promised to do “whatever it takes,” to maintain the financial system and print the world back to growth.

Thus far, we’d seen some pretty aggressive moves. The most aggressive was committed by the Bank of Japan, which announced a single QE program equal to 24% of Japanese GDP in April 2013.

However, the SNB was the first Central Bank to actually reach the point at which it had to decide between printing a truly insane amount of money relative to GDP (50%+) or simply giving up.

It chose to give up.

In many ways, the SNB was cornered by the ECB into this situation. I think this is why the SNB decided to make its announcement on a Thursday as opposed to over the weekend (when Central Banks usually announce bad news to minimize the market impact). The SNB wanted to cause mayhem, likely because it was frustrated by the ECB’s upcoming QE program of which the SNB was undoubtedly aware in advance.

This situation has since progressed with an even larger, more important Central Bank buckling to market forces.

That Central Bank is China.

As we’ve noted before, China’s economy is in tatters. At best it is growing around 3.5%. At worst it isn’t growing at all. And with its currency closely linked with the US Dollar (which is in a bull market) Chinese exporters were getting destroyed.

So what did China do? It chose to devalue the Yuan.

In short, a new player is in the global currency war. And it represents the second largest economy in the world. Having said that, we want you to take note of a few lessons from this situation:

- There are in fact problems that are too big for Central Banks to manage.

- Central Banks are in fact individual entities. True, they try to coordinate their moves, but when push comes to shove, it will be each Central Bank for itself. This trend will be increasing going forward.

- Central Banks have no problem lying about the significance of a situation right up until they shock the market (both the SNB and the PBOC’s moves were suddenly announced).

Of these, #1 is the most important. Since the mid-‘80s, the general consensus has been that there is no problem too great that Central Banks cannot fix it. This has been the case because most crisis that have occurred during that period were either isolated to a particular market (Asian Crisis, Latin American Crisis, Russian Ruble Crisis, etc.) or a particular asset class (Tech Bubble, Housing Bubble, etc.).

This situation has resulted in less and less volatility in the financial system, combined with increased risk taking on the part of investors. As a result, the necessary deleveraging has never been permitted to occur and the financial system has become increasing leveraged (meaning more and more debt).

You can see this in the below chart revealing total credit market instruments in the US (this only includes investment grade bonds, junk bonds, and commercial paper). The deleveraging of the 2008 crisis which nearly took down the entire financial system was a mere blip in a mountain of debt (and this doesn’t even include US sovereign debt, emerging market debt, derivatives, etc.).

Today, when you include global debt issuance, we are facing a debt super crisis, the likes of which has never existed before: $100 trillion in global bonds, with an additional $555 trillion in derivatives.

Central Banks, by printing money, began a war of competitive devaluation in 2008. This worked fine when they were coordinating their moves to prop the system up from 2009-2011. We even had some coordinated efforts by the Fed and the ECB to push the markets higher in 2012 in order to benefit President Obama’s re-election campaign.

However, 2012 marked the high water mark for Central Bank intervention without political repercussions. From that point onward, all Central Bank began to lose their political capital rapidly.

- In Japan, the Bank of Japan’s policies are demolishing the Middle Class. The number of Japanese living on welfare just hit a record and real earnings and household spending have been in a free fall since the middle of 2014.

- In Europe, the ECB’s President Mario Draghi has admitted in parliament that he was concerned about a “deflationary death spiral” and admitted that QE was the last tool left. Half of the ECB’s Board is against his direction.

- In the US, the Fed is now being targeted by Congress. Legislation has been introduced to audit the Fed AND force it to abide by the Taylor Rule.

- In China, deflation is spiraling out of control with a stock market crash, housing bubble bursting, and economic downturn that is more serve than most realize.

The significance of these developments cannot be overstated. Central Banks will be increasingly acting against one another going forward. There will more surprises and more volatility across the board. Eventually it will culminate in a Crash that will make 2008 look like a picnic.

Smart investors are preparing now, BEFORE it hits.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Financial Crisis “Round Two” Survival Guide that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

As we write this, there are less than 10 left.

To pick up yours, swing by….

Click Here Now!!!

Best Regards

Phoenix Capital Research

Our FREE e-letter: www.gainspainscapital.com

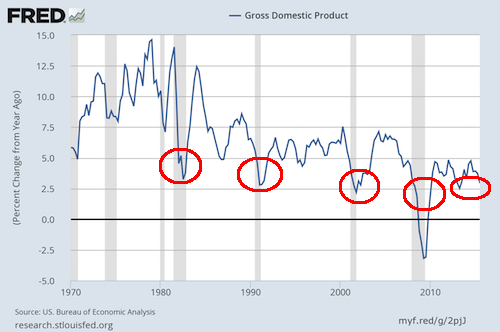

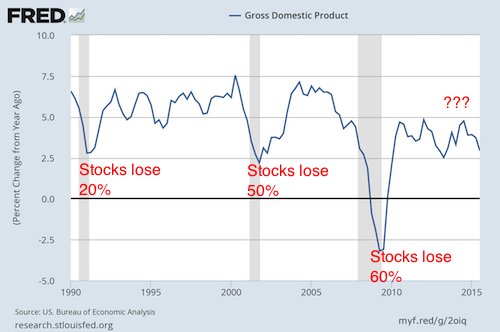

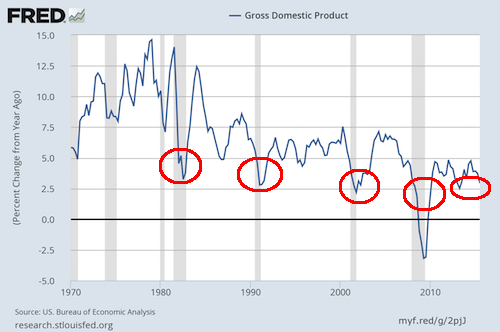

As you can see, the “recovery” of the last six years has largely involved a “growth” rate that was closely associated with recessions over the last 30 years. At best the US economy has been flatlining. At worst we’ve had bouts of economic collapse comparable to a recession.

As you can see, the “recovery” of the last six years has largely involved a “growth” rate that was closely associated with recessions over the last 30 years. At best the US economy has been flatlining. At worst we’ve had bouts of economic collapse comparable to a recession.