The following is an excerpt from Private Wealth Advisory...

The stock rally is at a critical juncture.

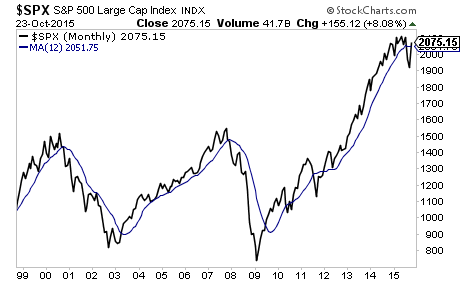

As I’ve mentioned before, a key momentum signal I like to watch is the 12-month moving average (MMA).

Over the last 20 years, this has been an excellent gauge for whether or not the market is in a bull market or breaking down. We had a few “false breakdowns” in 2010 and 2011. However, those signals were negated when the Fed launched QE 2 and Operation Twist respectively: both policies ignited stocks higher. This will not be the case this time (more on this later).

As I noted back in early September, Bear Markets do not happen all at once. EVERY time a major top has formed and stocks have taken out this line, we’ve had a stock rally to “kiss” the line one last time before the bear market really took hold.

Back in September, I forecast that we’d have a serious stock rally to “kiss” this line. Having chopped sideways for a month, stocks have finally staged that rally. We just barely poked above the 12-MMA last week.

The Opportunity to Make Triple If Not QUADRUPLE Digit Gains is Here

The largest investor fortunes in history were made during crises.

For that reason, we’ve launched a special options trading service designed specifically to profit from the coming crisis.

It’s called THE CRISIS TRADER and already it’s locking in triple digit winners including gains of 151%, 182%, 261% and even 436%!

And the REAL crisis hasn’t even started yet!

We have an success rate of 72%(meaning you make money on more than 7 out of 10 trades)…and thanks to careful risk control, we haven’t had a losing trade since JUNE.

Our next trade goes out tomorrow morning… you can get it and THREE others for just 99 cents.

However, this deal expires TONIGHT at midnight… we cannot maintain this track record with thousands of traders following these trades.

To grab one of the last $0.99, 30 day trial subscriptions to THE CRISIS TRADER…

CLICK HERE NOW!!!

———————————————————————–

What comes next is anyone’s guess. However, the fact remains that the last two violations of the 12-month moving average (2010 and 2011) were reversed by stock rallies kicked off by new Fed monetary policies (QE 2 and Operation Twist, respectively).

In the current political climate the Fed will be unable to do this. Private Wealth Advisory is not a political newsletter, but in a market climate in which Central Bank actions are the primary drivers of asset prices, we have to consider politics on occasion, at least in terms of their impact on Central Bank decision-making.

With that in mind, I want to note that wealth inequality has become one of the biggest issues for the 2016 US Presidential election. This topic has ensnared the Federal Reserve as a number of media outlets have finally caught on that QE and other Fed policies have in fact exacerbated wealth inequality.

With that in mind, it is highly unlikely that the Fed will be able to launch a new QE program or other major monetary policy anytime in the next 13 months (the election is November 2016).

Unless this stock rally can continue to go vertical, then we’re doomed to establish new lows. Stocks are sharply overbought and more overvalued by most metrics than almost any other time in history(only the Tech Bubble featured more ridiculous valuations).

Meanwhile, both corporate earnings and revenues are rolling over as the US re-enters a recession. My view: this rally is on borrowed time.

If you’re looking for actionable investment strategies to profit from this trend we highly recommend you take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets.

Indeed, while other investors are getting whipsawed by the markets…we’ve just locked in two more winners, bringing our winning streak to 35 straight winning trades!

All told 40 of our last 41 trades MADE MONEY.

However, I cannot maintain this track record with thousands upon thousands of investors following these recommendations.

So tonight at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

To lock in one of the remaining $0.98 slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research