20

Sep

2018

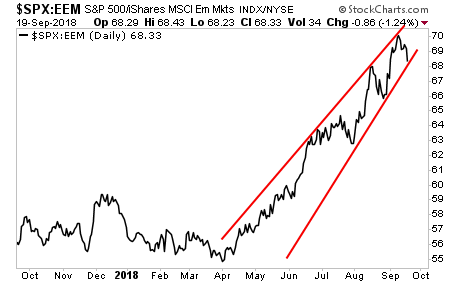

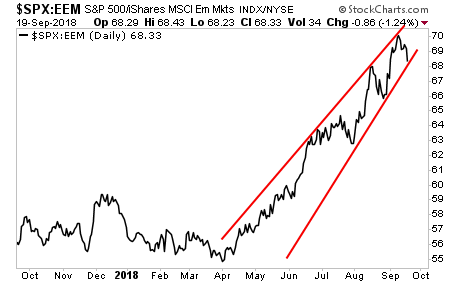

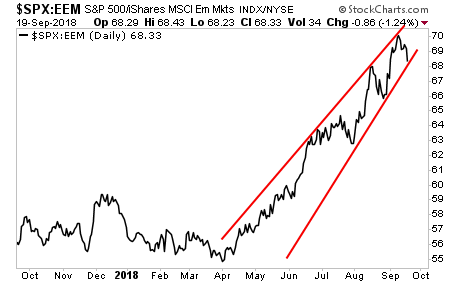

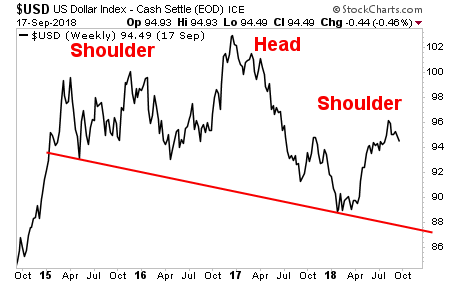

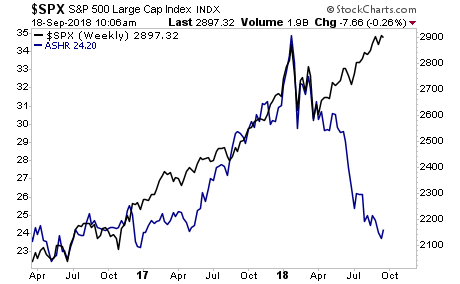

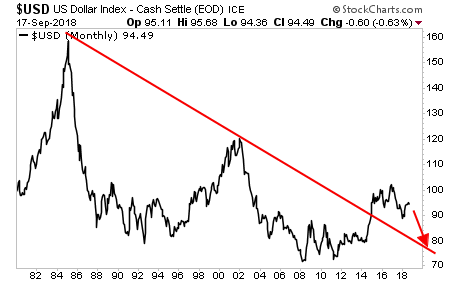

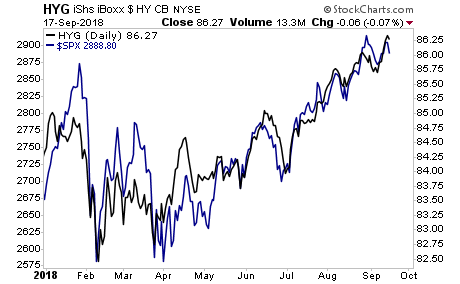

$SPX to $EEM Ratio suggests a shift is coming. $EEM to outperform

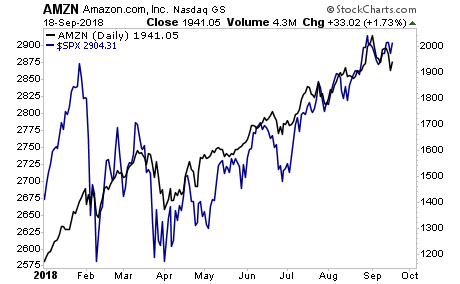

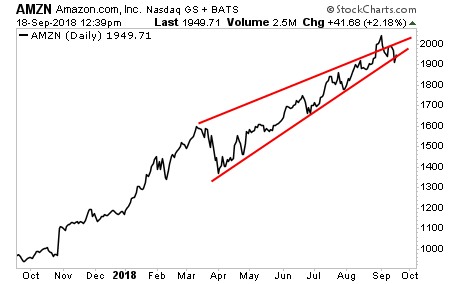

The single most important stock in the world is Amazon (AMZN)

