Over the last week, we’ve warned investors that the Fed’s actions are unleashing another round of inflation in the U.S. financial system.

By quick way of review.

- The only part of the inflation data that is declining year over year is Energy prices. Every other segment of the Consumer Price Index (CPI) continues to rise.

- Financial conditions are as loose today as they were when the Fed first started raising interest rates in March 2022. And yet, the Fed is preparing to cut rates instead of raising them.

- The Fed is still providing hundreds of billions of dollars in liquidity to the financial system via credit facilities.

- The Fed’s own research indicates that food inflation is the best predictor of future inflation. And agricultural commodities are skyrocketing to new highs.

Unfortunately for Americans, the Fed isn’t the only entity that is engaged in inflationary policies. The Biden administration is currently engaged in truly extraordinary levels of money printing.

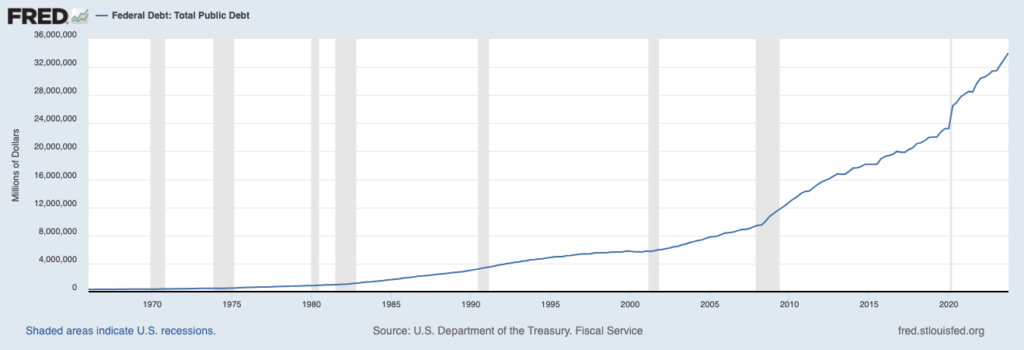

The Biden administration has added $6 trillion to the national debt since taking office. Bear in mind, this is happening at a time when the U.S. is collecting a record amount in taxes. So, the Biden administration is not only spending all of the tax dollars collected, it’s spending so much money that the U.S. is having to issue record amounts of debt!

The below chart needs no explanation. This is simply not sustainable.

Indeed, the pace of debt issuance is speeding up not slowing. The Biden admin issued $3 trillion in new debt in between 2021 and 2023. It added another $4 trillion in new debt in 2023 alone. At this pace. the U.S. will hit $40 trillion in debt some time in mid-2025.

Indeed, the pace of debt issuance is speeding up not slowing. The Biden admin issued $3 trillion in new debt in between 2021 and 2023. It added another $4 trillion in new debt in 2023 alone. At this pace. the U.S. will hit $40 trillion in debt some time in mid-2025.

The good news is that those investors who are properly positioned for this stand to generate truly EXTRAORDINARY returns in the coming months.

On that note, we recently published a Special Investment Report detailing three investments that will profit from this rampant government spending. Normally this report would cost $499, but we are giving copies FREE to anyone who joins our daily market commentary.

To pick up your copy, go to:

Graham Summers

Chief Market Strategist

Phoenix Capital Research, MBA