The Fed has unleashed inflation.

And it wants more of it.

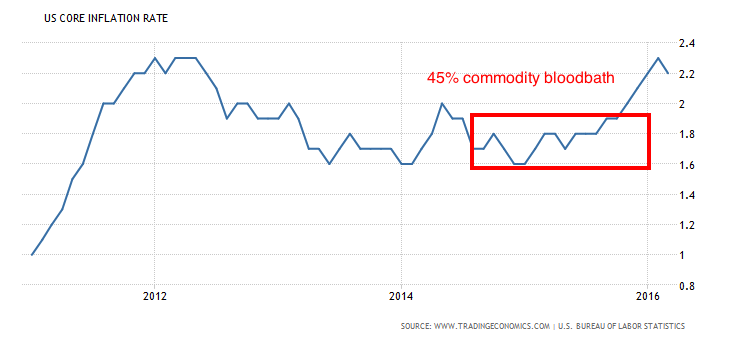

From mid-2014 until early 2016, commodities as an asset class, collapsed some 45%.

This was an all out bloodbath. But despite this collapse in prices, inflation began to perk up.

Since that time, numerous Fed officials, including Fed Vice-Chair Stanley Fischer have concluded that inflation has arrived and that the Fed wants more of it.

Beyond this, the Fed failed to raise rates in March despite data hitting levels at which it claimed a rate hike was warranted. It has also walked back its rate hike forecast from four potential rate hikes to just two (if that).

There is also the political issue to consider. President Obama had a sit down with Fed Chair Janet Yellen on Monday. This was the first one-on-one meeting they’ve had since October 2014 (right before Congressional elections).

The first Fed rate hike in nine years did so much damage that it took multiple Central Banks unveiling multiple new policies to undo it. In light of this, what are the odds Obama pushed Yellen to refrain from hiking rates and pushing an already weak economy into full-blown recession? Pretty darn high.

Which means you can forget about another rate hike this year. Instead we’ll get numerous Fed officials playing “good cop, bad cop” with different verbal interventions to maintain the illusion that another rate hike is possible.

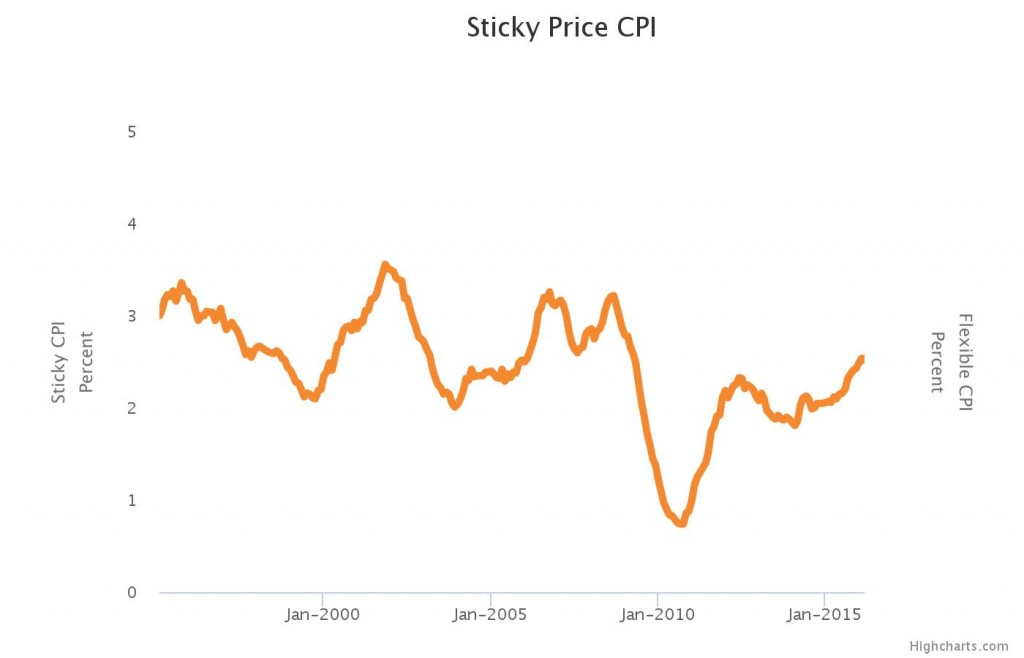

Politically it is not. Which means… inflation will be rising even more in the coming months. Indeed, sticky inflation is moving sharply higher. This will only worsen as commodities continue to rebound (oil is up 40% since its bottom).

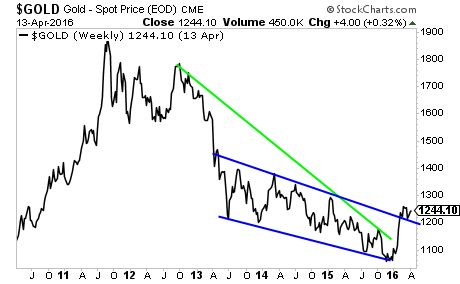

The precious metals markets know it too. Inflation is here. And the Fed isn’t going to try and stop it.

Gold and Gold-related investments will be exploding higher in the coming weeks.

If you’re an investor who wants to protect yourself from the coming bear market, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

To wit… in the last 16 months we’ve closed out 77 straight winning trades.

That is not a typo…

For 16 months, not only have Private Wealth Advisory subscribers locked in 77 CONSECUTIVE winners including gains of 18%, 36%, 69%, even 119%…

But throughout that ENTIRE TIME we’ve not closed a SINGLE loser.

Indeed, we just closed out two more double digit winners yesterday: gains of 10% and 40% opened just a few weeks before

As you can imagine, this track record is a getting a ton of attention, so we are going to be closing the doors on our current offer to explore Private Wealth Advisory at the end of this month.

So if you want to try Private Wealth Advisory for 30 days for just 98 cents, you need to get moving, because the clock is ticking and slots are quickly running out.

To lock in one of the remaining slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our FREE e-letter: http://gainspainscapital.com/

Follow us on Twitter: http://twitter.com/GainsPainsCapit