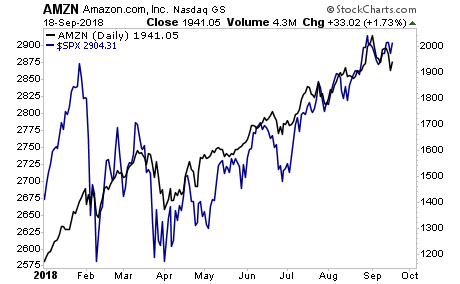

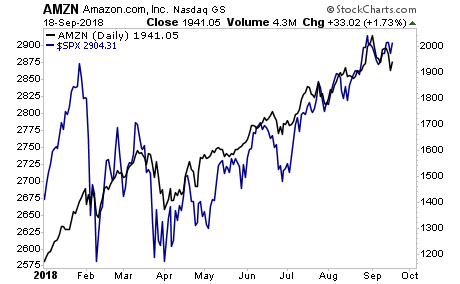

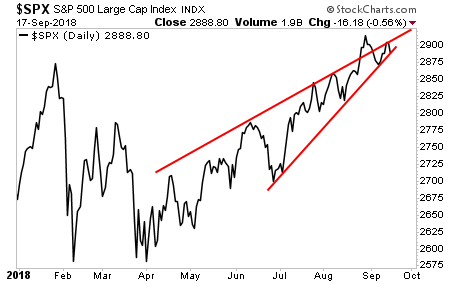

AMZN has become a proxy for the entire stock market. If you overlay AMZN’s chart with the S&P 500 (below) AMZN has lead the S&P 500 beautifully during this latest bull run.

Indeed, AMZN’s chart is effectively the same move as the broader market, with less volatility (not surprising given how intense buying has been of this one stock).

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

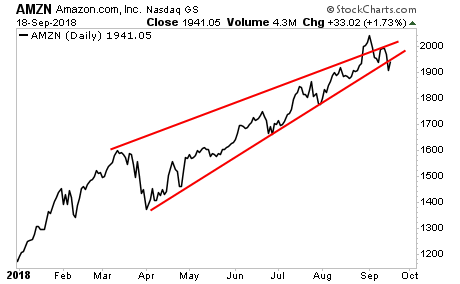

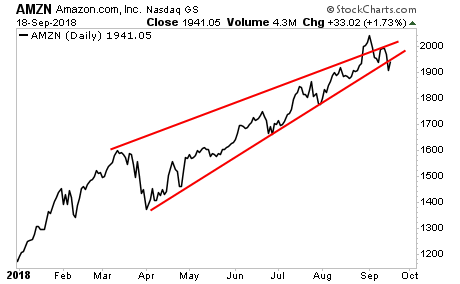

With that in mind, what happens to AMZN provides a glimpse into what will happen to the rest of the market. Which is why the failed breakout to the upside in August was a big warning to investors that the market was losing steam.

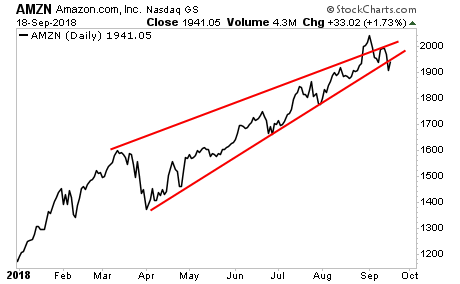

But what’s REALLY important is the recent breakdown. As you can see in the below chart, AMZN has broken its bull market trendline. It’s now bouncing to “kiss” former support. And if it cannot reclaim that line, the market is in SERIOUS trouble.

How serious?

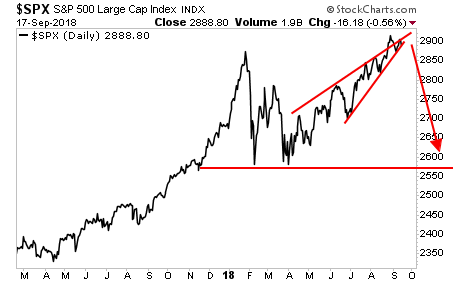

Something like this.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

The single most important stock in the world is Amazon (AMZN)

AMZN has become a proxy for the entire stock market. If you overlay AMZN’s chart with the S&P 500 (below) AMZN has lead the S&P 500 beautifully during this latest bull run.

