The Fed just admitted that I was right… and all of Wall Street was wrong.

Fed Chair Jerome Powell didn’t actually say the words “Graham Summers was right,” but he might as well have done so.

Back in 2017, when I published my bestselling book The Everything Bubble (available to all my clients for free as part of a trial subscription to Private Wealth Advisory) I predicted that the Fed would never be able to normalize policy.

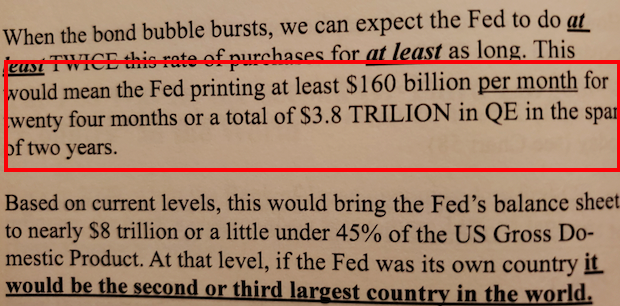

Instead, I predicted that the Fed would be forced to engage in ever larger monetary easing. My actual prediction was that the Fed would introduce QE programs of $160+ billion at the first sign of major trouble.

Here’s the actual quote from page 176.

At that time I wrote this, all of Wall Street, and every major Fed official went on record claiming that the Fed would have no difficulty in normalizing monetary policy. Soon after, the Fed began shrinking its balance sheet via a Quantitative Tightening program, while also raising interest rates at a pace of three to four hikes per year.

Fast forward to today, and the Fed is already back with a QE program of $60 billion per month, though the Fed is claiming this isn’t really QE (it is). And the Fed is doing this at a time when the U.S. economy is growing at over 3% per year.

Of course, $60 billion is nowhere near $160 billion. But then came Fed Chair Jerome Powell’s testimony to Congress yesterday.

During his testimony, Chair Powell stated that cutting interest rates won’t work anymore and that the Fed will need to “aggressively” implement QE and other items during the next downturn.

—————————————————–

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

An annual subscription to all of our current newsletters costs $1,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

That’s less that the cost of two year’s worth of subscriptions.

And if you are already a paying subscriber to one or more of our newsletters, we will refund your current orders, if you take advantage of this offer.

To do so…

——————————————-

Remember, the Fed is already employing a $60 billion per month QE program right now. So when Fed Chair Powell say the Fed will need to “aggressively” use QE during a downturn, he’s talking about truly MASSIVE amounts of QE.

Like $160 billion per month… which I predicted back in 2017… and which was laughed at and called insane at the time.

So why is the Fed doing all of this?

Because President Trump caught them trying to commit an economic coup… and gave them a choice…

EASE NOW or you’ll all fired.

The Fed claims to be apolitical, but we all know this is a load of BS. The Fed did everything it could to help the Obama administration by keeping interest rates at zero and printing over $3 trillion in new money.

Then President Trump won the 2016 Presidential election… and the Fed suddenly decided it was time to shrink its balance sheet buy $600 billion per year while also raising interest rates seven times.

Former Vice Chair Stanley Fisher admitted publicly that the Fed raised rates to intentionally hurt the economy and punish President Trump. The President caught them in the act and called Fed Chair Jerome Powell and his #2 to the White House for a “private dinner.”

Ever since then, the Fed has been working to get back in President Trump’s good graces. As a result, we’ve now got the Fed easing aggressively while the economy is already growing at 3% per year.

This is GUARANTEEING a landslide victory for President Trump in 2020.

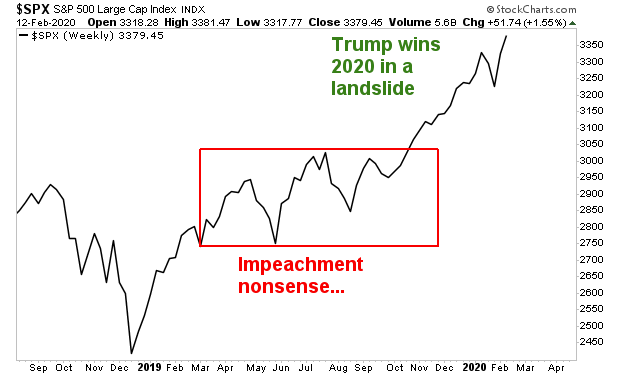

If you do not believe me, take a look at the stock market, which is the single greatest discounting mechanism on the planet.

People have political agendas/ biases. The stock market simply discounts reality.

With that in mind, what does the below chart tell you about the state of the U.S. economy? More importantly, what is the stock market is telling us about what’s coming down the pike for the U.S.?

I believe the market is “showing” us that President Trump is going to win the 2020 election in a landslide.

The Trump administration has successfully “branded” the stock market. As such, stocks are closely aligned with the President’s odds of re-election in 2020.

Which is why, this recent breakout to new highs is telling us Trump wins 2020 in a landslide… and that this time there will be few obstacles to his economic agenda.

I want to be clear here…

I DO NOT care about politics. You can hate President Trump or you can love him. That’s 100% up to you.

But the reality is that under the Trump administration the stock market is giving us a once in a lifetime opportunity to GET RICH from our investments.

My clients are already doing this with our new special report titled…

The MAGA Portfolio: Five Investments That Will Make Fortunes During Trump’s Second Term.

In it, I detail five HIGH OCTANE investments that are primed to EXPLODE higher when President Trump wins a second term.

In it, I detail five unique investments that I expect will produce the most extraordinary gains during President Trump’s second term.

Each one of these investments is in a unique position to profit from the combination of Trump economic reforms and Fed monetary easing, combining high growth opportunities with extreme profitability.

We are offering this report exclusively to subscribers of our e-letter Gains Pains & Capital. To pick up your copy please swing by:

https://phoenixcapitalmarketing.com/MAGA.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research