“Everybody has a plan until they get punched in the mouth.” ~Mike Tyson

I love boxing.

I first fell in love with the sport in my late ‘20s. Had I discovered it earlier in life, I probably would have simply added it to the sports I was already playing (soccer, swimming, baseball, and basketball).

However, because I discovered boxing in my late ‘20s, when I’d already started multiple businesses and had experienced both great success and great failure in life, boxing became more than just a passion, it became a kind of framework for understanding humanity.

To me there are a lot of parallels between investing and boxing. What works in one scenario doesn’t work in another. A great investor, like a great fighter, will have to learn to adapt if he or she wants to survive.

And most important, is what you do when you’re in a world pain, and your plans are blowing up in your face… what do you do when the market “punches you in the mouth”?

The above quote from Mike Tyson is one of my favorite boxing quotes. At the time reporters were harassing the heavyweight champion about how he would deal with Evander Holyfield’s fight plan.

Tyson responded in classic fashion, “Everybody has a plan until they get punched in the mouth.”

His point was… it’s easy to strategize ahead of the fact… but what do you do when things go south?

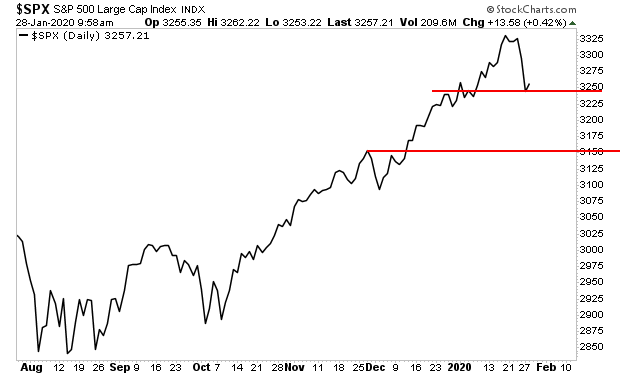

I was thinking about this quote yesterday when the market was a sea of red. We’ve all heard the famous investing adages: “always maintain your discipline,” “buy when there’s blood in the streets,” etc.

However, that’s a whole other animal to actually implement this stuff when the market “punches you in the mouth” and your portfolio is losing serious money.

Do you panic and let this affect you? Or do you keep your composure and take advantage of the situation?

It took me years to accomplish it, but I no longer see market corrections as painful.

Instead, I see them as opportunities to be taken advantage of.

For me, yesterday’s decline presented a major buying opportunity. Stocks fell right major support, which I believe would hold and lead to a significant bounce.

Seeing this, I took advantage of this situation to have clients open a new trade.

It’s already up significantly this morning. And I expect we’ll have even more trades in the next few days.

On that note, today is the last day our Special Report The Last Bull Market will be available to the public.

In it we outline how the bull market will unfold… which investments will perform best… and a unique play on stocks… a single investment… that has already returned 1,300%. And we believe it’s poised to more than TRIPLE in the next 24 months as the stock market roars higher.

We extended our deadline for this report based on the market hitting new all time highs last week, but this is IT. No more extensions.

To pick up one of the last copies…swing by:

https://phoenixcapitalmarketing.com/TLBM.html

Best Regards,

Graham Summers

Chief Market Strategist

Phoenix Capital Research