Indeed, AMZN’s chart is effectively the same move as the broader market, with less volatility (not surprising given how intense buying has been of this one stock).

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

With that in mind, what happens to AMZN provides a glimpse into what will happen to the rest of the market. Which is why the failed breakout to the upside in August was a big warning to investors that the market was losing steam.

But what’s REALLY important is the recent breakdown. As you can see in the below chart, AMZN has broken its bull market trendline. It’s now bouncing to “kiss” former support. And if it cannot reclaim that line, the market is in SERIOUS trouble.

How serious?

Something like this.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

The single most important stock in the world is Amazon (AMZN)

AMZN has become a proxy for the entire stock market. If you overlay AMZN’s chart with the S&P 500 (below) AMZN has lead the S&P 500 beautifully during this latest bull run.

Indeed, AMZN’s chart is effectively the same move as the broader market, with less volatility (not surprising given how intense buying has been of this one stock).

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

With that in mind, what happens to AMZN provides a glimpse into what will happen to the rest of the market. Which is why the failed breakout to the upside in August was a big warning to investors that the market was losing steam.

But what’s REALLY important is the recent breakdown. As you can see in the below chart, AMZN has broken its bull market trendline. It’s now bouncing to “kiss” former support. And if it cannot reclaim that line, the market is in SERIOUS trouble.

How serious?

Something like this.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 9 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

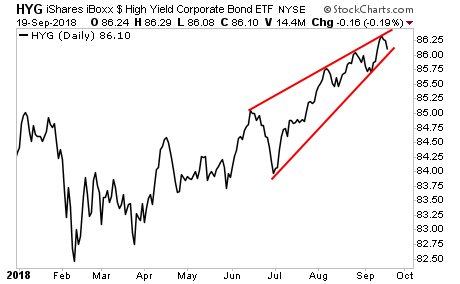

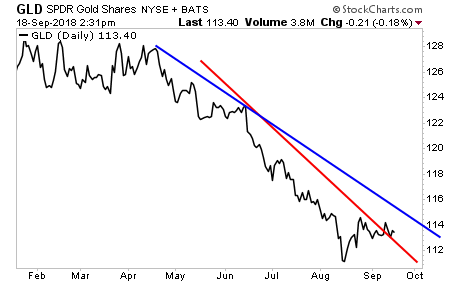

One trendline broken. Need the blue one to go to be certain bottom is in.

For more charts, market insights, and trading ideas, join our free e-letter Gains Pains & Capital.

We’ll even throw in three investment reports (a $99 value) FREE of charge.

Just use the link below:

https://phoenixcapitalmarketing.com/evergreen3reports.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

I keep warning and warning… but no one is listening.

