The following is an excerpt from our value investing newsletter Stock Picker Elite

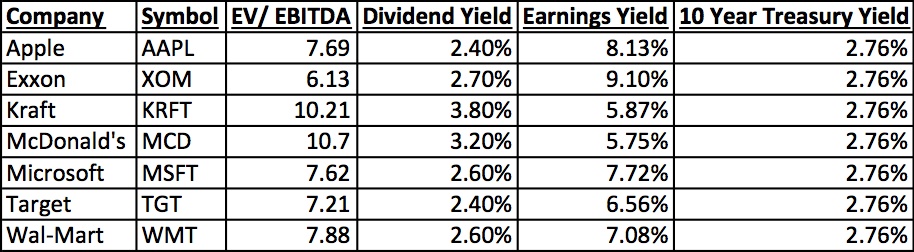

On that note, I want to point out that some of the best businesses in the world are beginning to approach valuations that are attractive (see Figure 1 below).

In terms of valuing a company, there are two key metrics I like. One is Enterprise Value (EV) divided by Earnings Before Taxes Interest Depreciation and Appreciation (EBITDA) or EV/ EBITDA.

I prefer this metric to the more traditional Price to Earnings (P/E) valuation metric because both Price (Market Cap) and Earnings are not very accurate measurements of a company’s health.

Regarding price, consider the following… a company that has a market cap of $10 billion, earnings $2 billion, has $2 billion in cash and has $9 billion in debt will look cheap with a P/E of 5… even though its debt load could bankrupt it.

Enterprise Value clears this issue up by including a company’s debt and cash on hand in the valuation process: EV is a company’s market cap, plus its debt, minus its cash. As such it is a much closer approximation of a company’s health than market cap.

Regarding earnings, as I noted in last issue of Cigar Butts & Moats there are dozens and I literally mean dozens of ways to craft earnings to be better than reality.

For that reason I prefer Earnings Before Taxes Interest Depreciation and Appreciation (EBITDA) as a metric for a company’s earning potential.

I realize this term sounds confusing, but EBITDA is essentially the money a company generates before it pays taxes or manipulates the value of the assets on its balance sheet. As such it’s a much cleaner representation of the cash a company generates.

Thus, EV/ EBITDA is a much better valuation metric than P/E. For that reason I’ve priced the businesses in Figure 1 by EV/ EBITDA.

Another term you need to know about is earnings yield. For those of you who are unfamiliar with earnings yield, this is essentially a ratio made by dividing a company’s Earnings Per Share by its Price Per Share.

I like to use this ratio relative to the yield on the ten-year Treasury (which is considered risk free) to asset the benefit of owning a stock. Given the increased risk of owning a stock, the earnings yield should be dramatically higher than the yield on the Ten Year Treasury.

However, the cash a company generates does not necessarily equal the cash it pays its owners. So I also like to consider a businesses’ dividend yield relative to the yield on the Ten Year Treasury as well.

These three metrics (EV/ EBITDA, Earnings Yield, Dividend Yield) can be used to give a decent “back of the envelope” assessment of the value of a stock.

As you can see in Figure 1 above, some of the best businesses in the world are beginning to trade at attractive valuations from an EV/EBITDA and Earnings Yield perspective.

However, the dividend yield is generally less attractive for most of these companies than the yield on the Ten Year Treasury. And given that stocks are far more volatile, I believe there is simply too much risk here relative to the cash reward for owning them at this time.

I bring all of this up, because I want to make you aware that the bargain basement sale I predicted last issue is only just beginning. And while it is tempting to start backing up the truck to invest, we need to consider the old adage that the fact a stock is cheap doesn’t mean it cannot get cheaper.

Between the low dividends and the risk to the global economy I’ve outlined in last issue, these valuations, while attractive, are not nearly as attractive as I’d like.

When you can buy a business like Apple at a dividend yield of 4+% at a time when the 10 Year Treasury is yielding 2.0% or less, THEN it’s time to go shopping based on the potential risk reward.

This time is coming. But it’s not here yet. The macro picture for the world is dangerous. And high quality companies will not be spared the carnage if a market onslaught begins (which is looking increasingly likely).

Stock Picker Elite is our long-term value-investing newsletter based on the investment methodologies of the Godfather of value investing, Benjamin Graham, and his legendary pupil Warren Buffett.

We launched Stock Picker Elite in May 2013. Since that time we’ve outperformed the stock market every year, often by double digits.

A subscription to Stock Picker Elite costs $99.99 and comes with:

- 12 monthly issues of Stock Picker Elite

- Our Special Report How to Make a Fortune With Value Investing which outlines how Warren Buffett and Benjamin Graham did what they did (a $199 value).

- Real time investment alerts as needed

All just for $99.99 per year.

To sign up for Stock Picker Elite

Best Regards

Phoenix Capital Research