The US Dollar is going to blow up the global debt markets leading to a global debt crisis.

The blogosphere is rife with talk of the “death of the US Dollar.”

The US Dollar will eventually die, as all fiat currencies do. But the fact remains that everyone on the planet has been borrowing in US Dollars or leveraging up using Dollars for decades and a massive debt crisis is coming first.

When you borrow in US Dollars you are effectively shorting the US Dollar. So when leverage decreases through defaults or restructuring, the number of US Dollars outstanding diminishes.

And this strengthens the US Dollar… which means you debts become more expensive… leading inevitably to more defaults and a debt crisis.

With that in mind, it looks as though we are in the early stages of a massive, multi-year Dollar deleveraging cycle. Indeed, the greenback is now breaking out against EVERY major world currency. As I said before, a crisis is coming!

The US Dollar Has Broken Out Against Every Major Currency

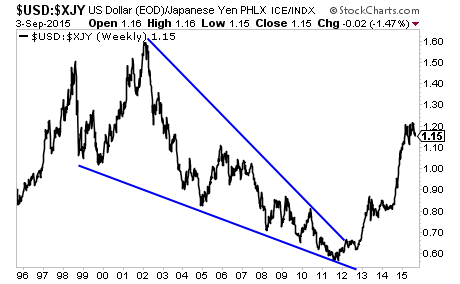

Here’s the US Dollar/ Japanese Yen:

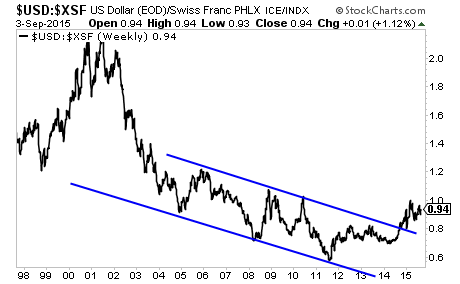

Even the Swiss’s decision to break the peg to the Euro hasn’t stopped the US Dollar from breaking out of a long-term downtrend relative to the Franc:

Even the Swiss’s decision to break the peg to the Euro hasn’t stopped the US Dollar from breaking out of a long-term downtrend relative to the Franc:

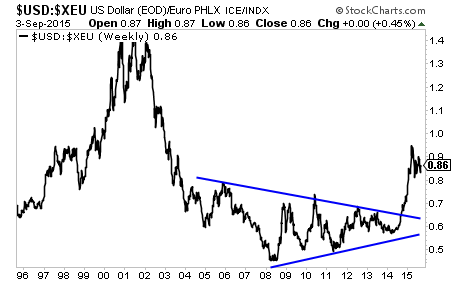

The fact that we are getting major breakouts of multi-year if not multi-decade patterns against every major world currency indicates that this US Dollar bull market is the REAL DEAL, not just an anomaly.

The fact that we are getting major breakouts of multi-year if not multi-decade patterns against every major world currency indicates that this US Dollar bull market is the REAL DEAL, not just an anomaly.

With that in mind, I continue to believe the US Dollar is in the beginning of a multi-year bull market. And this will result in various crises along the way culminating in a global debt crisis far greater than 2008.

Globally there is over $9 trillion borrowed in US Dollars and invested in other assets/ projects. This global carry trade is now blowing up and will continue to do so as Central Banks turn on one another.

This will bring about a wave of deleveraging that will see the amount of US Dollars in the system shrink. This in turn will drive the US Dollar higher triggering a debt crisis for any debt that is priced in US Dollars.

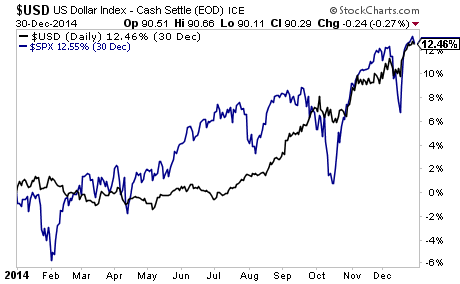

The US Dollar Is Now Outperforming Stocks!

Indeed, consider that the US Dollar actually MATCHED the performance of stocks for the year of 2014.

And it continues to crush stocks’ performance in 2015 as well.

And it continues to crush stocks’ performance in 2015 as well.

Any entity or investor who is using aggressive leverage in US Dollars will be at risk of imploding. Globally that $9 trillion in US Dollar carry trades is equal in size to the economies of Germany and Japan combined. That is a heck of a debt crisis.

Any entity or investor who is using aggressive leverage in US Dollars will be at risk of imploding. Globally that $9 trillion in US Dollar carry trades is equal in size to the economies of Germany and Japan combined. That is a heck of a debt crisis.

Smart investors are preparing now.

If you’re looking for actionable investment strategies to profit from this trend we highly recommend you take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets: we just closed TWO new double digit winners yesterday.

This brings us to a TWENTY NINE trade winning streak… and 35 of our last 36 trades have been winners!

Indeed… we’ve only closed ONE loser in the 12 months.

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents

During that time, you’ll receive over 50 pages of content… along with investment ideas that will make you money… ideas you won’t hear about anywhere else.

To take out a $0.98 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research