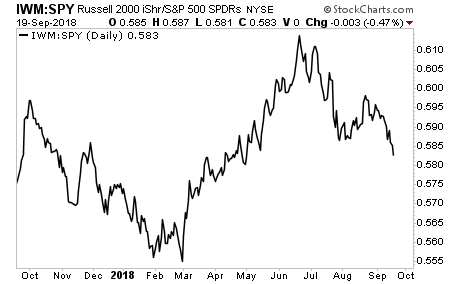

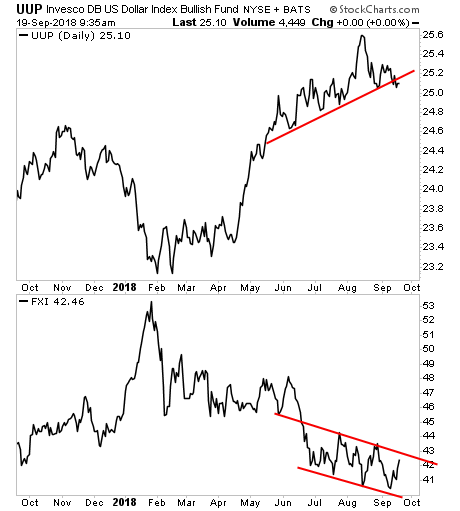

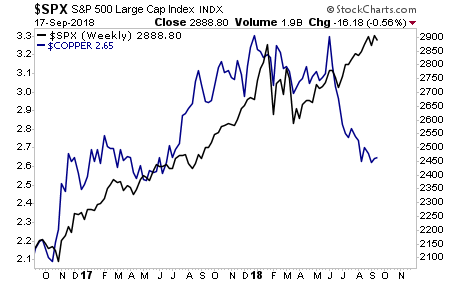

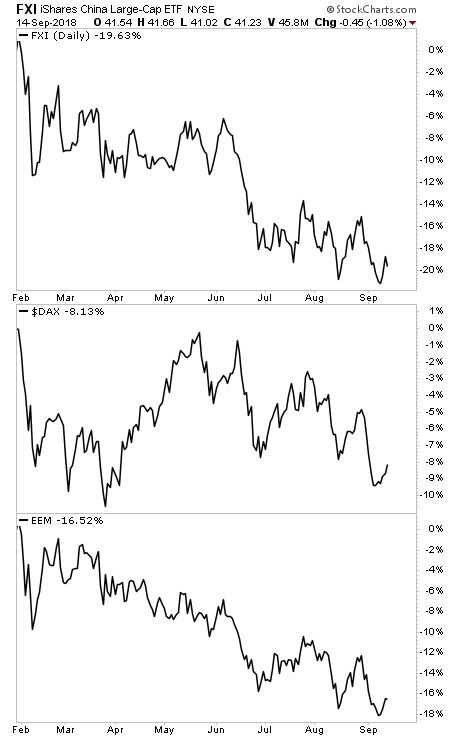

The market meltdown that started in Emerging Markets earlier this year WILL spread to the US.

Don’t believe me?

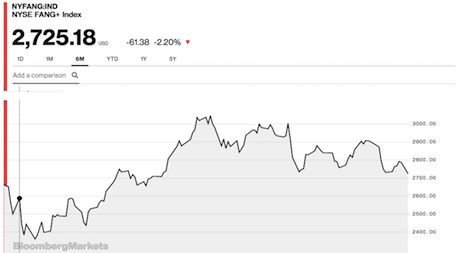

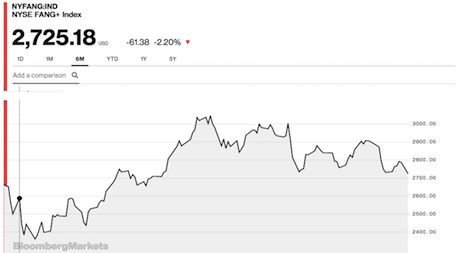

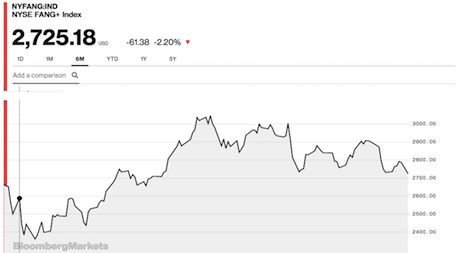

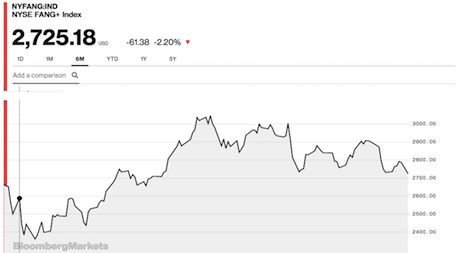

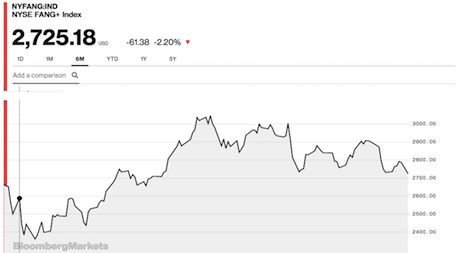

The FANG stocks, which lead the rally throughout 2008 (indeed by some measures these five stocks have accounted for over 50% of ALL market gains) have peaked. Heck, they didn’t just peak, they’re down 15% since their recent peak. We’re talking close to bear market territory.

