By Graham Summers, MBA

It’s time to tell the truth when it comes to Fed political interventions.

One of the biggest myths concerning the Fed is that it is politically independent. This is laughably false to anyone who has paid attention during the last 25 years.

Consider that in 2012, the Bernanke-led Fed announced QE 3, its largest QE program in history at the time (an $80 billion per month, open-ended program), a mere THREE MONTHS before the U.S. Presidential election.

Bear in mind, the U.S. economy was growing and the U.S. financial system wasn’t under significant duress at the time. So this was blatant political interference to aid the Obama Administration’s re-election bid by boosting the stock market and economy.

A second major example of Fed political bias concerns its major shift in monetary policy once Donald Trump became President. To fully grasp this, we need to provide a little historical context.

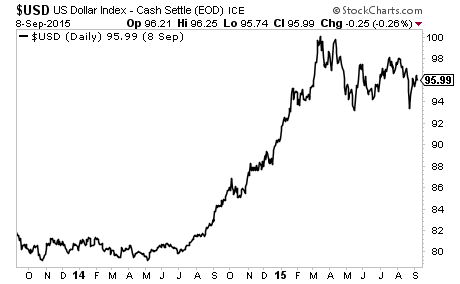

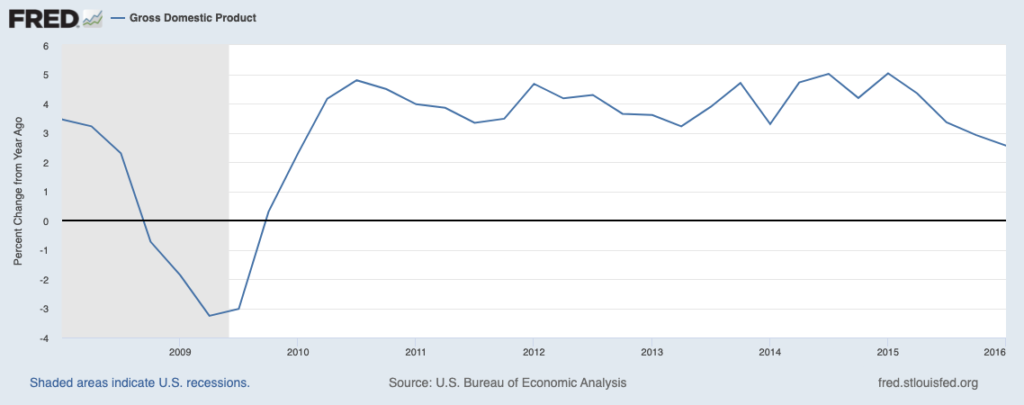

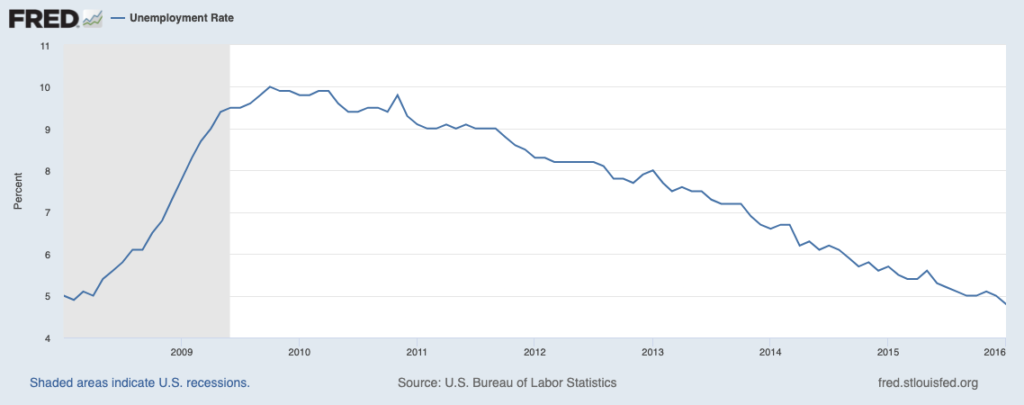

Between 2008 and 2016, the Fed engaged in eight years of extraordinary monetary easing, maintaining interest rates of 0.25% (zero), and engaging in over $3 trillion worth of QE from 2008 to 2015. Bear in mind that throughout this time, the U.S. economy was technically NOT in recession. Economic growth was steady:

