This is a continuation of a series of essays I wrote concerning the global shift away from the US Dollar as reserve currency. If you missed those essays, a brief recap of the items listed were:

1) China and Russia dropping the US Dollar for trade

2) China ramping up trade with Brazil

3) Saudi Arabia moving to strengthen trade with China and Russia

4) China, Russia, Brazil, India, and now South Africa are moving to trade more in their own currencies (not the US Dollar)

5) Singapore (major financial center in Asia) starting to trade yuan

All of these items are real and documented. And the pace of the move away from the Dollar as reserve currency is not slowing.

Indeed, it was just revealed that ASEAN+3 countries (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, Vietnam, China, Japan, and South Korea) are researching the prospect of a “common currency” similar to the Euro.

The significance of this development cannot be overstated. The primary question those who do not believe the US Dollar could lose its reserve currency status ask is: what will be the replacement?

For certain there is no one currency that could fit the bill. The Chinese yuan could not do it as China is not ready and in fact ready to suffer a housing and banking collapse. Russia’s economy is a disaster aside from a few key areas (Moscow, St Petersburg, etc), the Euro in its current form won’t even exist in a few years, and Japan is both an ecological and financial disaster (they’ve just announced a 1 QUADRILLION stimulus plan.

Thus, the idea that any one of these currencies could replace the US Dollar as reserve currency of the world at this time is absurd.

However, a common currency comprised of most Asian countries (the primary creditor nations and manufacturing base of the world) is a completely different story.

Understand, I am aware that common currencies in general are flawed (especially when you’re uniting a bunch of bankrupt aging countries like Europe). However, a common currency comprised of Asian countries would overcome be a much more viable alternative to the US Dollar as reserve currency of the world.

The reason for this is that a common currency in Asia would get past the individual risks of any one Asian nation’s currency (Thailand and Japan in particular are a mess) at least in the beginning.

True, ultimately a common currency there would prove as futile as the Euro. However, it would serve as a “stepping stone” in the process of finding a replacement of the US Dollar as world reserve currency.

What I mean is that should a common currency be introduced in Asia, it would probably work for about 10-15 years. By then we’re well into the 2020s if not the 2030s at which point it is quite possible China will indeed be in a place to provide a world reserve currency on its own.

I wish to stress that even if Asia doesn’t implement a common currency and the US Dollar remains the world’s reserve currency (I put the odds of this at 20%), we are still facing a debt default in the US which will result in the US Dollar dropping dramatically in value and ushering in serious if not hyper-inflation.

Indeed, most commentators fail to understand the real reason Weimar Germany suffered hyperinflation. Niall Ferguson’s book, “The Ascent of Money” explains that it was in fact a political mistake that ushered in hyperinflation:

Yet it would be wrong to see the hyperinflation of 1923 as a simple consequence of the Versailles Treaty. That was how the Germans liked to see it, of course…All of this was to overlook the domestic political roots of the monetary crisis. The Weimar tax system was feeble, not least because the new regime lacked legitimacy among higher income groups who declined to pay the taxes imposed on them.

At the same time, public money was spent recklessly, particularly on generous wage settlements for public sector unions. The combination of insufficient taxation and excessive spending created enormous deficits in 1919 and 1920 (in excess of 10 per cent of net national product), before the victors had even presented their reparations bill… Moreover, those in charge of Weimar economic policy in the early 1920s felt they had little incentive to stabilize German fiscal and monetary policy, even when an opportunity presented itself in the middle of 1920.

A common calculation among Germany’s financial elites was that runaway currency depreciation would force the Allied powers into revision the reparations settlement, since the effect would be to cheapen German exports.

What the Germans overlooked was that the inflation induced boom of 1920-22, at a time when the US and UK economies were in the depths of a post-war recession, caused an even bigger surge in imports, thus negating the economic pressure they had hoped to exert. At the heart of the German hyperinflation was a miscalculation.

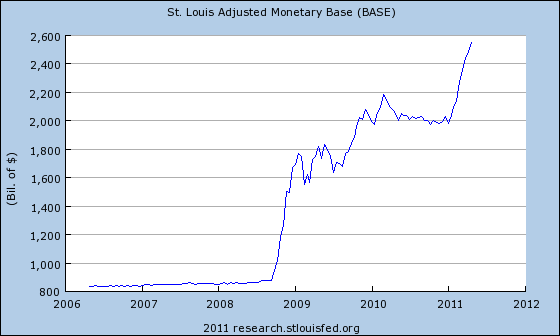

The similarities between the US today and Weimar pre-hyperinflation are striking. As in Weimar, US fiscal authorities are not taking any steps to rein in their loose money policies. Similarly, the US Fed, like Germany’s financial elites believes that currency depreciation is a good thing.

Thus we have a rather frightening set-up for hyperinflation in the US: the largest emerging market players are moving away from using the US Dollar at the same time that US monetary authorities are engaging in disastrous policies similar to those employed by the men who brought hyperinflation to Weimar Germany.

I firmly believe the US will see serious (‘70s style inflation) if not hyperinflation within the next 2-3 years. It could come sooner depending on how the Fed’s policies play out.

On that note, if you’ve yet to take steps to prepare your portfolio for the coming inflationary disaster, our FREE Special Report, The Inflationary Holocaust explains not only why inflation is here now, why the Fed is powerless to stop it, and three investments that absolutely EXPLODE as a result of this.

All in all its 14 pages contain a literal treasure trove of information on how to take steps to prepare AND profit from what’s to come. And it’s all 100% FREE.

To pick up your copy today, go to http://www.gainspainscapital.com and click on FREE REPORTS.

Good Investing!

Graham Summers.

PS. We also offer a FREE Special Report specifying exactly how to prepare for the coming collapse in the US stock market (inflation will NOT be positive for stocks for much longer).

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, go to http://www.gainspainscapital.com and click on FREE REPORTS.

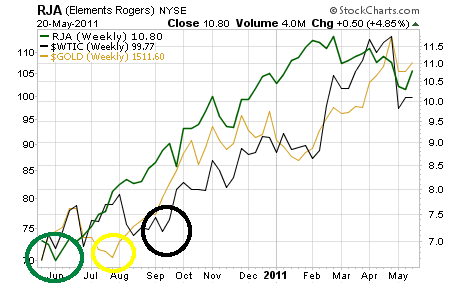

With that in mind, the first warning we got of trouble in the markets came from the agri space which began to roll over in February 2011. They fell hard, forming a domed top and are now bouncing off support to retest their descending trendline since the Feb 2011 top:

With that in mind, the first warning we got of trouble in the markets came from the agri space which began to roll over in February 2011. They fell hard, forming a domed top and are now bouncing off support to retest their descending trendline since the Feb 2011 top: