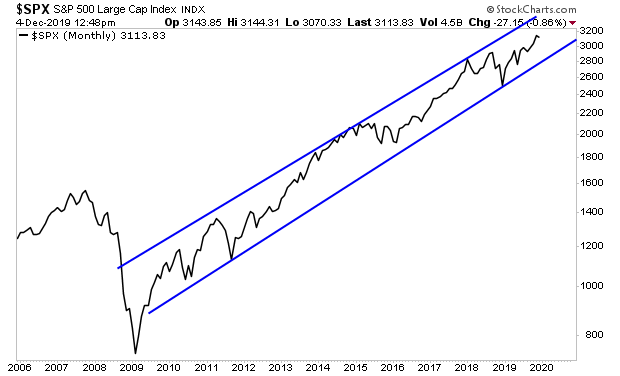

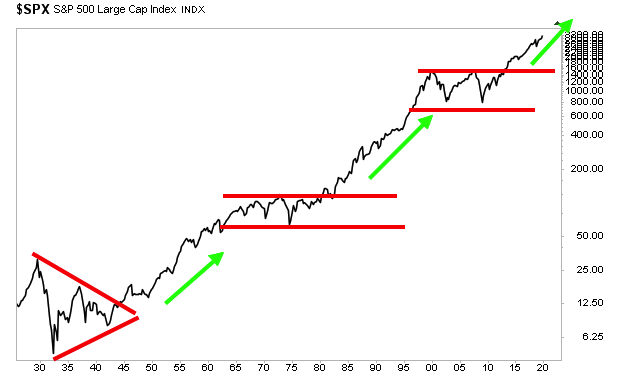

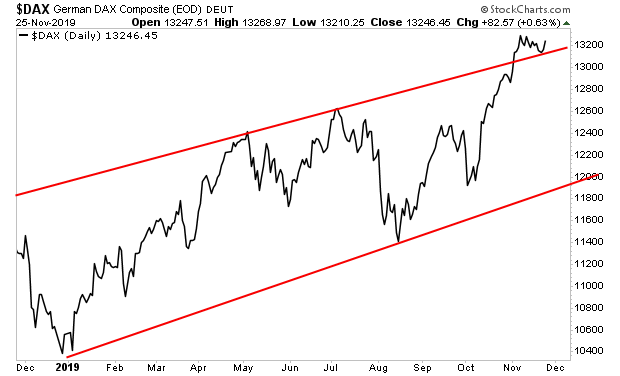

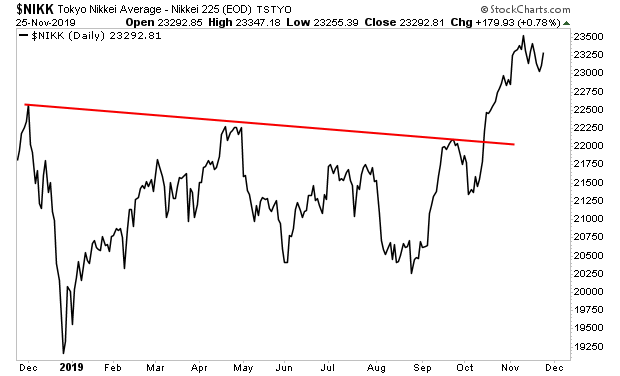

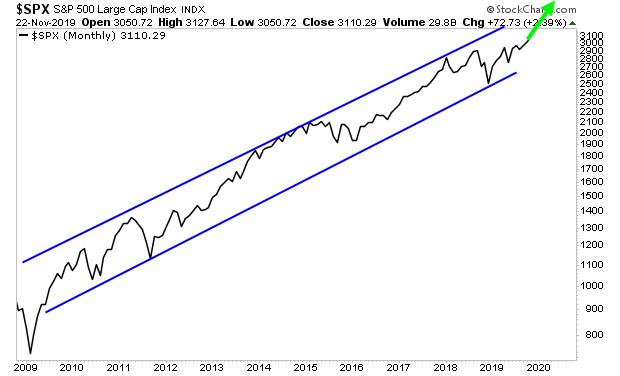

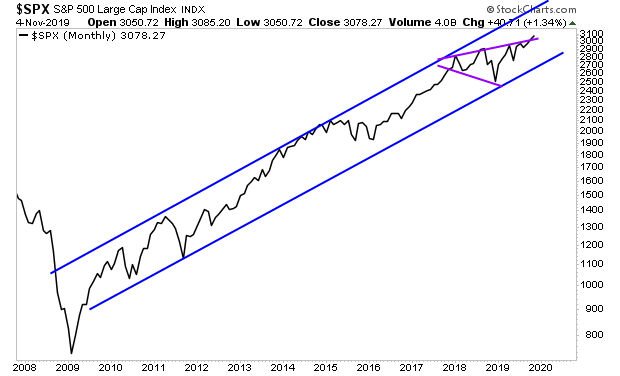

The Santa rally has ignited stocks to new all-time highs.

