Dear Investor,

Stocks are crashing before the market’s

open.

As I warned earlier this week… it’s very

likely that the Bull Market in stocks is over.

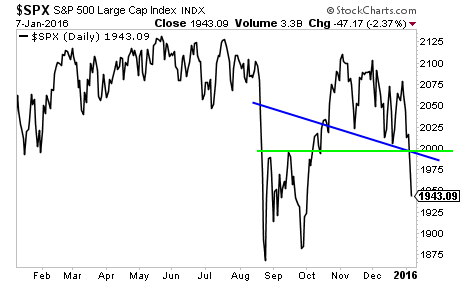

Indeed, the breakdown is actually MUCH bigger than most investors

realize. We’ve actually broken THE bull market line that goes all

the way back to 2009!

If you are not preparing for a bear market in stocks, you

NEED to do so NOW.

I can show you how.

To whit, while most investors got taken to the cleaners

yesterday, Private Wealth

Advisory subscribers have

locked in TWO new winners.

This brings our current winning streak to 45 straight

winners!

WE HAVEN’T CLOSED A SINGLE

LOSING

TRADE IN 14 MONTHS!

And when this collapse accelerates we’ll be seeing

even MORE winners. We just opened two new trades

to profit from what’s happening in the markets yesterday.

Already they are soaring higher.

To find out what they are, all you need to do is take out a

30 day trial to Private

Wealth Advisory.

All it costs is just 98 cents!

If you decide Private

Wealth Advisory is not for you

just drop us a line during the first 30 days and we’ll

cancel it for you without charging ANOTHER RED CENT.

I know you’ll stay with us though. Our track record

is the best in the industry. Which is why less than 5%

of all subscribers choose to cancel.

To take out a $0.98 30 day trial to Private Wealth Advisory…

Phoenix Capital Research