ALL of the so called, “economic recovery” that began in 2009 has been based on the Central Banks’ abilities to rein in the collapse.

The first round of interventions (2007-early 2009) was performed in the name of saving the system. The second round (2010-2012) was done because it was generally believed that the first round hadn’t completed the task of getting the world back to recovery.

However, from 2012 onward, everything changed. At that point the Central Banks went “all in” on the Keynesian lunacy that they’d been employing since 2008. We no longer had QE plans with definitive deadlines. Instead phrases like “open-ended” and doing “whatever it takes” began to emanate from Central Bankers’ mouths.

However, the insanity was in fact greater than this. It is one thing to bluff your way through the weakest recovery in 80+ years with empty promises; but it’s another thing entirely to roll the dice on your entire country’s solvency just to see what happens.

In 2013, the Bank of Japan launched a single QE program equal to 25% of Japan’s GDP. This was unheard of in the history of the world. Never before had a country spent so much money relative to its size so rapidly… and with so little results: a few quarters of increased economic growth while household spending collapsed and misery rose alongside inflation.

This was the beginning of the end. Japan nearly broke its bond market launching this program (the circuit breakers tripped multiple times in that first week). However it wasn’t until last month that things truly became completely and utterly broken.

———————————————————————–

The Opportunity to Make Triple If Not QUADRUPLE Digit Gains is Here

The largest investor fortunes in history were made during crises.

For that reason, we’ve launched a special options trading service designed specifically to profit from the coming crisis.

It’s called THE CRISIS TRADER and already it’s locking in triple digit winners including gains of 151%, 182%, 261% and even 436%!

And the REAL crisis hasn’t even started yet!

We have an success rate of 72%(meaning you make money on more than 7 out of 10 trades)…and thanks to careful risk control, we haven’t had a losing trade since JUNE.

A new trade just went out yesterday.. you can get it and THREE others for just 99 cents.

However, this deal expires on Friday at midnight… we cannot maintain this track record with thousands of traders following these trades.

To grab one of the last $0.99, 30 day trial subscriptions to THE CRISIS TRADER…

———————————————————————–

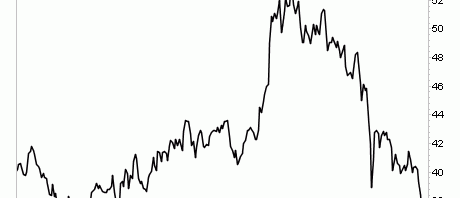

A month or so ago, China lost control of its stock market. Despite freezing the market, banning short-selling, arresting short-sellers, and injecting billions of Dollars per day into the markets, China’s stock market continues to implode.

Please let this sink in: a Central bank, indeed, one of the largest, most important Central Banks, has officially “lost control.”

This will not be a one-off event. With the Fed and other Central banks now leveraged well above 50-to-1, even those entities that were backstopping an insolvent financial system are themselves insolvent.

The Big Crisis, the one in which entire countries go bust, has begun. It will not unfold in a matter of weeks; these sorts of things take months to complete. But it has begun.

If you’re looking for actionable investment strategies to profit from this trend we highly recommend you take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets: we just closed two new double digit winners last week.

This brings us to a TWENTY ONE trade winning streak… and 27 of our last 28 trades have been winners!

Indeed… we’ve only closed ONE loser in the 12 months.

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents

During that time, you’ll receive over 50 pages of content… along with investment ideas that will make you money… ideas you won’t hear about anywhere else.

To take out a $0.98 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research