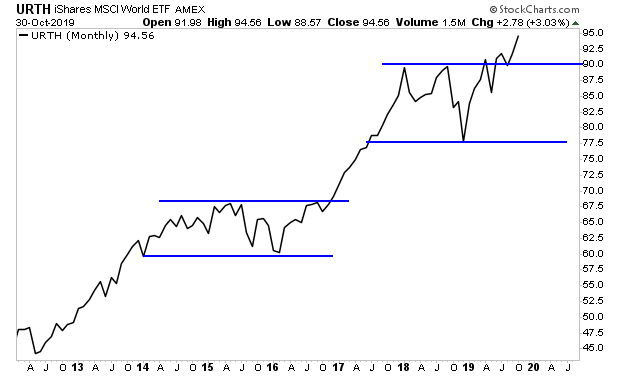

However, the bigger story is that the stock market is showing zero indication that President Trump will step down as President. If anything, the stock market has begun discounting a landslide win by Trump in the 2020 election.

Early in his first term, the President began branding the stock market as a barometer of his success. Indeed, Treasury Secretary Steve Mnuchin even went so far as to admit the Trump White House views the stock market as a “report card.”

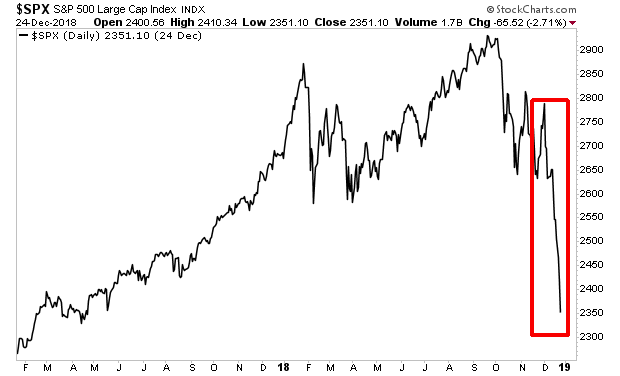

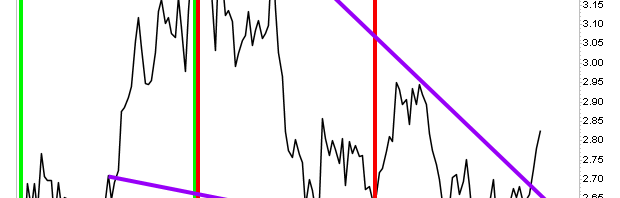

As a result of this, the market is now closely tied to Trump’s Presidency. Time and again during the Mueller investigation, whenever a story hit the wires suggesting the president was in danger, the stock market would nose-dive.

