The facts are now becoming abundantly clear, that the forecast we’ve maintained for well over two years has been validated: the US is in a DE-pression and both Washington and the Federal Reserve have wasted trillions of Dollars.

The reality is that what’s happening in the US today is not a cyclical recession, but a one in 100 year, secular economic shift.

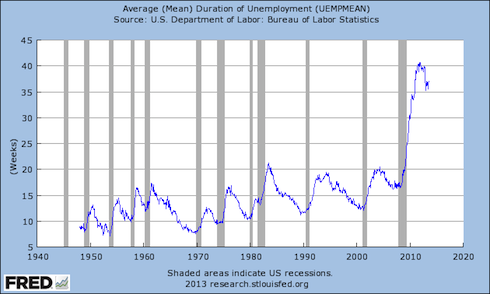

See for yourself. Here’s duration of unemployment. Official recessions are marked with gray columns. Bear in mind that the Feds measure unemployment based on people looking for work, so if you stop looking, you no longer count as unemployed and this number will fall.

Even with this accounting gimmick, the average duration is still at 35 weeks.

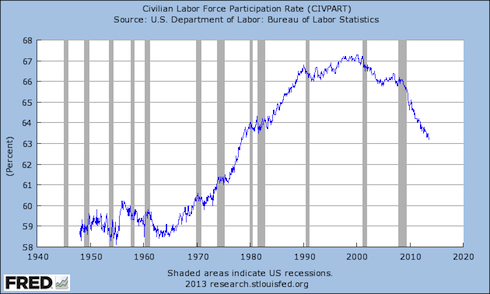

Here’s the labor participation rate with recessions again market by gray columns:

Another way to look at this chart is to say that since the Tech Crash, a smaller and smaller percentage of the US population has been working. Today, the same percentage of the US population are working as in 1978.

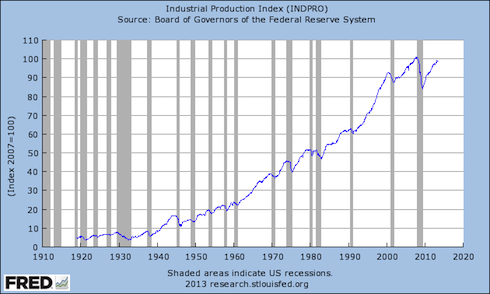

Here’s industrial production. I want to point out that during EVERY recovery since 1919 industrial production has quickly topped its former peak. Not this time. We’ve spent literally trillions of US Dollars on Stimulus and bailouts and production is well below the pre-Crisis highs.

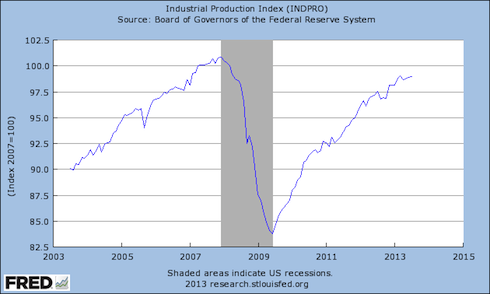

Here’s a close up of the last 10 years.

Again, what’s happening in the US is NOT a garden-variety cyclical recession. It is a STRUCTURAL SECULAR DEPRESSION.

And those who claim we’ve turned a corner are going by “adjusted” AKA “massaged” data. The actual data (which is provided by the Federal Reserve and Federal Government by the way) does not support these claims at all. In fact, if anything they prove we’ve wasted money by not permitted the proper debt restructuring/ cleaning of house needed in the financial system.

Which is why smart investors are already preparing for a market meltdown.

On that note, I’ve already prepared readers of my Private Wealth Advisory newsletter with a number of targeted investment strategies designed to help them not only manage risk, but produce outsized profits during the coming economic slowdown.

Already we’ve locked in 14 straight winners over the last two months. More are coming.

Indeed, during the first round of the Euro Crisis we locked in 73 straight winning trades and not one single closed loser. That was during a time when the market went nowhere.

So we’re getting ready for another similar winning streak during this next round of economic contraction. You can make money during times of slow growth, but you need the right investment strategies.

If these sound like the kind of investment strategies you could use for your portfolio, I suggest taking out a trial subscription to Private Wealth Advisory. You’ll immediately begin receiving my bi-weekly investment reports outlining the most important developments in the market.

You’ll also receive my real-time trade alerts, telling you the minute it’s time to open or sell a trade.

All just for $299 a year.

You get:

- 26 bi-weekly investment reports (ranging from 15-30 pages in length)

- Six Special Reports outlining unique opportunities and risks in the markets that 99% of investors don’t know about.

- 30-50 trades per year provided to you in real time

- The sense of calm in knowing that you’ve got your financial house in order.

To sign up for Private Wealth Advisory…

Yours in Profits,

Graham Summers

Chief Market Strategist

Phoenix Capital Research