The Bank of Japan came out this morning and admitted that helicopter money is not on the agenda.

The yen pared an advance against the dollar as it emerged that an interview in which Bank of Japan Governor Haruhiko Kuroda dismissed the idea of so-called helicopter money was conducted in June.

The Japanese currency earlier jumped more than 1 percent after, in comments broadcast on BBC Radio 4 on Thursday, Kuroda said there was no need or possibility for such a strategy. The interview was conducted on June 17, a BBC spokeswoman said.

Source: Bloomberg

This is not a surprise to anyone who does actual analysis. Kuroda said back in April 2016 that the Bank of Japan CANNOT implement helicopter money because it is ILLEGAL under Japan’s constitution.

The Single Best Options Trading Service on the Planet

THE CRISIS TRADER has produced an astounding 145% return on invested capital thus far in 2016.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades. And thanks to careful risk management we’ve seen triple digit returns on invested capital every year since inception.

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER...

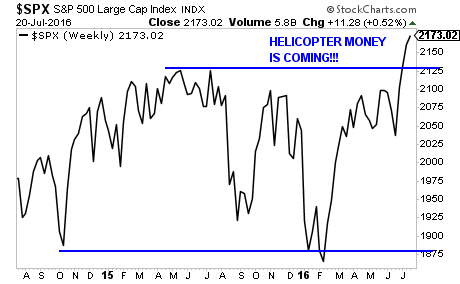

The fact is that the market broke out to new all time highs based on a complete lie. Helicopter money is not coming to Japan… at least not any time soon. The entire market move from the BREXIT lows has been a desperate manipulation by Central Banks as they begin to lose control of the financial system.

We saw the same thing happen in 2007: a final push to new all-time highs in October. What followed wasn’t pretty.

A Crash is coming… and the time to prepare is NOW, before it hits.

Private Wealth Advisory subscribers have now closed their 97th STRAIGHT winner.

That’s correct. We’re at 97 winners… all in a row.

This is not cherry picking or ignoring losers… the last time we closed a losing trade was NOVEMBER 2014.

However, I cannot continue this incredible track record with thousands of investors following our strategies.

So we are raising the price on a subscription to Private Wealth Advisory from $179 to $200 tomorrow at Midnight.

So if you want to lock in one of the remaining slots you need to move fast. Because we might close the doors early based on subscribers pouring

in.

To lock in one of the remaining $179 slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research