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

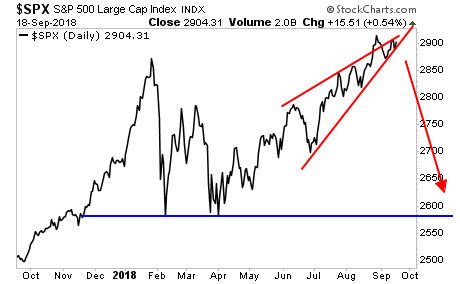

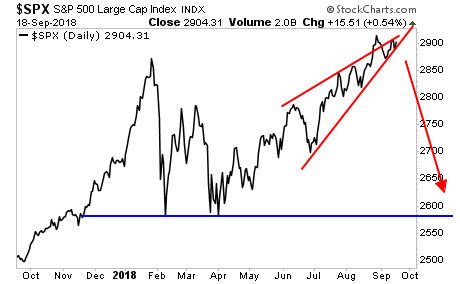

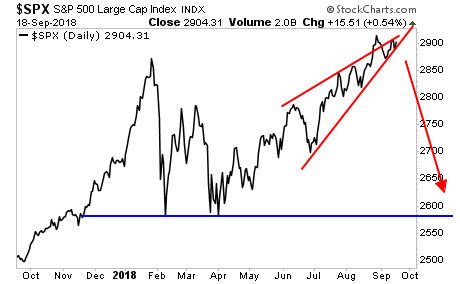

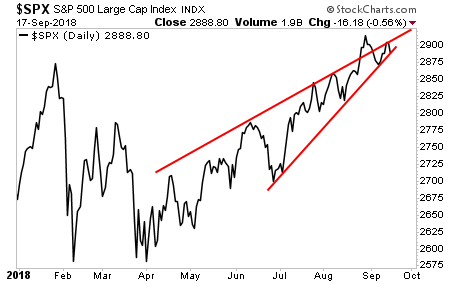

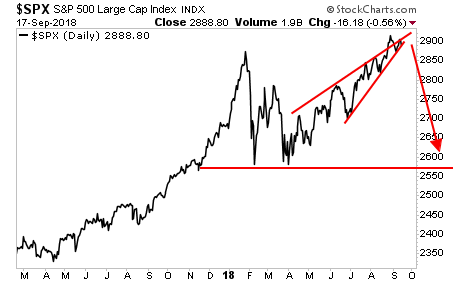

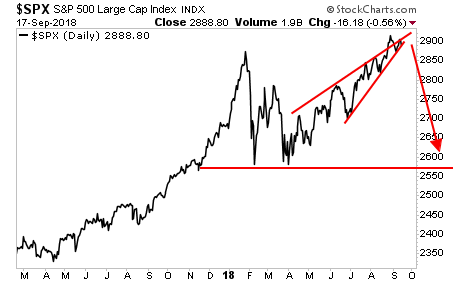

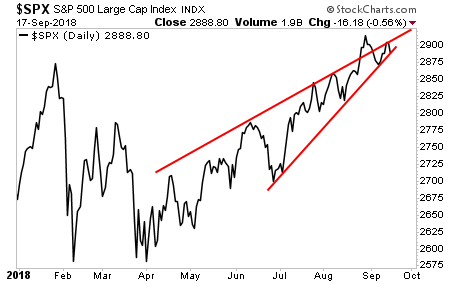

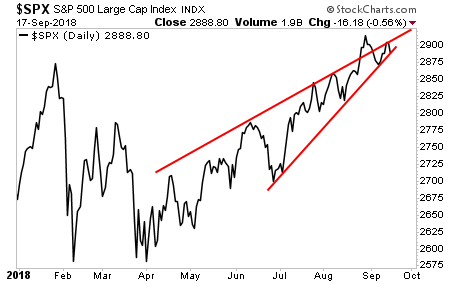

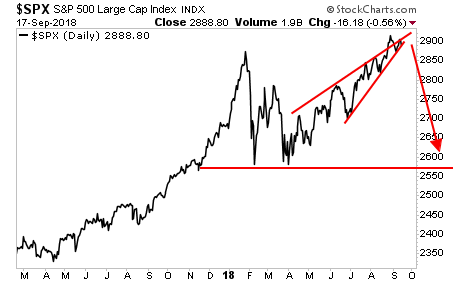

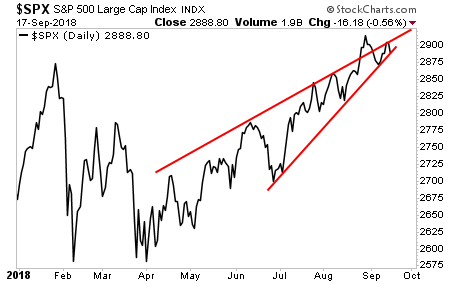

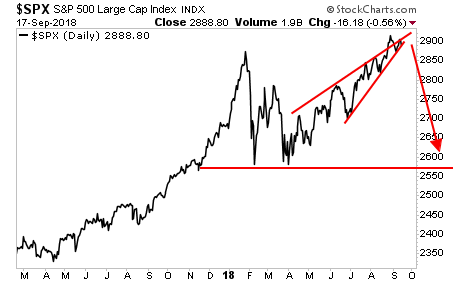

On top of this, the S&P 500 FAILED to launch a breakout of its rising wedge formation. A failed breakout is one of the most dangerous chart developments because it often results in a VIOLENT reversal.

We’re talking about a move like this:

The best part… 99% of investors won’t see this coming.And smart investors who put capital to work here stand to make LITERAL fortunes.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 17 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

I keep warning and warning… but no one is listening.

The market meltdown that started in Emerging Markets earlier this year WILL spread to the US.

Don’t believe me?

The FANG stocks, which lead the rally throughout 2008 (indeed by some measures these five stocks have accounted for over 50% of ALL market gains) have peaked. Heck, they didn’t just peak, they’re down 15% since their recent peak. We’re talking close to bear market territory.

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

On top of this, the S&P 500 FAILED to launch a breakout of its rising wedge formation. A failed breakout is one of the most dangerous chart developments because it often results in a VIOLENT reversal.

We’re talking about a move like this:

The best part… 99% of investors won’t see this coming.And smart investors who put capital to work here stand to make LITERAL fortunes.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 17 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

I keep warning and warning… but no one is listening.

The market meltdown that started in Emerging Markets earlier this year WILL spread to the US.

Don’t believe me?

The FANG stocks, which lead the rally throughout 2008 (indeed by some measures these five stocks have accounted for over 50% of ALL market gains) have peaked. Heck, they didn’t just peak, they’re down 15% since their recent peak. We’re talking close to bear market territory.

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

