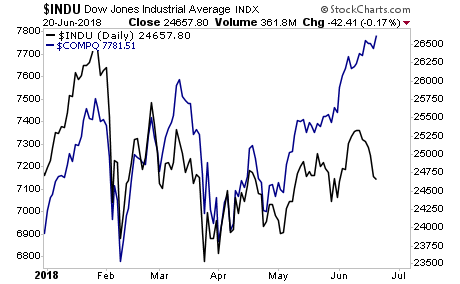

If you need more evidence that the Fed screwed up during its latest FOMC meeting, take a look at the below chart.

This chart shows the Dow Jones Industrial Average (a stock index comprised of economically sensitive bell-weathers such as Caterpillar) vs. the NASDAQ (a stock index that is heavily skewed towards Tech giants).

As you can see, for most of this year to date, these two indices have moved in a virtual lockstep. The NASDAQ began to outpace the DJIA in April when the Fed increased its QT program from $10 billion to $30 billion per month.

—————————————————————-

That Makes NINE Straight Double Digit Winners!

Our options trading system is on a HOT streak, having locked in NINE double digit winners in the last four weeks.

Don’t believe me?

You can see EVERY trade we’ve made this year HERE.

As a result we’re now up 41% this year alone.

In fact, we haven’t had a losing trade APRIL 2018.

Best of all, this system couldn’t be easier: we only trade one trade, once per week… and we’re CRUSHING the market.

To join us today, take out a 60 day trial subscription.

If you’re not seeing SERIOUS returns within the first 60 days, we’ll issue a full refund, NO QUESTIONS ASKED.

To take out a trial subscription…

—————————————————————-

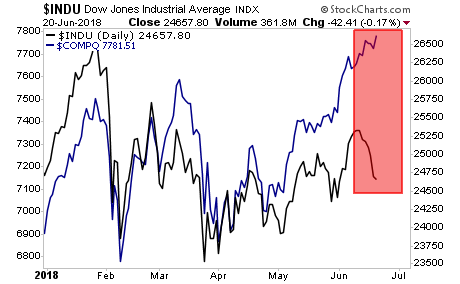

However, it wasn’t until last week’s FOMC that the divergence became extreme. As you can see in this second chart, the DJIA rolled over IMMEDIATELY after the Fed meeting and has taken a nosedive ever since. The NASDAQ, on the other hand, has gone straight up.

Put simply, the market is discounting that Fed policy is going to crush the economic expansion, leaving the only growth in the large Tech space.

If the Fed doesn’t figure this out soon, we could very well see a market bloodbath hit.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

We’ve extended our offer to download this report FREE by one week. But this week is the last time this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research