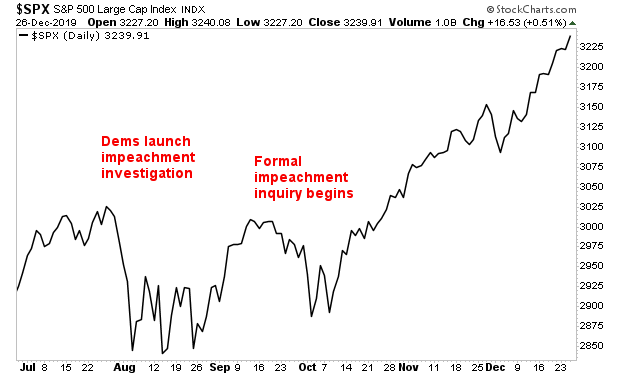

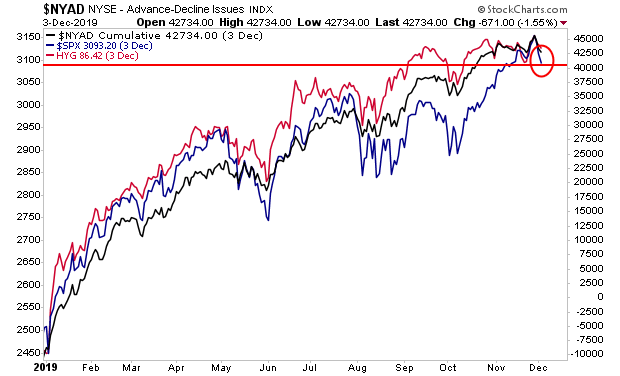

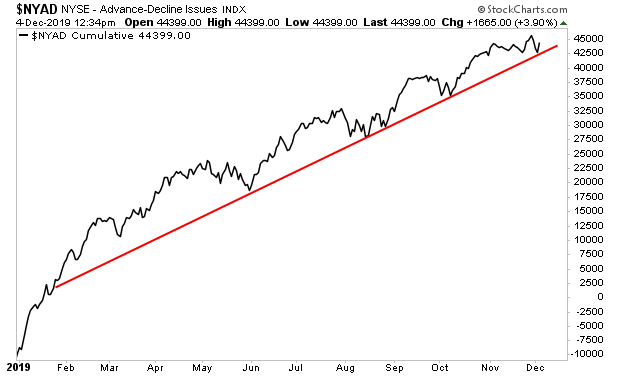

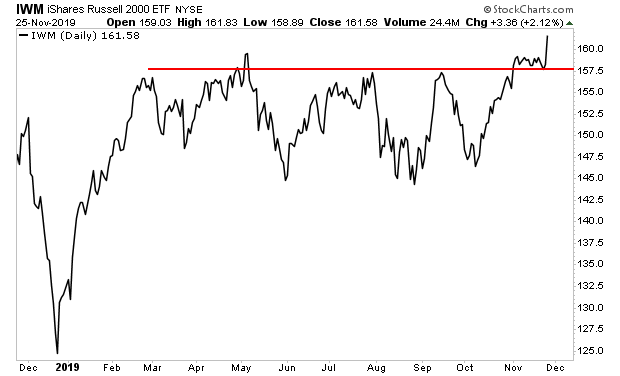

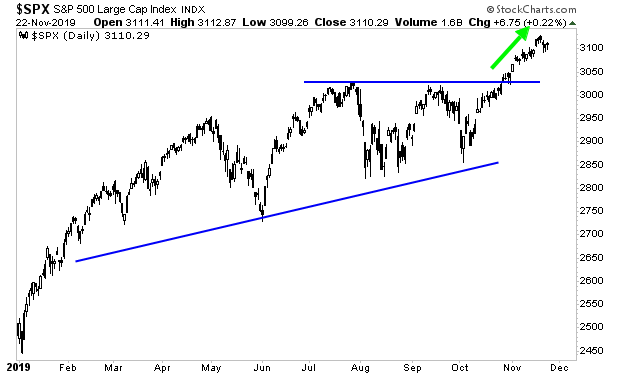

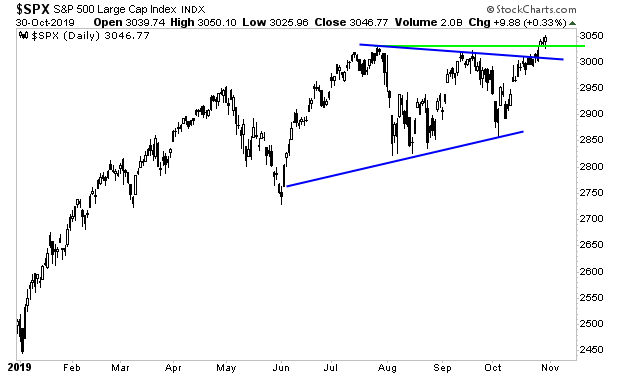

Compare that to the stock market’s performance during the current phony impeachment sham. The Democrats first began an impeachment investigation in late July. They upgraded the process to an impeachment inquiry in late September. And since that time the stock market has gone STRAIGHT UP.

———————————————————–

Get a LIFETIME Subscription to All Of Our Products For Just $2,500

An annual subscription to all of our current newsletters costs $1,500.

But today, you can get a LIFETIME subscription to ALL of them, along with every new product we ever launch, for just $2,500.

We have only ONE slot left for this offer.

To snatch it for yourself…

———————————————————–

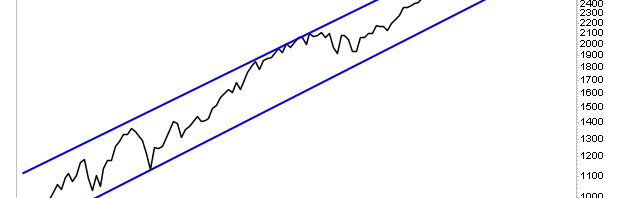

This tells us one thing: there is zero danger of President Trump leaving office. If anything, the market is beginning to discount a second Trump term… one in which the President is even more aggressive in his economically friendly policies.

Those who seek profit from this, need to invest in the sectors that will most benefit from a second Trump term.

Indeed, we’ve discovered a unique play on stocks… a single investment… that has already returned 1,300%. And we believe it’s poised to more than TRIPLE in the next 24 months as President Trump secures a second term in a landslide win.

To find out what it is… pick up a copy of our report…The Last Bull Market of Our Lifetimes

There are fewer than 19 copies left.

Graham Summers

Chief Market Strategist

Phoenix Capital Research

`

`