On top of this, the S&P 500 FAILED to launch a breakout of its rising wedge formation. A failed breakout is one of the most dangerous chart developments because it often results in a VIOLENT reversal.

We’re talking about a move like this:

The best part… 99% of investors won’t see this coming.And smart investors who put capital to work here stand to make LITERAL fortunes.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 17 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

For more charts, market insights, and trading ideas, join our free e-letter Gains Pains & Capital.

We’ll even throw in three investment reports (a $99 value) FREE of charge.

Just use the link below:

https://phoenixcapitalmarketing.com/evergreen3reports.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

For more charts, market insights, and trading ideas, join our free e-letter Gains Pains & Capital.

We’ll even throw in three investment reports (a $99 value) FREE of charge.

Just use the link below:

https://phoenixcapitalmarketing.com/evergreen3reports.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

I keep warning and warning… but no one is listening.

The market meltdown that started in Emerging Markets earlier this year WILL spread to the US.

Don’t believe me?

The FANG stocks, which lead the rally throughout 2008 (indeed by some measures these five stocks have accounted for over 50% of ALL market gains) have peaked. Heck, they didn’t just peak, they’re down 15% since their recent peak. We’re talking close to bear market territory.

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

On top of this, the S&P 500 FAILED to launch a breakout of its rising wedge formation. A failed breakout is one of the most dangerous chart developments because it often results in a VIOLENT reversal.

We’re talking about a move like this:

The best part… 99% of investors won’t see this coming.And smart investors who put capital to work here stand to make LITERAL fortunes.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 17 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

For more charts, market insights, and trading ideas, join our free e-letter Gains Pains & Capital.

We’ll even throw in three investment reports (a $99 value) FREE of charge.

Just use the link below:

https://phoenixcapitalmarketing.com/evergreen3reports.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

For more charts, market insights, and trading ideas, join our free e-letter Gains Pains & Capital.

