Who are you going to believe… the mainstream shills, or your own eyes and wallets?

The economic data in the US is telling us that the economy is booming. GDP growth is roaring at annualized rate of over 4%. Unemployment is collapsing, with over 300,000 new jobs being created last month. And inflation has been tackled, falling from a peak of nearly 9% to 3% where is sits today.

The mainstream media parrots these data points as if they were facts. There’s only one problem… if any of this were true, the Biden administration’s approval rating would not have just hit a new low of 37%. You can’t argue that the economy is doing great, but the President is doing an awful job at the same time. So one of these items (the economic data or the President’s approval ratings) is false.

It’s not the approval ratings.

The economic data in the U.S., particularly any economic data that is politically important (GDP growth, inflation, employment) is now largely fiction. And I don’t mean “fiction” as in there are honest mistakes being made because things are complicated; I mean fiction as in the bulk of the data is invented in a spreadsheet by a government beancounter.

Case in point, we are told that in January the economy added 353,000 jobs. As ZeroHedge notes this happened in a month in which the economy actually LOST 63,000 full time jobs and gained 96,000 part-time jobs. Yes, somehow the economy “created” 353,000 jobs while losing 96,000 full time jobs.

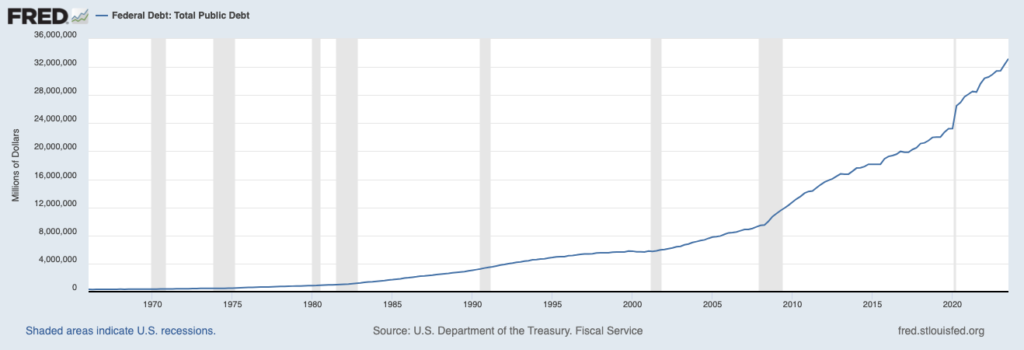

Some added food for thought about the true state of the economy. As I write this, the U.S. is adding over $2 trillion in debt every year. The below chart needs no explanation. This is obviously NOT going to end well.

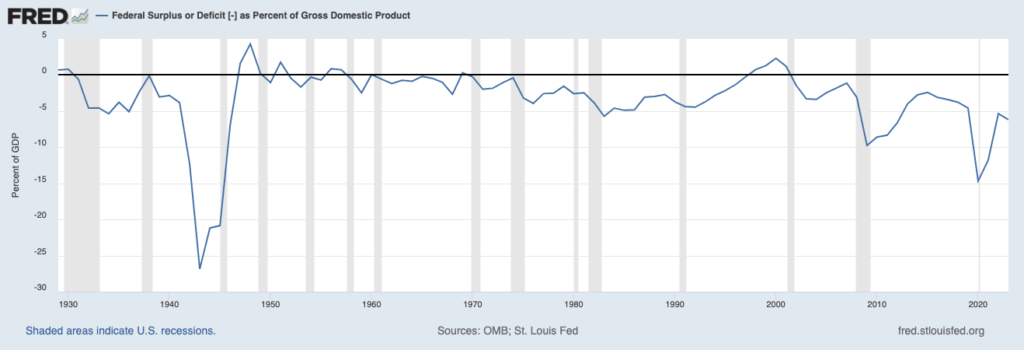

Why is the U.S. adding so much debt?

Because the Biden administration is running the largest deficit as a percentage of GDP outside of WWII. Yes, the deficit is larger today than it’s been during any recession in the last 100 years. Surely this must be because the economy is roaring!

If all of the above items make your head hurt, consider the added insanity that financial institutions and fund managers actually invest trillions of dollars based on this stuff. And people wonder why no one ever sees a crisis coming in advance!?!?

Don’t fall for this stuff. There’s a lot of money to be made in the markets based on these lies, but it takes a lot of work and insight!

To start receiving our daily market insights every weekday before the market’s open (9:30AM EST), use the link below. There is no fee or cost to GAINS PAINS & CAPITAL. Access is free to the public.