A growing number of investors are beginning to realize that Central Banks are effectively out of ammo (for now).

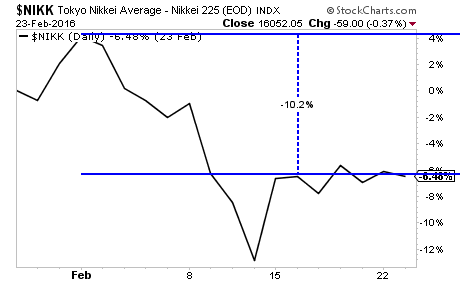

Last week I noted that the Bank of Japan’s implementation of NIRP only generated a brief rally in Japanese stocks. That rally has since been obliterated as Japanese stocks collapsed 10%.

This collapse has finally prompted the mainstream financial media to question NIRP. It’s a shame no one bothered to question NIRP, ZIRP, and QE when the markets were still rallying!

———————————————————————–

The Single Best Options Trading Service on the Planet

Our options service THE CRISIS TRADER is absolutely KILLING it.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades.

Even if you include ALL of our losers, we finished 2015 UP 35%

Over the same time period, the S&P 500 was DOWN.

This continues this year. Already we’ve closed out FIVE double digit winners in 2016. Including a 43% gain closed within 24 hours of us opening it!

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER...

———————————————————————–

HSBC: Sweden’s Experience Shows Negative Rates Haven’t Worked

The ‘Monetary Madness’ That’s Pushing Japanese Bonds Negative

Negative Interest Rates Can Hurt Global Stocks

COLUMN-Banks drink from NIRP’s poisoned well: James Saft

H/T Bill King for noting the change in media tone.

I point this out because it indicates that we are at a critical turning point. Between 2009 and last week, the financial media rarely questioned Central Bank policy, if ever.

The fact that we are now seeing numerous articles criticizing NIRP and Central Banks, tells us that psychologically a significant shift has taken place. That shift will see growing criticism of Central Banks along with an increase in bearish sentiment amongst investors.

This shift was also evident in today’s Q&A session between Fed Chair Janet Yellen and Congress. For the first time in recent memory, a Fed Chair was grilled on the legality and legitimacy of Fed Policy by members of Congress (with the exception of former Congressman Ron Paul).

Does this mean that Central Banks will simply “give up and go home?”

Yes and No.

For certain, the bar has been set much higher for Central Bank monetary policy. Interest rate cuts alone won’t cut it anymore. The ECB has cut rates into NIRP three times. None of these cuts produced a significant stock rally. Only QE did.

Similarly, the Bank of Japan has obtained its best results with QE programs. As I noted previously NIRP barely even bought 24 hours’ worth of market gains.

In simple terms, unless a new large-scale QE program or direct money printing is announced, markets are unlikely to react strongly to new monetary policy from Central Banks.

Another Crisis is coming. Smart investors are preparing now.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 75 straight winning trades.

And throughout the last 14 months, we’ve not closed a SINGLE loser.

With a track record like this, we’re getting a LOT of attention, so we’re going to be raising the price of a Private Wealth Advisory in the next few weeks.

However, you can try it right now for 30 days for just 98 cents… but you better move fast, because these slots are selling out!!!

To lock in a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research