We’ll even throw in three investment reports (a $99 value) FREE of charge.

Just use the link below:

https://phoenixcapitalmarketing.com/evergreen3reports.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

I keep warning and warning… but no one is listening.

The market meltdown that started in Emerging Markets earlier this year WILL spread to the US.

Don’t believe me?

The FANG stocks, which lead the rally throughout 2008 (indeed by some measures these five stocks have accounted for over 50% of ALL market gains) have peaked. Heck, they didn’t just peak, they’re down 15% since their recent peak. We’re talking close to bear market territory.

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week.

We are closing the doors on this system to new clients on Friday this week.

To lock in one of the last slots…

————————————————-

On top of this, the S&P 500 FAILED to launch a breakout of its rising wedge formation. A failed breakout is one of the most dangerous chart developments because it often results in a VIOLENT reversal.

We’re talking about a move like this:

The best part… 99% of investors won’t see this coming.And smart investors who put capital to work here stand to make LITERAL fortunes.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 17 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

The Powell Fed has set one goal and one goal only for its policy…

Hitting the “neutral rate of interest.”

The neutral rate of interest is when the Fed has rates equal to the pace of inflation. While this is technically what the Fed is SUPPOSED to be doing, NO Fed (or any other Central Bank for that matter) has done it in over 30 years: the Greenspan, Bernanke, and Yellen Feds were all notorious for running “accommodative” policy in which rates were kept well BELOW the rate of inflation.

Indeed, if you had to summate Fed policy from 1987 to 2018, the best word would be “accommodative.” It is not coincidental that this time period coincided with serial bubbles in the financial markets. This was done intentionally by Alan Greenspan, Ben Bernanke, and Janet Yellen.

Not Jerome Powell. During his July Q&A session with Congress in July, Fed Chair Powell emphasized that the most important focus for the Fed under his leadership would be “a neutral rate of interest.”

In answering a question [concerning the yield curve flattening] from Senator Pat Toomey of Pennsylvania, Powell said that, in his view, “What really matters is what the neutral rate of interest is.” And perhaps longer-term Treasury yields send a message about that rate.

Source: Bloomberg

————————————————-

This Trading System Produces Average Annual Gains of 41% in Up and DOWN Markets

It’s called The Crisis Trader and it uses market volatility to produce double digit winners over 80% of the time.

Don’t believe us? You can see for yourself if you..

————————————————-

I initially thought this was Powell playing to Congress (for 30+ years Fed Chairs have simply told Congress what it wanted to hear during their testimony). However, since that time, the Powell Fed has made it 100% clear that it did in fact WANT neutral rates.

Last month, Dallas Fed President Robert Kaplan outlined this in no uncertain terms.

My own view, informed by the work of my colleagues Evan Koenig at the Dallas Fed as well as John Williams of the New York Fed and Thomas Laubach at the Federal Reserve Board, is that the longer-run neutral real rate of interest is in a broad range around 0.50 to 0.75 percent, or a nominal rate of roughly 2.50 to 2.75 percent…

With the current fed funds rate at 1.75 to 2 percent, it would take approximately three or four more federal funds rate increases of a quarter of a percent to get into the range of this estimated neutral level…

Source: Dallas Fed

The key items in the above quote are the fact that a Fed President is OPENLY calling for neutral rates (all but unheard of).

Moreover, Kaplan is basing his view on the work of NY Fed President John Williams. Williams is Vice-Chair for the Fed (Powell’s right hand man). He, like Powell, is also a voting member of the Fed Board.

Put a different way… the above quote is effectively Fed leadership broadcasting to the world that its current line of thinking is that the Fed will be hiking rates until it reaches a neutral rate.

Doing this is going to create a SERIOUS issue for the financial markets. As we noted last week, already globally numerous markets ranging from China to Germany have entered corrections, if not outright bear markets as a result of the Fed’s hawkishness.

Eventually this mess is going to spill into the US markets. When it does, the bursting of the Everything Bubble will have officially hit US shores. And smart investors who put capital to work here stand to make LITERAL fortunes.

Again, the Everything Bubble is bursting. And smart investors who put capital to work here stand to make LITERAL fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 17 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research