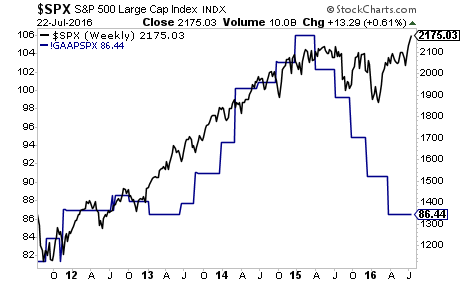

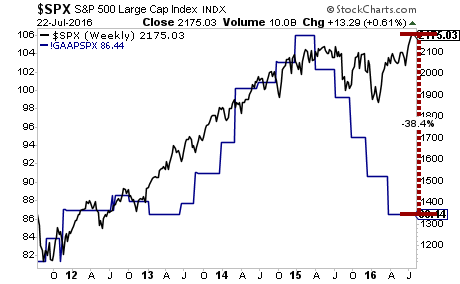

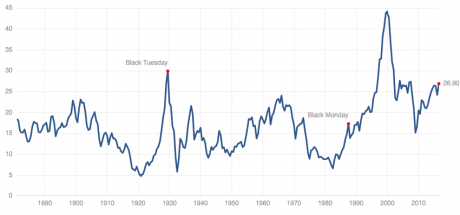

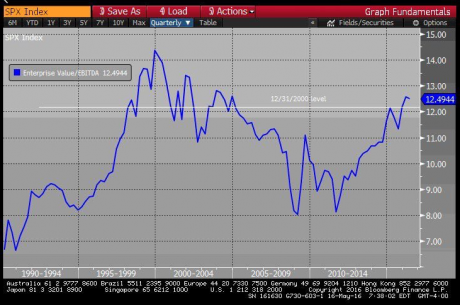

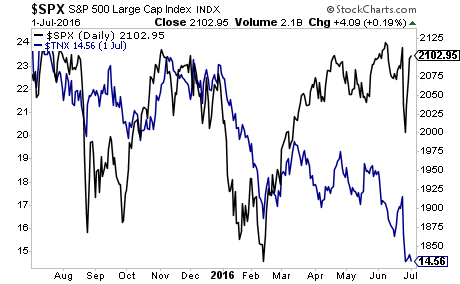

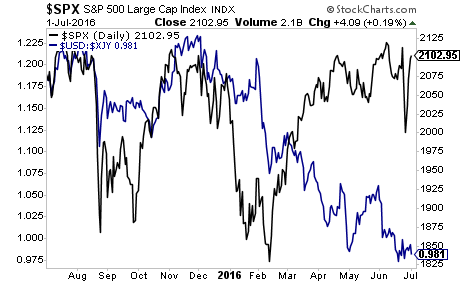

Yesterday, I pointed out that the markets were severely overvalued relative to earnings.

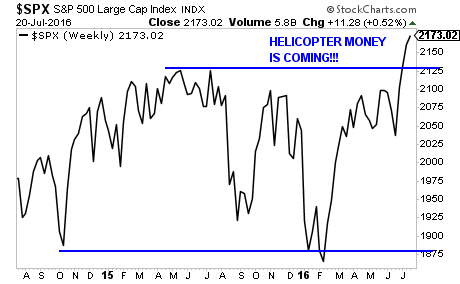

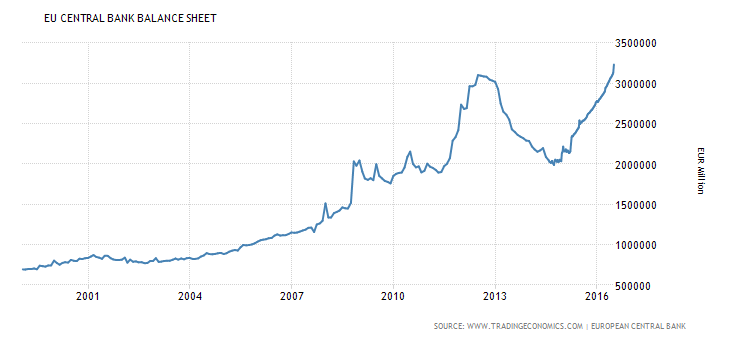

Today, I’m going to show you just how extended the S&P 500 is.

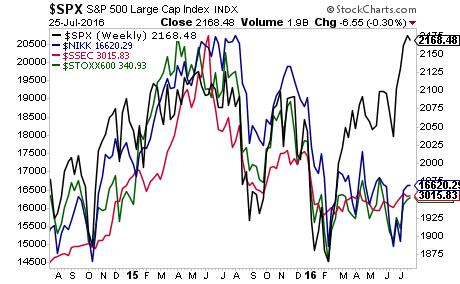

This is a chart showing the S&P 500 (black), compared to Japan (blue), China (red), and Europe (green).

As you can see, the S&P 500 has completely disconnected, not just from earnings, but from every other major stock index in the world.

For the S&P 500 to be in line with the rest of the world, it needs to fall to at least 1975 (a 9% drop).

The Single Best Options Trading Service on the Planet

THE CRISIS TRADER has produced an astounding 145% return on invested capital thus far in 2016.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades. And thanks to careful risk management we’ve seen triple digit returns on invested capital every year since inception.

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER...

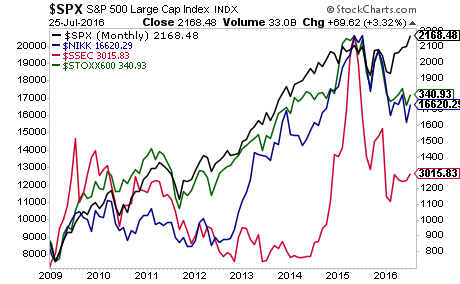

And if you go back to the 2009 lows, the divergence is even more extreme.

A Crash is coming.

Imagine if you’d prepared for the 2008 Crash several months ahead of time. Imagine the returns you could have seen if you had started prepping in July 2008 instead of waiting for the disaster to unfold.

I can show you how.

Since NOVEMBER 2014, Private Wealth Advisory subscribers have locked in 98 winning investments.

In fact, we just closed another double digit winner (11%) yesterday. And that one had only been open for FOUR DAYS.

Indeed, the last time we closed a losing trade was……. NOVEMBER 2014.

However, I cannot continue this incredible track record with thousands of investors following our strategies.

Based on what’s happening in the markets, we’ve extended the deadline for our current offer.

However, this is it…

TONIGHT (TUESDAY) at midnight, we are raising the price on a subscription to Private Wealth Advisory from $179 to $200.

If you have any interest in locking in one of the remaining lower cost slots… you need to move NOW!

To lock in one of the remaining $179 slots…

To lock in one of the remaining $179 slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research