The War on Cash is now accelerating.

As the financial system lurches towards collapse, the elites and those who derive power from sitting at the top of the food chain are growing increasingly desperate to maintain the status quo.

When 2008 hit, the Fed cut rates to zero and began implementing QE. It has now maintained ZIRP for six years (the single longest period in history) and has grown its balance sheet by over $3.5 trillion (larger than most countries).

ZIRP has made no sense whatsoever since 2011. You cannot continue to babble about a “recovery” when ZIRP is in place. No legitimate “recovery” in economic history required ZIRP four years into a new business cycle.

Moreover, QE was known to be a Wall Street bailout and an economic dud as early as 2010. The man who ran QE 1 admitted the former in an op-ed piece. And anyone who’s examined Japan’s multi-decade, multi-Trillions of Yen QE failures knows the latter.

Despite this, the Fed ran QE ran through 2014 printing another $2 trillion in the process. That is correct, the Fed had rates at zero and was printing over $85 billion per month SIX years into a “recovery.”

With the US now back in recession and another financial crisis at our doorstep, the calls are going up for even more dramatic measures.

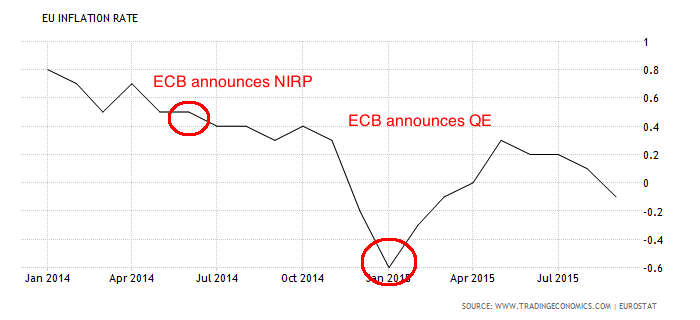

Multiple Fed Presidents have called for NEGATIVE interest rate policy (NIRP) in the US. Obviously these “date driven” individuals haven’t bothered to examine the fact that in Europe, NIRP didn’t accomplish ANYTHING as far as inflation targets were concerned.

———————————————————————–

The Opportunity to Make Triple If Not QUADRUPLE Digit Gain is Here

The largest investor fortunes in history were made during crises.

For that reason, we’ve launched a special options trading service designed specifically to profit from the coming crisis.

It’s called THE CRISIS TRADER and already it’s locking in triple digit winners including gains of 151%, 182%, 261% and even 436%!

And the REAL crisis hasn’t even started yet!

We have an success rate of 72%(meaning you make money on more than 7 out of 10 trades)…and thanks to careful risk control, we’re outperforming the S&P 500 by over 50%!

Our next trade is going out shortly… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER…

———————————————————————–

The ECB implemented NIRP in June 2014. Europe’s inflation rate actually COLLAPSED in the six months following it, resulting in the ECB announcing QE. THAT policy (the first in Europe’s history) generated five months’ worth of uptick in inflation before rolling over again.

Somehow the Fed missed this when it began calling for NIRP in the US. Even more amazingly, no one has bothered to ask the Fed why six years into this “recovery” the Fed is even discussing NIRP. ZIRP was a disaster. Why would NIRP fix anything?

Somehow the Fed missed this when it began calling for NIRP in the US. Even more amazingly, no one has bothered to ask the Fed why six years into this “recovery” the Fed is even discussing NIRP. ZIRP was a disaster. Why would NIRP fix anything?

NIRP will not be the last straw either. If the markets begin the truly collapse, the Fed will likely announce another, even larger QE program. That is precisely what Japan did in April 2013 despite the clear evidence that its previous EIGHT QE programs had failed to accomplish anything of note.

But even NIRP and QE will likely not be the Fed’s worst atrocity against capital formation. Before it’s all said and done, the Fed will likely push to either implement a carry tax on physical cash OR ban physical cash entirely.

This will eventually result in a stock market crash, very likely within the next 12 months… and smart investors would do well to prepare now before it hits.

If you’re looking for actionable investment strategies to profit from this trend we highly recommend you take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets: we just opened seven trades to profit from the above trends in the last two weeks. As we write this, ALL of them are soaring.

This brings us to a THIRTY FIVE trade winning streak… and 41 of our last 42 trades have been winners!

Indeed… we’ve only closed ONE loser in the last FOURTEEN MONTHS.

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents

During that time, you’ll receive over 50 pages of content… along with investment ideas that will make you money… ideas you won’t hear about anywhere else.

To take out a $0.98 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research