And the unemployment rate was in a clear downtrend:

Once the Fed actually ended easing, it embarked on one of the feeblest campaigns of tightening monetary policy in history, raising rates only one time in 2015 and 2016. I would note that all of this took place under the Obama administration.

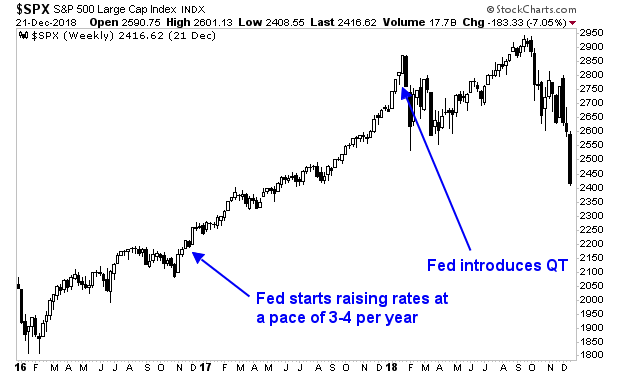

Then Donald Trump won the 2016 Presidential election, and suddenly the Fed “got religion” about normalizing monetary policy. It raised rates three times in 2017 and another four times in 2018. In 2018 it also began shrinking its balance sheet via a process called Quantitative Tightening or QT. It would ultimately drain $500 billion in liquidity from the financial system via QT in 12 months. That is quite a shift considering the Fed had maintained rates at or close to ZERO for eight years prior to this.

Throughout 2016-2018, the Fed ignored numerous signals that this pace of tightening was placing the financial system under duress, right up until the junk bond market froze and the U.S. stock market crashed 20% during the holidays in December 2018.

For those who would argue that the Fed’s sudden shift from maintaining easy monetary policy for the better part of a decade to aggressively normalizing policy in the span of 20 months had nothing to do with Donald Trump being President, consider that former Fed Vice Chair Stanley Fisher admitted in an interview that the Fed’s raising rates in December 2018 was done specifically to hurt the economy because the Fed was annoyed with President Trump’s constant tweeting about them.

So again… the Fed IS a political entity… and it leans LEFT.

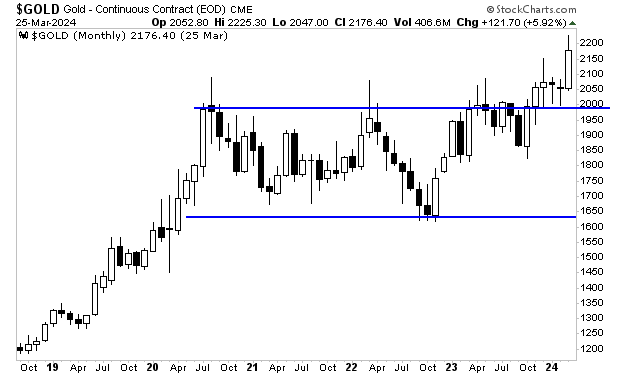

I’ll detail what this means investors as we head into the 2024 President election in tomorrow’s article. But for now, gold is giving us a clue.

The good news is that those investors who are properly positioned for this stand to see extraordinary gains.

On that note, the FREE copies of our Special Investment Report detailing three investments that will profit from the next round of inflation are rapidly being reserved. So if you want reserve one, you better move fast!

To pick up your copy, go to:

https://phoenixcapitalmarketing.com/inflationstorm.html

Graham Summers

Chief Market Strategist

Phoenix Capital Research, MBA