The official data is out and it shows that GDP collapsed 0.7% in the first quarter of 2015.

The financial world is shocked by this because:

1) The drop occurred despite the Government massaging the heck out of the data to make it look better.

2) The world has bought into the idea that the Fed can remove any and all recessions by printing money.

Regarding #1, the Government recently added a bunch of bogus measures to GDP such as intellectual property. How exactly you can accurately measure the value of intellectual property is beyond me. But then again, much of what the Government does in the name of “the better good” is beyond me as well.

Despite adding this and a slew of other accounting gimmicks, the economy collapsed 0.7% in the first quarter. This is shocking only to those who believe that official GDP is an accurate measure of economic growth.

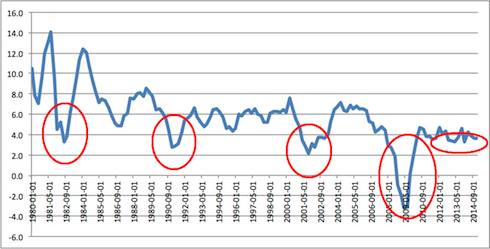

Our readers have been well aware for some time that the GDP number is largely an accounting fiction meant to overstate growth. Indeed, if you strip out the various gimmicks employed by the BLS, you find that the year over year growth for GDP has been at levels usually associated with recessions for years.

Recessionary levels are circled in the chart below.

Small wonder the “recovery” has felt so weak… the economy has been moving at pace usually associated with a contraction!

Still… the fact that even the “official” numbers are now showing a contraction means that things are only getting worse. The bubble heads on TV will try to blame seasonal adjustments for the reason the GDP numbers looked so bad… but these folks have not once mentioned that those same seasonal adjustments have overstated economic growth for the last five years.

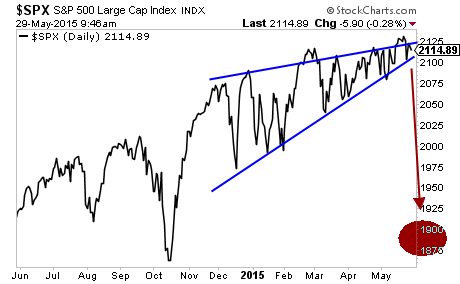

We’ve been calling for a new recession for months now. And it looks like it’s finally showing up in the official numbers. With stocks pricing in economic perfection and the Fed cornered from more serious easing (the Fed can, at best, promise to put off a rate hike… more QE is completely out of the question) the markets are set for a significant drop.

If you’re looking for actionable investment strategies to profit from the coming collapse, we highly recommend you take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter that tells you what stocks to buy, and what stocks to avoid to insure you see consistent gains. Our track record is rock solid with recent positions closed out with gains of 26%, 29%, and 37%… all held for six months.

In fact, we just closed two new winners of 20% and 52% last week!!!

And we’ve only closed ONE loser in the last 7 months!

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents

If you don’t like it… just drop us a line and you won’t be charged again. Everything you received during your 30 day trial (the reports, investment ideas, etc.) are yours to keep…

To take out a $0.98 trial subscription to Private Wealth Advisory...

Best Regards

Graham Summers

Phoenix Capital Research